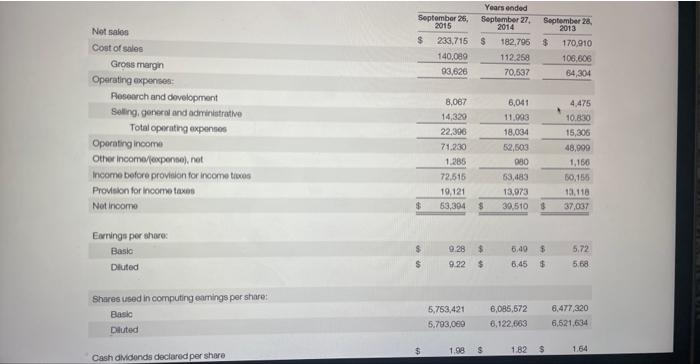

Question: Earrings per thare: Basic: Dluted begin{tabular}{llllll|} $ & 9.28 & $ & 6.49 & $ & 5.72 $ & 9.22 & $ & 6.45

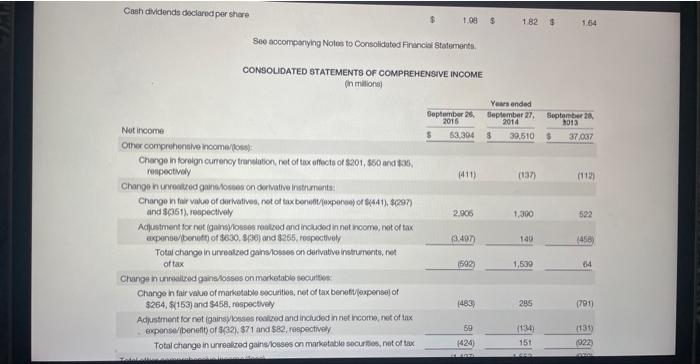

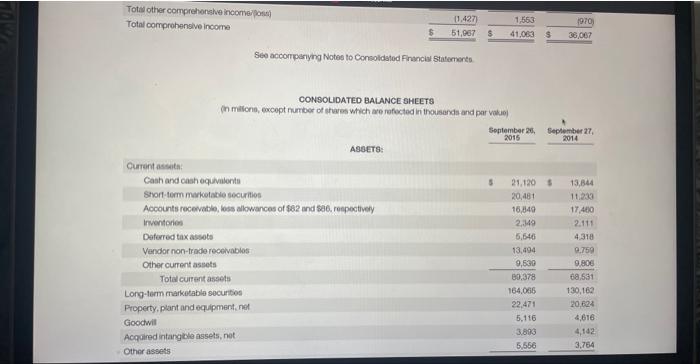

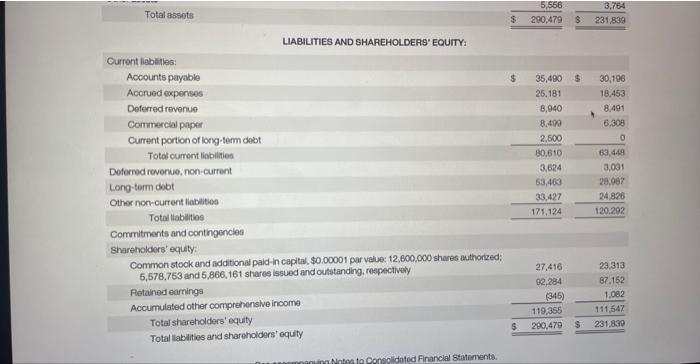

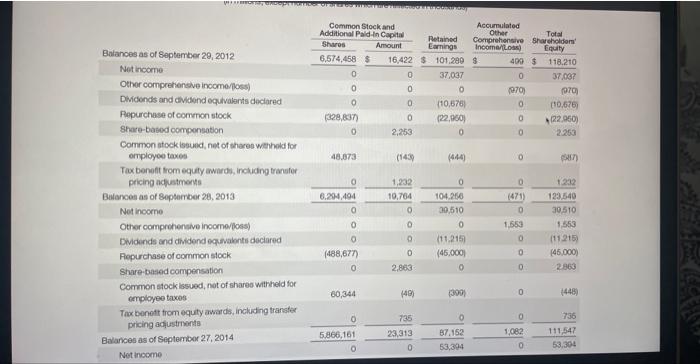

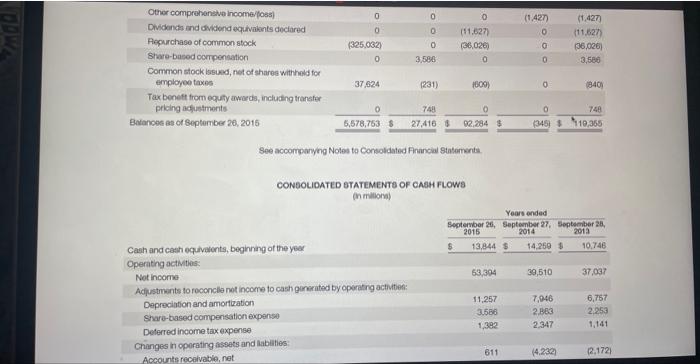

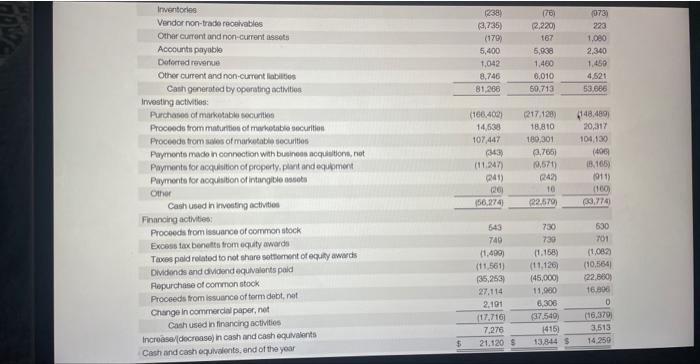

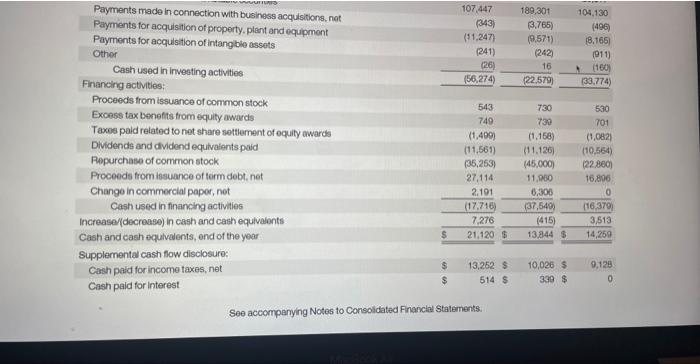

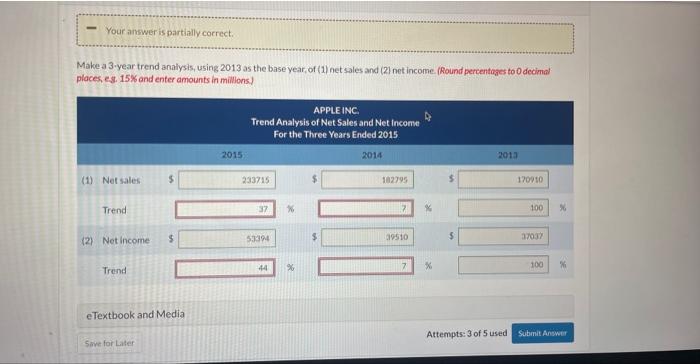

Earrings per thare: Basic: Dluted \begin{tabular}{llllll|} $ & 9.28 & $ & 6.49 & $ & 5.72 \\ $ & 9.22 & $ & 6.45 & $ & 5.68 \end{tabular} Shares used in computing eamings per share: Busia Deluted 5,753,4215,793,0696,085,6726,122,0636,477,3206,521,634 Cash didonds declared per share $ 1,98& 1.82$ 1.64 CONSOLDATED STATEMENTS OF COMPREHENSVE INCOME (n milionsi See accomparying Notes to Consoldated Fnwnciv Statemeres CONSOLIDATED BALANCE BHEETS (n malicne, excopt number of stwes which are refocted in thousands and par voliol Total assots \begin{tabular}{rr} 3,7645,556 \\ $200,479 & $231,839 \\ \hline \end{tabular} LABMLITES AND SHAREHOLDERS' EQUITY: Curront liablities: Accounts payable Accrued experisos Deterred revenue Comimercial paper Current portion of long-tem debt Total current liabilities Deforred rovenue, non-current Long-term dobt Other non-ourrent liablitios Totaillabilites Commitmonts and contingencies Shareholdors' equity: Common stock and additiond paid-in capital, $0.00001 par value: 12,600,000 shares authorzed: 5,578,753 and 5,866,161 stures issued and outstanding, respectively Fetained earnings Accumulated other comprehonsive income Total shareholders' equity Total llablities and shareholders' equity See accompunyng Notes ta Consoldated Fhancial Statomenti CONDOLIOATED BTATEMENTO OF CASM FLOWS (nmilion) See accompanying Notes to Consoldated Financhal Statements. Your anwer is partially cocrect. Make a 3-year trend analysis, using 2013 as the base year, of (1) net sales and (2) net income. (Round percentoges too decima) places, est. 15% and enter amounts in milions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts