Question: EACH QUESTION WILL BE CHECKED AGAINST AI USAGE SO DO NOT RELY ON THEM! CAN YOU ALSO PROVIDE THE DETAILED CALCULATION? THANK YOU!! A few

EACH QUESTION WILL BE CHECKED AGAINST AI USAGE SO DO NOT RELY ON THEM!

CAN YOU ALSO PROVIDE THE DETAILED CALCULATION? THANK YOU!!

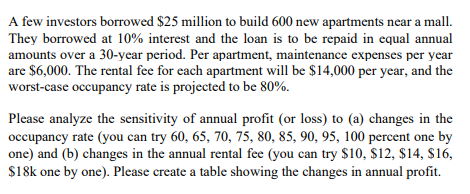

A few investors borrowed $25 million to build 600 new apartments near a mall. They borrowed at 10% interest and the loan is to be repaid in equal annual amounts over a 30 -year period. Per apartment, maintenance expenses per year are $6,000. The rental fee for each apartment will be $14,000 per year, and the worst-case occupancy rate is projected to be 80%. Please analyze the sensitivity of annual profit (or loss) to (a) changes in the occupancy rate (you can try 60,65,70,75,80,85,90,95,100 percent one by one) and (b) changes in the annual rental fee (you can try $10,$12,$14,$16, $18k one by one). Please create a table showing the changes in annual profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts