Question: Easy Excel Problem NPV, PP, Decision Matrix, and explanation. Answer quickly and correctly for thumbs up. Thanks for your help! - Let's say that a

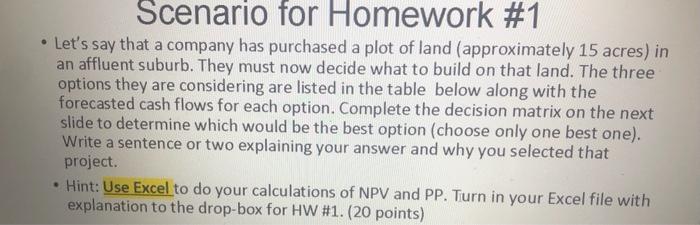

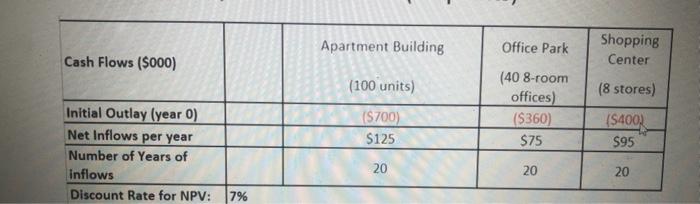

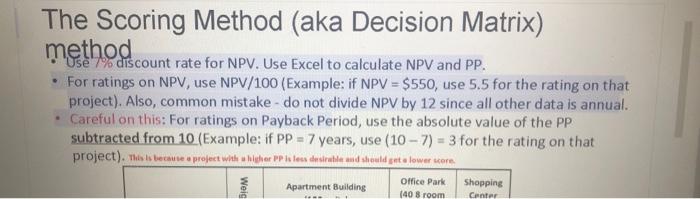

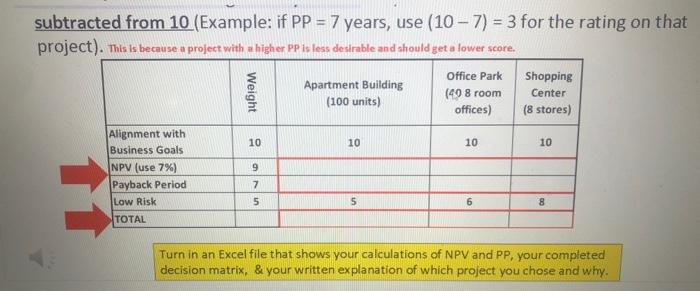

- Let's say that a company has purchased a plot of land (approximately 15 acres) in an affluent suburb. They must now decide what to build on that land. The three options they are considering are listed in the table below along with the forecasted cash flows for each option. Complete the decision matrix on the next slide to determine which would be the best option (choose only one best one). Write a sentence or two explaining your answer and why you selected that project. - Hint: Use Excel to do your calculations of NPV and PP. Turn in your Excel file with explanation to the drop-box for HW \#1. (20 points) \begin{tabular}{|l|c|c|c|c|} \hline Cash Flows (\$000) & & Apartment Building & Office Park (40 8-room offices) & Shopping Center (8 stores) \\ \hline Initial Outlay (year 0) & (100 units) & ($360) & (S400) \\ \hline Net Inflows per year & ($700) & 575 & 595 \\ \hline Number of Years of inflows & $125 & 20 & 20 \\ \hline Discount Rate for NPV: & 7% & 20 & & \\ \hline \end{tabular} The Scoring Method (aka Decision Matrix) method - For ratings on NPV, use NPV/100 (Example: if NPV =$550, use 5.5 for the rating on that project). Also, common mistake - do not divide NPV by 12 since all other data is annual. - Careful on this: For ratings on Payback Period, use the absolute value of the PP subtracted from 10 (Example: if PP=7 years, use (107)=3 for the rating on that Project). This ls because a project whh u highor PF is less desirahle and should set s lower scere. subtracted from 10 (Example: if PP=7 years, use (107)=3 for the rating on that project). This is because a project with a higher pp is less desirable and should get a lower score. Turn in an Excel file that shows your calculations of NPV and PP, your completed decision matrix, \& your written explanation of which project you chose and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts