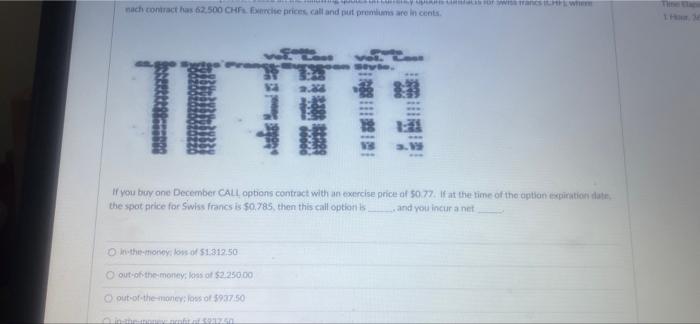

Question: each contract has 62,500 CHFs. Exercise prices, call and put premiums are in cents. 5600 11 Oin-the-money; loss of $1,312.50 O out-of-the-money; loss of $2,250.00

nach contract has 62,500 cHin. fyinclie prices, call and put premiums are in cents. If you boy one December CALL opbions contract with an exercise price of 5077 . If at the time of the aption ecpirintion dati the spat price for Siwiss francs is 40,785 , then this call optionts and wou incur a net in the itioncy: losis of 51,312.50 : outiokthemonters kas of $2.25000 put-of the-moneri loss of $93750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts