Question: Each response should be about one paragraph long, describing the justification for your decision: United Airlines sells a non-refundable airplane ticket for a round trip,

Each response should be about one paragraph long, describing the justification for your decision: United Airlines sells a non-refundable airplane ticket for a round trip, New York to Los Angeles, on October 30th, for a cash payment of $600. The outbound flight is scheduled for December 23rd and the return flight is scheduled for January 2nd. Are the revenue recognition criteria met or not met? Why or why not?

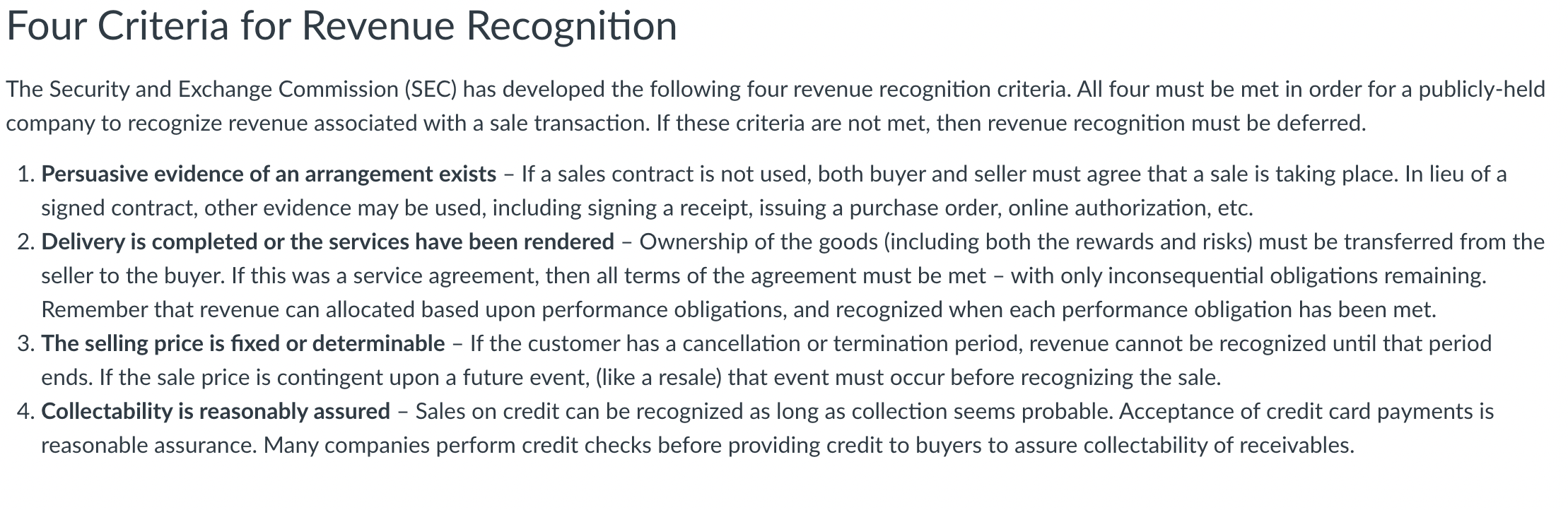

Four Criteria for Revenue Recognition The Security and Exchange Commission (SEC) has developed the following four revenue recognition criteria. All four must be met in order for a publicly-held company to recognize revenue associated with a sale transaction. If these criteria are not met, then revenue recognition must be deferred. 1. Persuasive evidence of an arrangement exists - If a sales contract is not used, both buyer and seller must agree that a sale is taking place. In lieu of a signed contract, other evidence may be used, including signing a receipt, issuing a purchase order, online authorization, etc. 2. Delivery is completed or the services have been rendered - Ownership of the goods (including both the rewards and risks) must be transferred from the seller to the buyer. If this was a service agreement, then all terms of the agreement must be met - with only inconsequential obligations remaining. Remember that revenue can allocated based upon performance obligations, and recognized when each performance obligation has been met. 3. The selling price is fixed or determinable If the customer has a cancellation or termination period, revenue cannot be recognized until that period ends. If the sale price is contingent upon a future event, (like a resale) that event must occur before recognizing the sale. 4. Collectability is reasonably assured Sales on credit can be recognized as long as collection seems probable. Acceptance of credit card payments is reasonable assurance. Many companies perform credit checks before providing credit to buyers to assure collectability of receivables. Four Criteria for Revenue Recognition The Security and Exchange Commission (SEC) has developed the following four revenue recognition criteria. All four must be met in order for a publicly-held company to recognize revenue associated with a sale transaction. If these criteria are not met, then revenue recognition must be deferred. 1. Persuasive evidence of an arrangement exists - If a sales contract is not used, both buyer and seller must agree that a sale is taking place. In lieu of a signed contract, other evidence may be used, including signing a receipt, issuing a purchase order, online authorization, etc. 2. Delivery is completed or the services have been rendered - Ownership of the goods (including both the rewards and risks) must be transferred from the seller to the buyer. If this was a service agreement, then all terms of the agreement must be met - with only inconsequential obligations remaining. Remember that revenue can allocated based upon performance obligations, and recognized when each performance obligation has been met. 3. The selling price is fixed or determinable If the customer has a cancellation or termination period, revenue cannot be recognized until that period ends. If the sale price is contingent upon a future event, (like a resale) that event must occur before recognizing the sale. 4. Collectability is reasonably assured Sales on credit can be recognized as long as collection seems probable. Acceptance of credit card payments is reasonable assurance. Many companies perform credit checks before providing credit to buyers to assure collectability of receivables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts