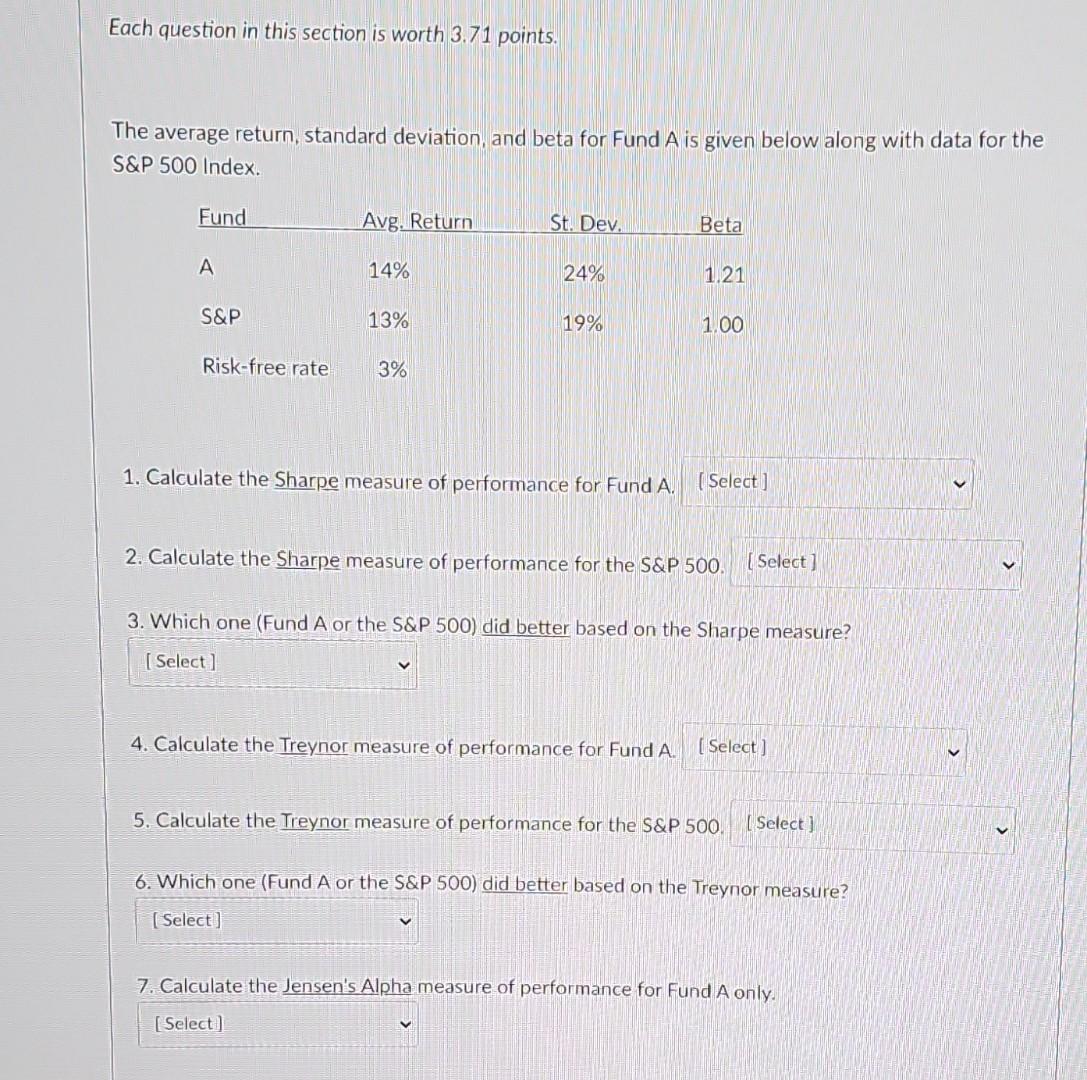

Question: Each question in this section is worth 3.71 points. The average return, standard deviation, and beta for Fund A is given below along with data

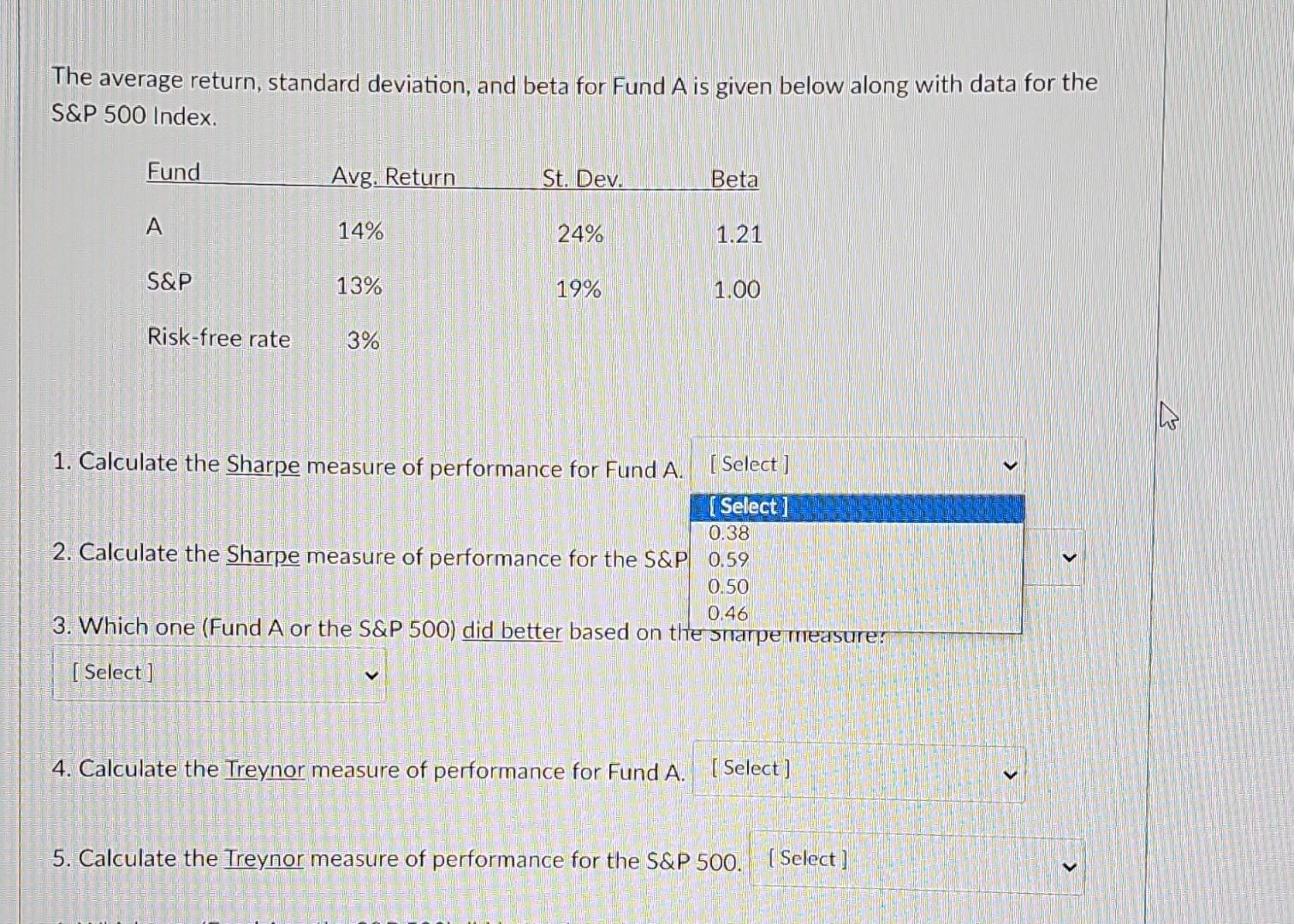

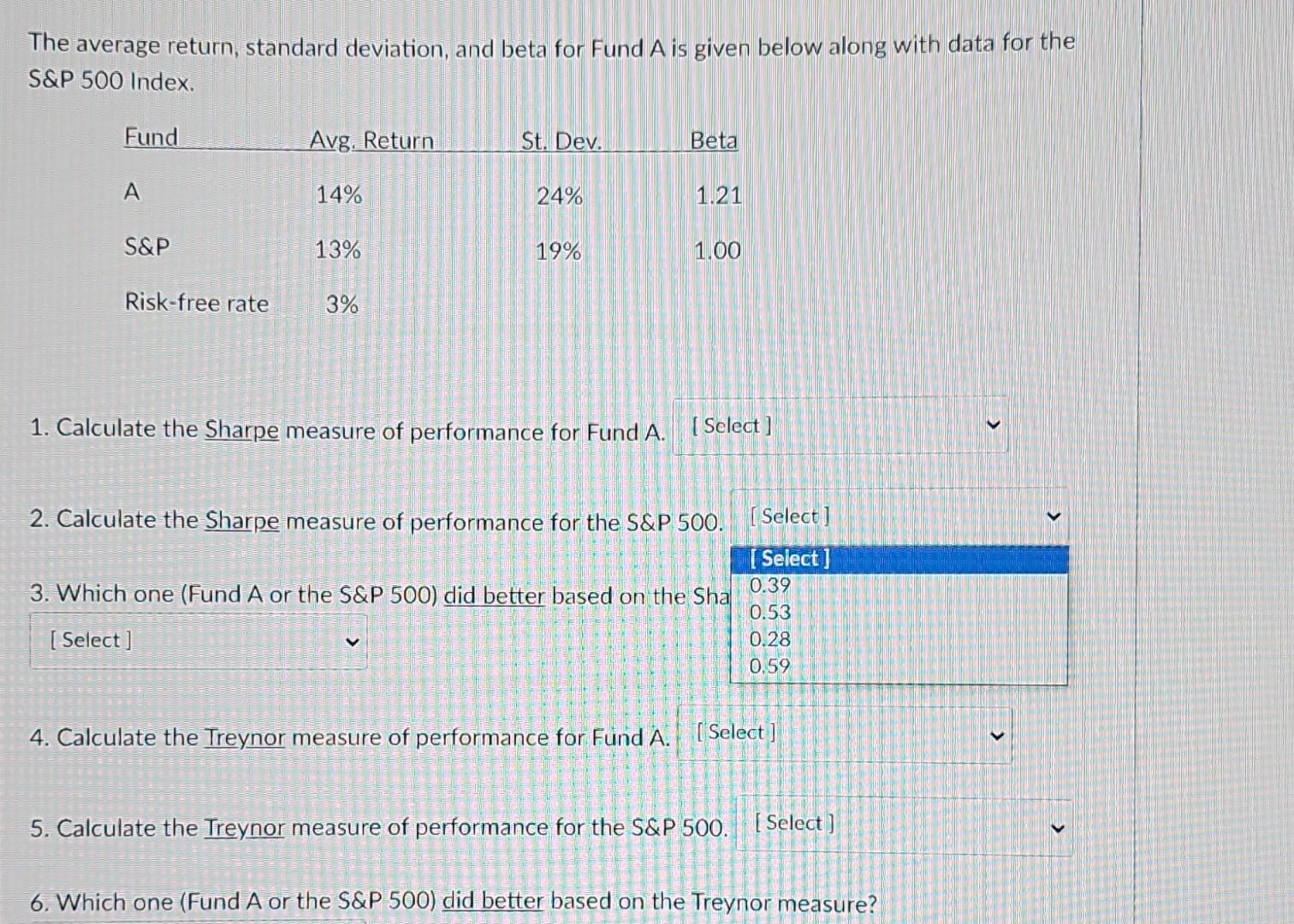

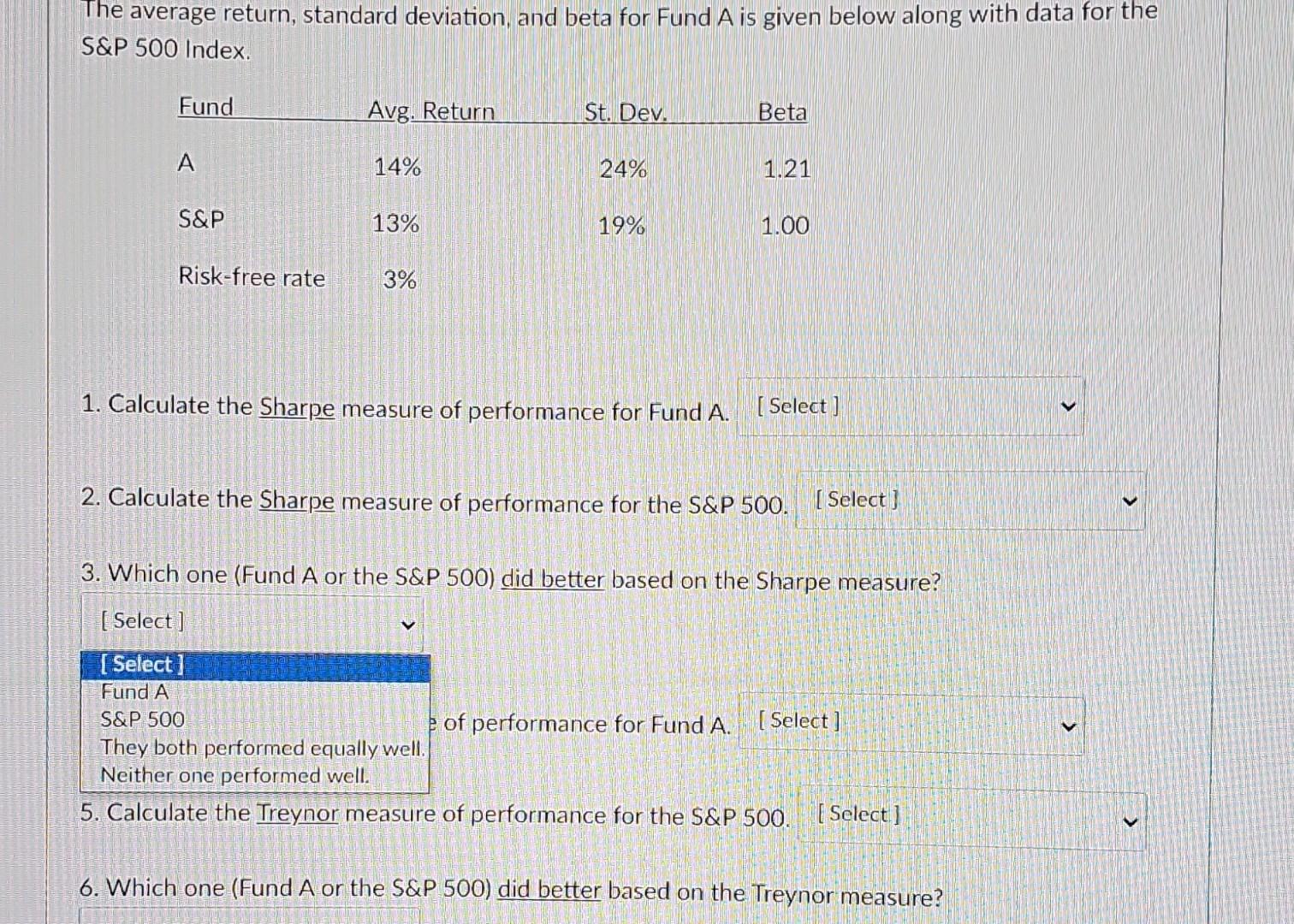

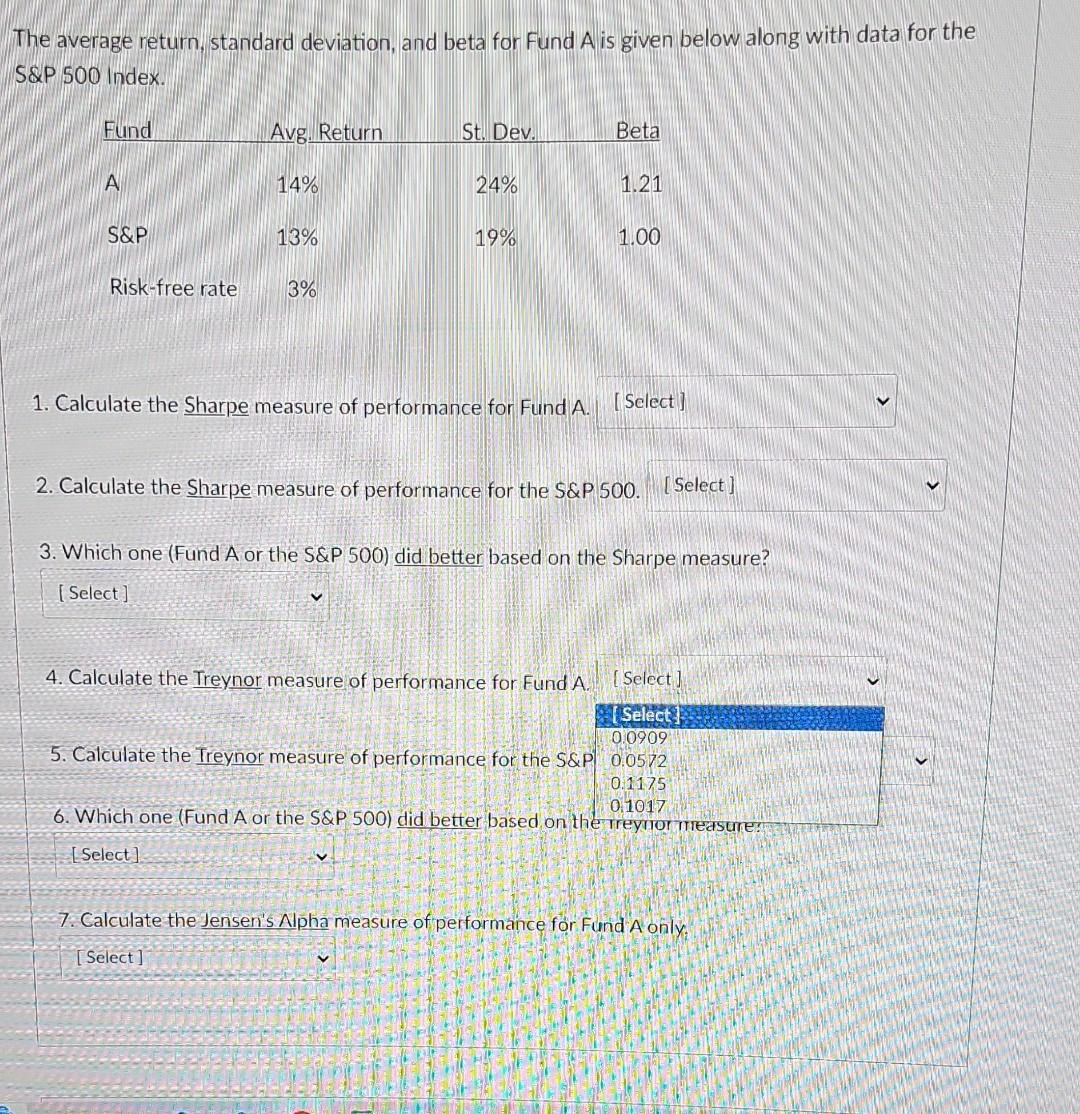

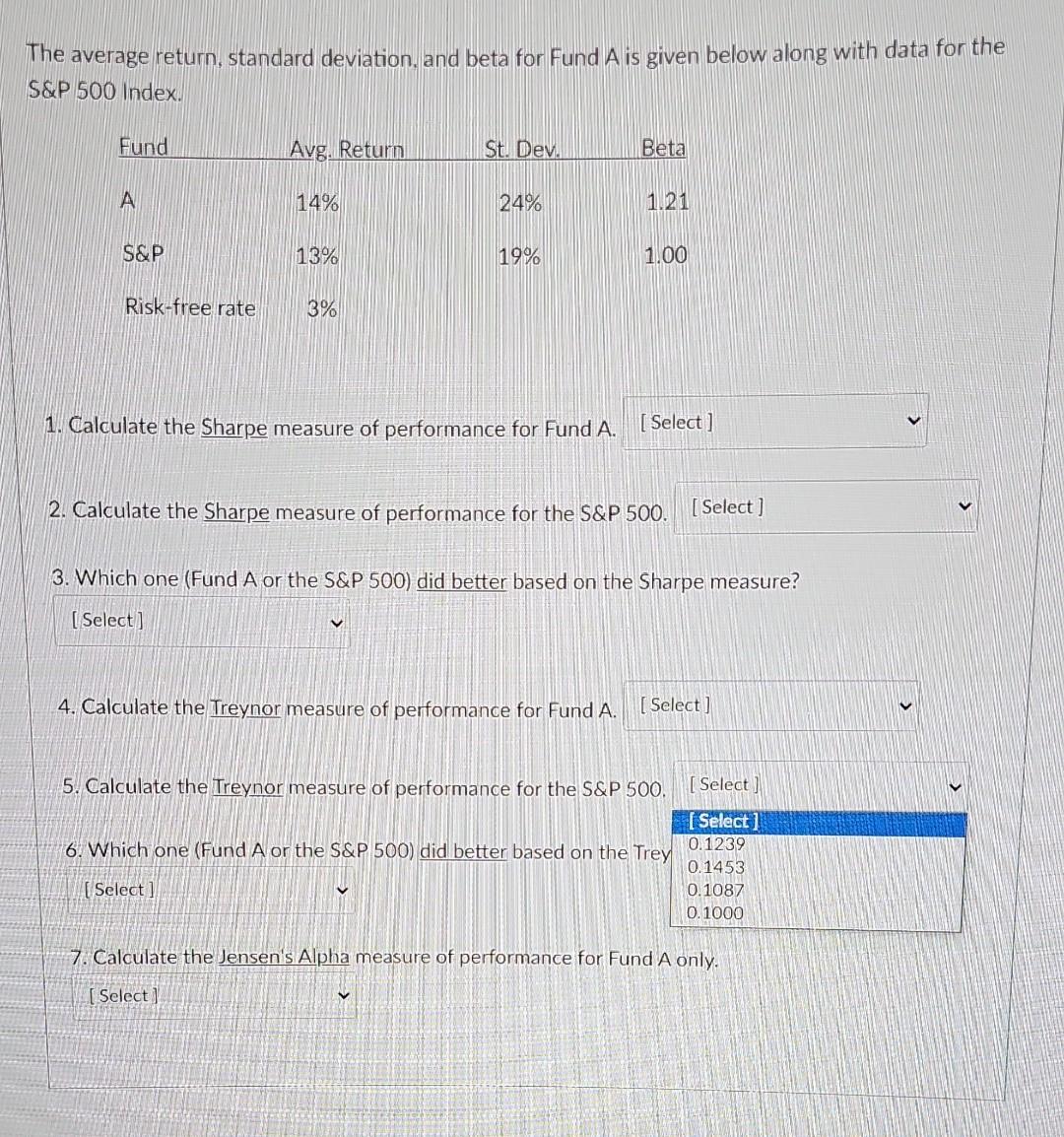

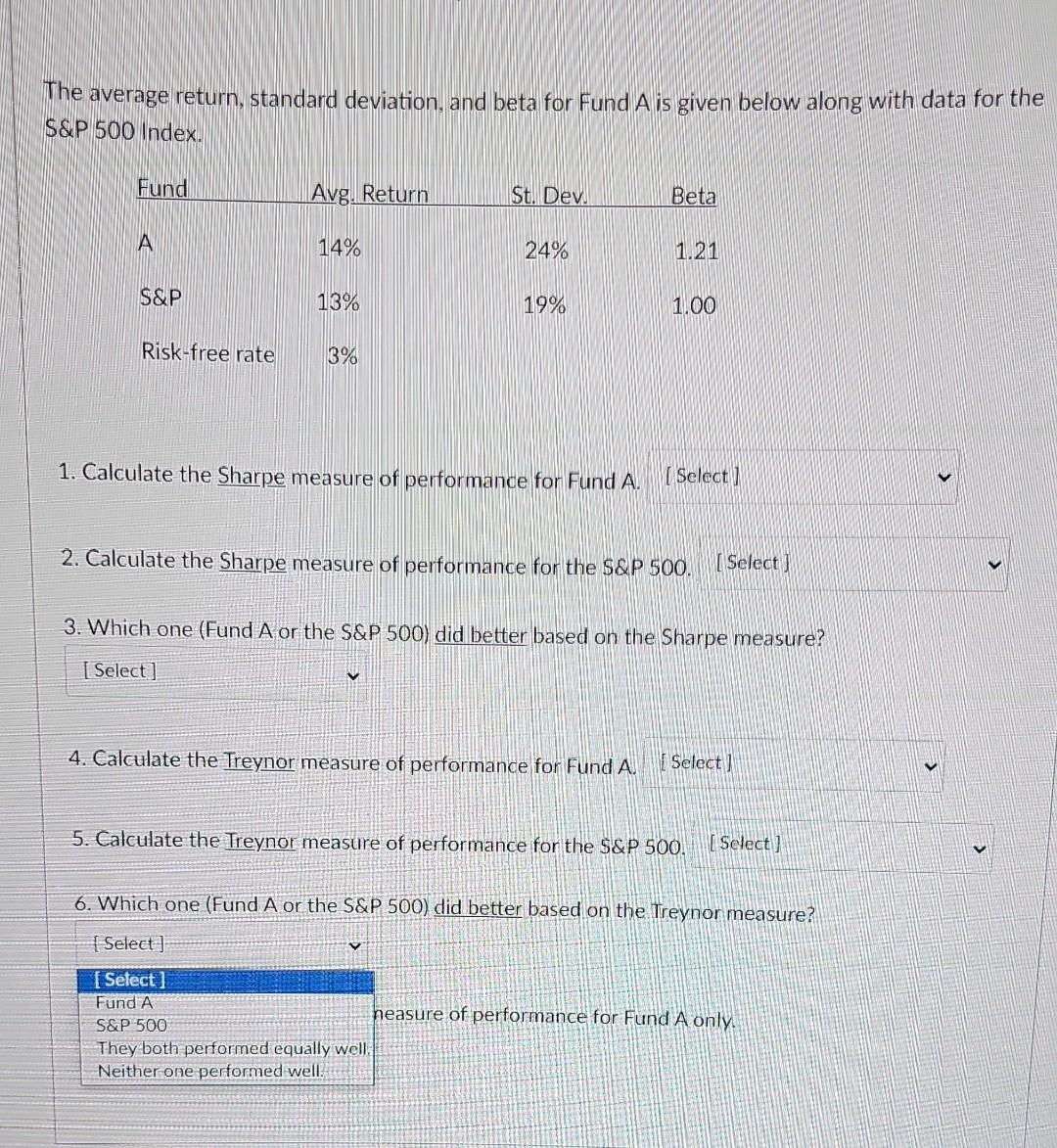

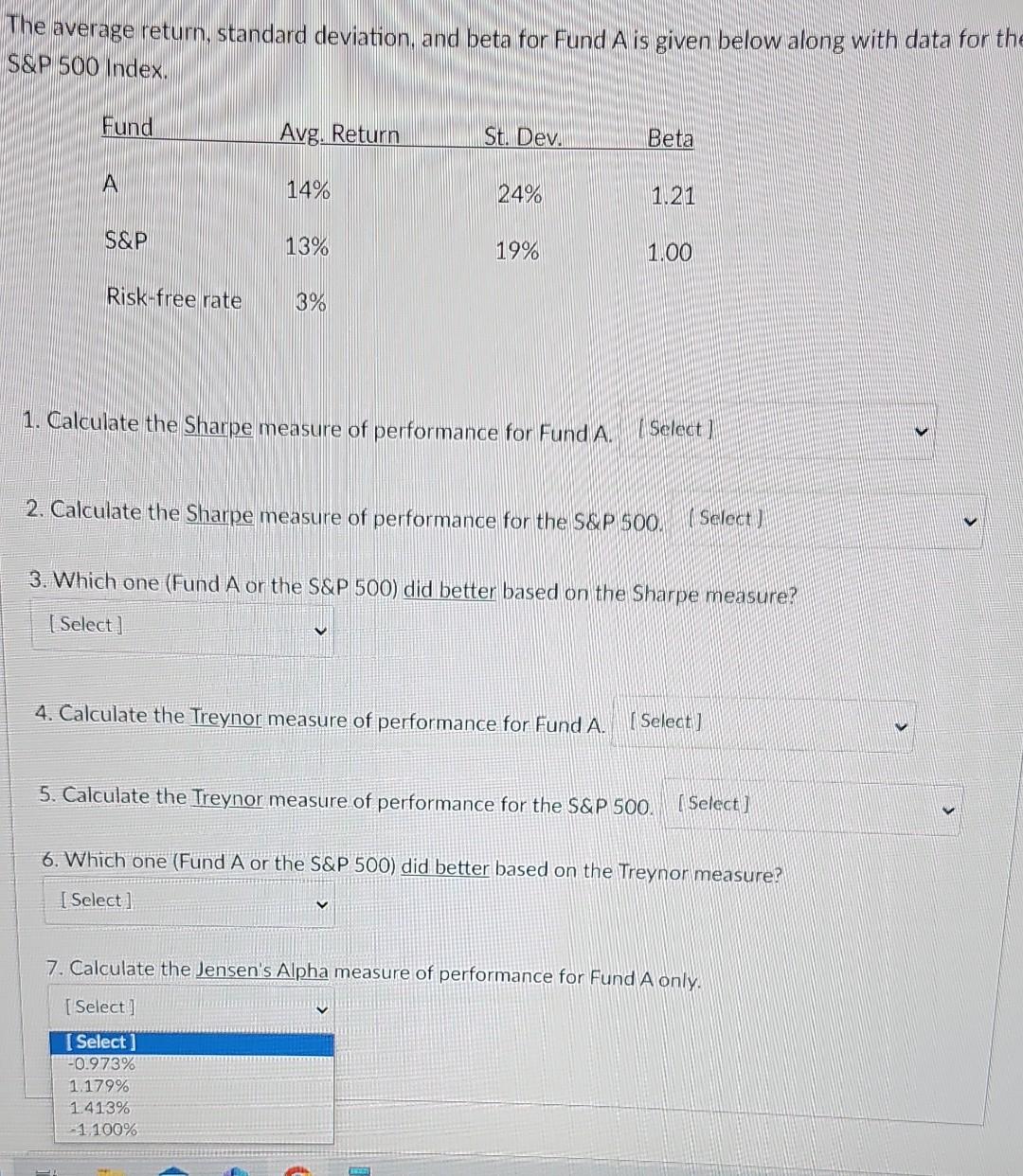

Each question in this section is worth 3.71 points. The average return, standard deviation, and beta for Fund A is given below along with data for the S\&P 500 Index. 1. Calculate the Sharpe measure of performance for Fund A. 2. Calculate the Sharpe measure of performance for the S&P500. 3. Which one (Fund A or the S\&P 500) did better based on the Sharpe measure? 4. Calculate the Treynor measure of performance for Fund A. 5. Calculate the Treynor measure of performance for the S\&P 500. 6. Which one (Fund A or the S\&P 500) did better based on the Treynor measure? 7. Calculate the Jensen's Alpha measure of performance for Fund A only. The average return, standard deviation, and beta for Fund A is given below along with data for the S\&P 500 Index. 1. Calculate the Sharpe measure of performance for Fund A. 2. Calculate the Sharpe measure of performance for the S\&P 3. Which one (Fund A or the S\&P 500) did better based on t. 4. Calculate the Treynor measure of performance for Fund A. 5. Calculate the Treynor measure of performance for the S\&P 500. The average return, standard deviation, and beta for Fund A is given below along with data for the S\&P 500 Index. 1. Calculate the Sharpe measure of performance for Fund A. 2. Calculate the Sharpe measure of performance for the S\&P 500. 3. Which one (Fund A or the S\&P 500) did better based on the She 4. Calculate the Treynor measure of performance for Fund A. 5. Calculate the Treynor measure of performance for the S\&P 500. 6. Which one (Fund A or the S\&P 500) did better based on the Treynor measure? The average return, standard deviation, and beta for Fund A is given below along with data for the S\&P 500 Index. 1. Calculate the Sharpe measure of performance for Fund A. 2. Calculate the Sharpe measure of performance for the S\&P 500. 3. Which one (Fund A or the S\&P 500) did better based on the Sharpe measure? [Select ] of performance for Fund A. 5. Calculate the Treynor measure of performance for the S\&P 500. 6. Which one (Fund A or the S\&P 500) did better based on the Treynor measure? The average return, standard deviation, and beta for Fund A is given below along with data for the s\&P 500 index. 1. Calculate the Sharpe measure of performance for Fund A. 2. Calculate the Sharpe measure of performance for the S\&P 500. 3. Which one (Fund A or the S\&P 500) did better based on the Sharpe measure? 4. Calculate the Treynor measure of performance for Fund A. [Select] 5. Calculate the Treynor measure of performance for the S\&F 6. Which one (Fund A or the S\&P 500) did better based on th [Sel] 7. Calculate the Jensen's Alpha measure of performance for Fund A only The average return, standard deviation, and beta for Fund A is given below along with data for the S\&P 500 Index. 1. Calculate the Sharpe measure of performance for Fund A. 2. Calculate the Sharpe measure of performance for the S\&P 500 . 3. Which one (Fund A or the S\&P 500) did better based on the Sharpe measure? 4. Calculate the Treynor measure of performance for Fund A. 5. Calculate the Treynor measure of performance for the S\&P 500. 6. Which one (Fund A or the S\&P 500) did better based on the Tre) 7. Calculate the Jensen's Alpha measure of performance for Fund A only. The average return, standard deviation, and beta for Fund A is given below along with data for the S\&P 500 Index. 1. Calculate the Sharpe measure of performance for Fund A. 2. Calculate the Sharpe measure of performance for the S\&P 500 . 3. Which one (Fund A or the S\&P 500) did better based on the Sharpe measure? 4. Calculate the Treynor measure of performance for Fund A. 5. Calculate the Treynor measure of performance for the \( \$ \& P 500 \)amp;P500. 6. Which one (Fund A or the S\&P 500) did better based on the Treynor measure? [Select]. leasure of performance for Fund A only. The average return, standard deviation, and beta for Fund A is given below along with data for th S\&P 500 Index. 1. Calculate the Sharpe measure of performance for Fund A. [Select] 2. Calculate the Sharpe measure of performance for the S\&P SOO. (Select) 3. Which one (Fund A or the S\&P 500) did better based on the Sharpe measure? 4. Calculate the Treynor measure of performance for Fund A. 5. Calculate the Treynor measure of performance for the S\&P 500 . 6. Which one (Fund A or the S\&P 500) did better based on the Treynor measure? 7. Calculate the Jensen's Alpha measure of performance for Fund A only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts