Question: E8-8 Computing Depreciation under Alternative Methods LO8-3 Purity lce Cream Company bought a new Ice cream maker at the beginning of the year at a

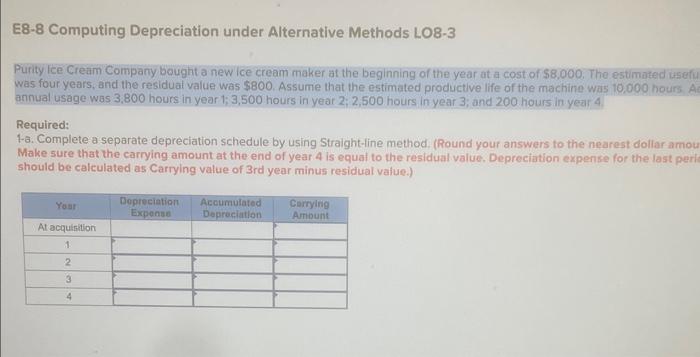

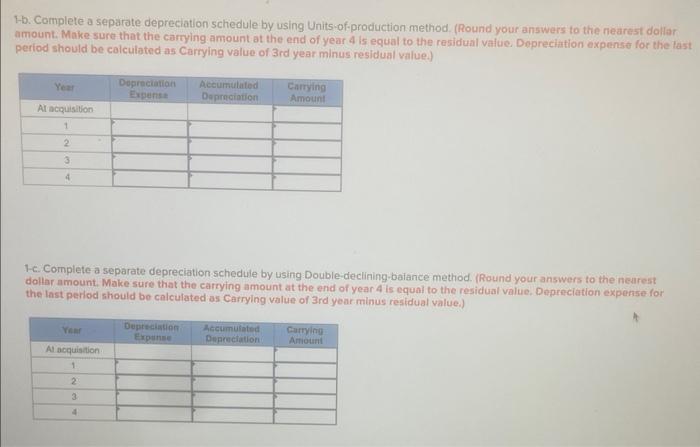

E8-8 Computing Depreciation under Alternative Methods LO8-3 Purity lce Cream Company bought a new Ice cream maker at the beginning of the year at a cost of $8,000. The estimated useft was four years, and the residual value was $800. Assume that the estimated productive life of the machine was 10,000 hours A annual usage was 3,800 hours in year 1;3,500 hours in year 2; 2,500 hours in year 3; and 200 hours in year 4 . Required: 1-a. Complete a separate depreciation schedule by using Straight-line method, (Round your answers to the nearest dollar amo Make sure that the carrying amount at the end of year 4 is equal to the residual value. Depreciation expense for the last peri should be calculated as Carrying value of 3 rd year minus residual value.) 1-b. Complete a separate depreciation schedule by using Units.of-production method. (Round your answers to the nearest dollar amount. Make sure that the carrying amount at the end of year 4 is equal to the residual value. Depreciation expense for the last period should be colculated as Carrying value of 3 rd year minus residual value.) 1-c. Complete a separate depreciation schedule by using Double-declining-baiance method. (Round your answers to the nearest dollar amount. Make sure that the carrying amount at the end of year 4 is equal to the residual value. Depreciation expense for the last period should be calculated as Carrying value of 3 rd year minus residual value.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts