Question: = Review Homework: HW 11 Question 1, B9-10 (book/static) > HW Score: 12.5%, 0.5 of 4 points Points: 0.5 of 1 Close Previous question (Related

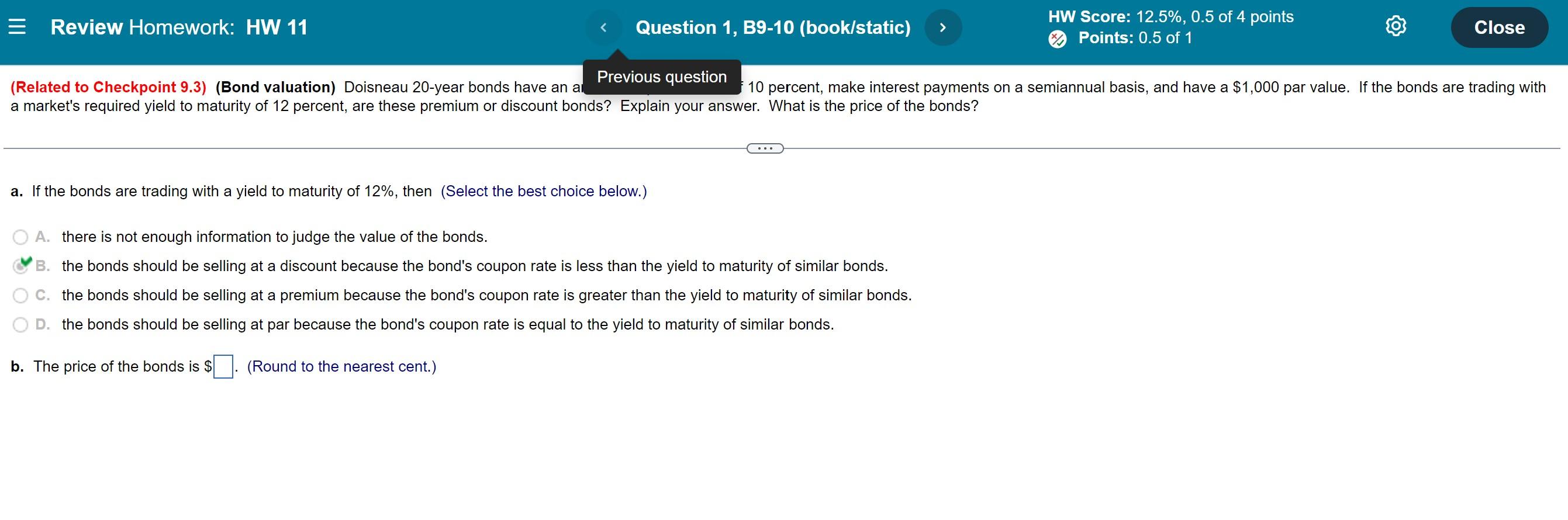

= Review Homework: HW 11 Question 1, B9-10 (book/static) > HW Score: 12.5%, 0.5 of 4 points Points: 0.5 of 1 Close Previous question (Related to Checkpoint 9.3) (Bond valuation) Doisneau 20-year bonds have an ai 10 percent, make interest payments on a semiannual basis, and have a $1,000 par value. If the bonds are trading with a market's required yield to maturity of 12 percent, are these premium or discount bonds? Explain your answer. What is the price of the bonds? a. If the bonds are trading with a yield to maturity of 12%, then (Select the best choice below.) A. there is not enough information to judge the value of the bonds. B. the bonds should be selling at a discount because the bond's coupon rate is less than the yield to maturity of similar bonds. C. the bonds should be selling at a premium because the bond's coupon rate is greater than the yield to maturity of similar bonds. D. the bonds should be selling at par because the bond's coupon rate is equal to the yield to maturity of similar bonds. b. The price of the bonds is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Lets analyze the problem step by step Part a Premium or Discount Coupon Rate 10 annually Yield to Ma... View full answer

Get step-by-step solutions from verified subject matter experts