Question: Each team will write a single report and work should be distributed as evenly as possible. Reports should be professionally prepared, for example, properly

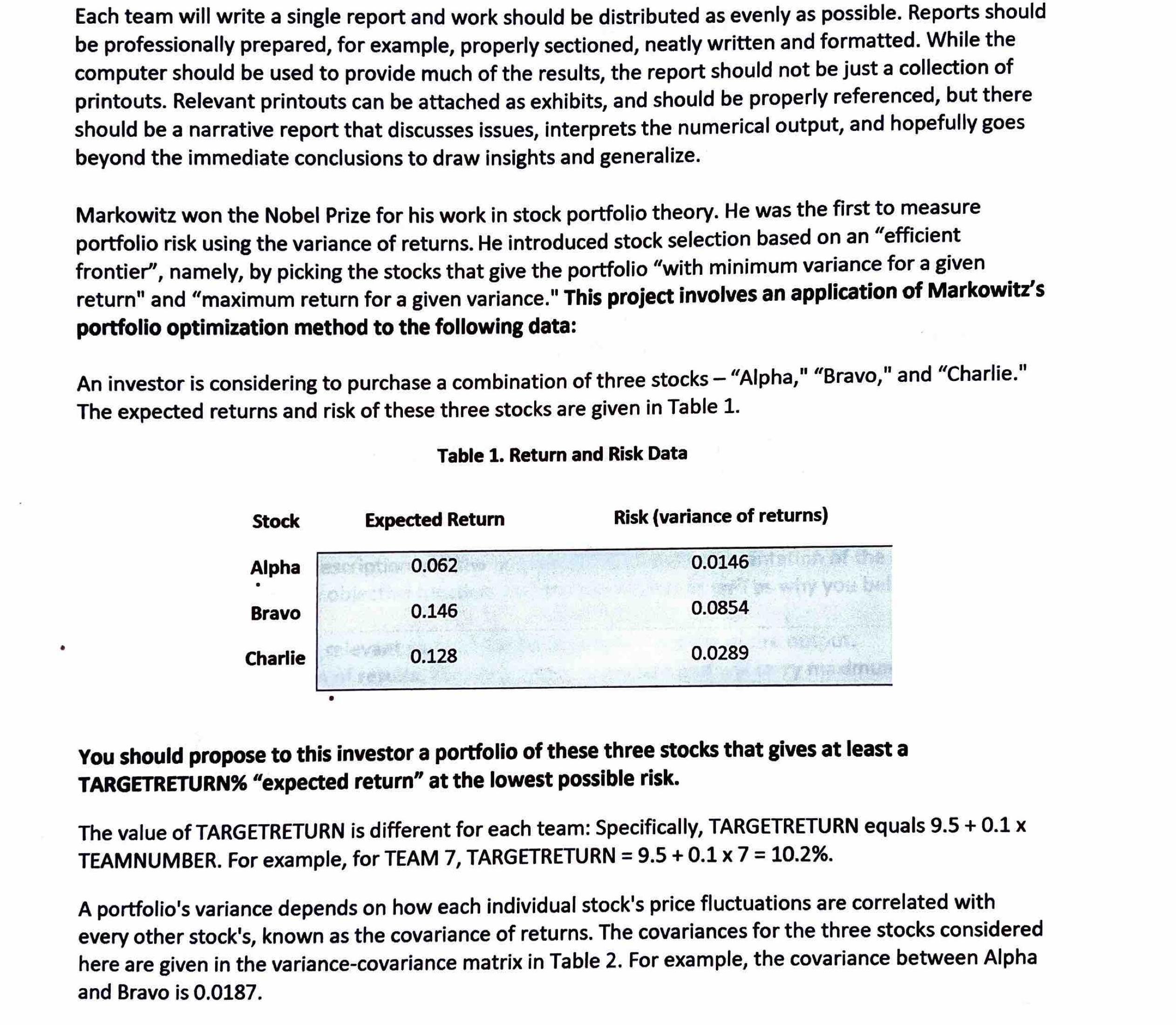

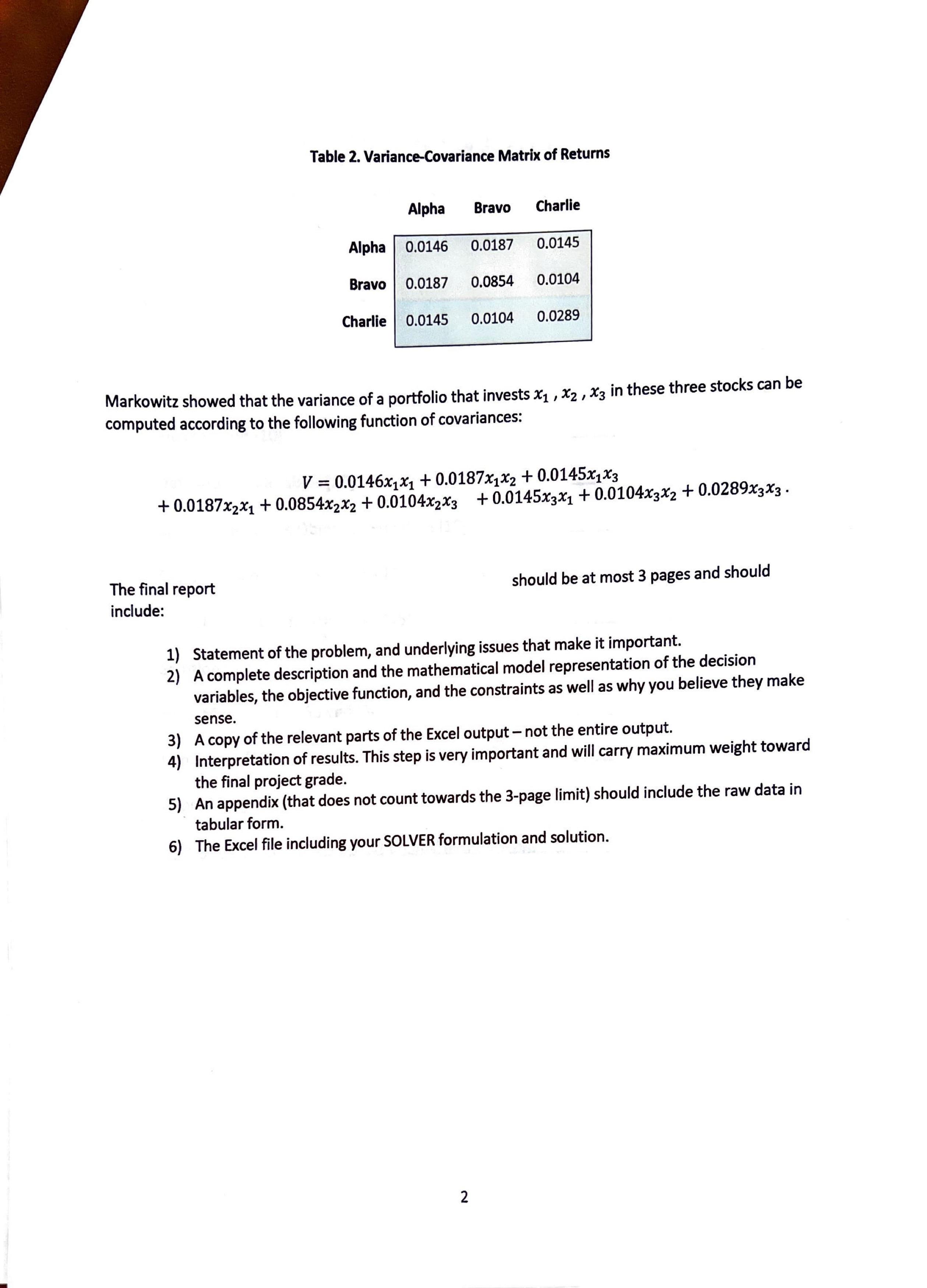

Each team will write a single report and work should be distributed as evenly as possible. Reports should be professionally prepared, for example, properly sectioned, neatly written and formatted. While the computer should be used to provide much of the results, the report should not be just a collection of printouts. Relevant printouts can be attached as exhibits, and should be properly referenced, but there should be a narrative report that discusses issues, interprets the numerical output, and hopefully goes beyond the immediate conclusions to draw insights and generalize. Markowitz won the Nobel Prize for his work in stock portfolio theory. He was the first to measure portfolio risk using the variance of returns. He introduced stock selection based on an "efficient frontier", namely, by picking the stocks that give the portfolio "with minimum variance for a given return" and "maximum return for a given variance." This project involves an application of Markowitz's portfolio optimization method to the following data: An investor is considering to purchase a combination of three stocks - "Alpha," "Bravo," and "Charlie." The expected returns and risk of these three stocks are given in Table 1. Table 1. Return and Risk Data Stock Alpha excipting 0.062 Bravo Expected Return Charlie 0.146 0.128 Risk (variance of returns) 0.0146 0.0854 0.0289 madmus You should propose to this investor a portfolio of these three stocks that gives at least a TARGETRETURN% "expected return" at the lowest possible risk. The value of TARGETRETURN is different for each team: Specifically, TARGETRETURN equals 9.5 + 0.1 x TEAMNUMBER. For example, for TEAM 7, TARGETRETURN = 9.5+ 0.1 x 7 = 10.2%. A portfolio's variance depends on how each individual stock's price fluctuations are correlated with every other stock's, known as the covariance of returns. The covariances for the three stocks considered here are given in the variance-covariance matrix in Table 2. For example, the covariance between Alpha and Bravo is 0.0187. Table 2. Variance-Covariance Matrix of Returns Alpha Bravo Charlie The final report include: 0.0187 Alpha 0.0146 Bravo 0.0187 0.0854 0.0104 0.0145 Charlie 0.0145 0.0104 0.0289 Markowitz showed that the variance of a portfolio that invests x, x, x3 in these three stocks can be computed according to the following function of covariances: V = 0.0146xx +0.0187xx + 0.0145x1x3 +0.0187xx +0.0854x2x2 +0.0104x2x3 +0.0145x3x +0.0104x3x2 +0.0289x3x3. 2 should be at most 3 pages and should 1) Statement of the problem, and underlying issues that make it important. 2) A complete description and the mathematical model representation of the decision variables, the objective function, and the constraints as well as why you believe they make sense. 3) A copy of the relevant parts of the Excel output - not the entire output. 4) Interpretation of results. This step is very important and will carry maximum weight toward the final project grade. 5) An appendix (that does not count towards the 3-page limit) should include the raw data in tabular form. 6) The Excel file including your SOLVER formulation and solution.

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Report on Portfolio Optimization using Markowitzs Method 1 Statement of the Problem The problem at h... View full answer

Get step-by-step solutions from verified subject matter experts