Question: *EACH* QUESTION PLEASEEEE HELP W WORK 1-10 :(((( 1) A company had free cash flows of $556 million last year. Free cash flows are expected

*EACH* QUESTION PLEASEEEE HELP W WORK 1-10 :((((

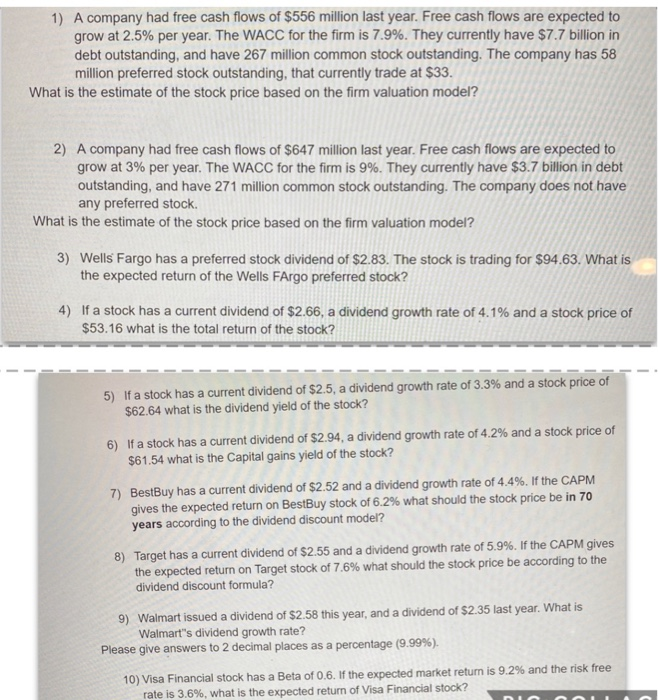

1) A company had free cash flows of $556 million last year. Free cash flows are expected to grow at 2.5% per year. The WACC for the firm is 7.9%. They currently have $7.7 billion in debt outstanding, and have 267 million common stock outstanding. The company has 58 million preferred stock outstanding, that currently trade at $33. What is the estimate of the stock price based on the firm valuation model? 2) A company had free cash flows of $647 million last year. Free cash flows are expected to grow at 3% per year. The WACC for the firm is 9%. They currently have $3.7 billion in debt outstanding, and have 271 million common stock outstanding. The company does not have any preferred stock. What is the estimate of the stock price based on the firm valuation model? 3) Wells Fargo has a preferred stock dividend of $2.83. The stock is trading for $94.63. What is the expected return of the Wells FArgo preferred stock? 4) If a stock has a current dividend of $2.66, a dividend growth rate of 4.1% and a stock price of $53.16 what is the total return of the stock? 5) If a stock has a current dividend of $2.5, a dividend growth rate of 3.3% and a stock price of $62.64 what is the dividend yield of the stock? 6) If a stock has a current dividend of $2.94, a dividend growth rate of 4.2% and a stock price of $61.54 what is the Capital gains yield of the stock? 7) BestBuy has a current dividend of $2.52 and a dividend growth rate of 4.4%. If the CAPM gives the expected return on BestBuy stock of 6.2% what should the stock price be in 70 years according to the dividend discount model? 8) Target has a current dividend of $2.55 and a dividend growth rate of 5.9%. If the CAPM gives the expected return on Target stock of 7.6% what should the stock price be according to the dividend discount formula? 9) Walmart issued a dividend of $2.58 this year, and a dividend of $2.35 last year. What is Walmart's dividend growth rate? Please give answers to 2 decimal places as a percentage (9.99%). 10) Visa Financial stock has a Beta of 0.6. If the expected market return is 9.2% and the risk free rate is 3.6%, what is the expected return of Visa Financial stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts