Question: Easy Finance Question. Received wrong answer in the previous post. Only solve if your sure about your answer. Please solve all 3 parts Question 4

Easy Finance Question. Received wrong answer in the previous post. Only solve if your sure about your answer.

Please solve all 3 parts

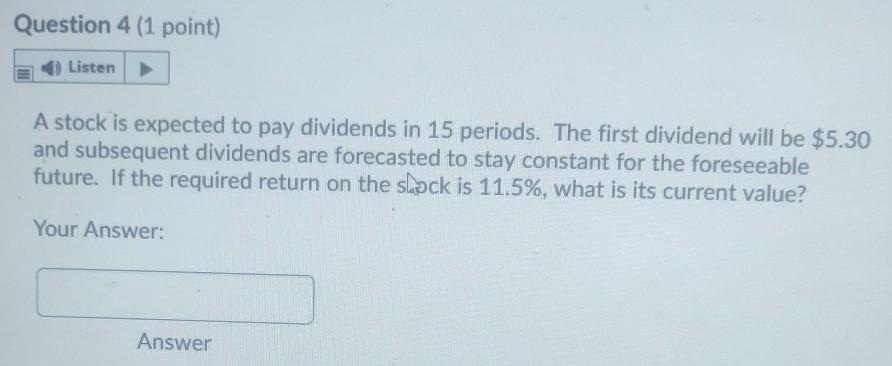

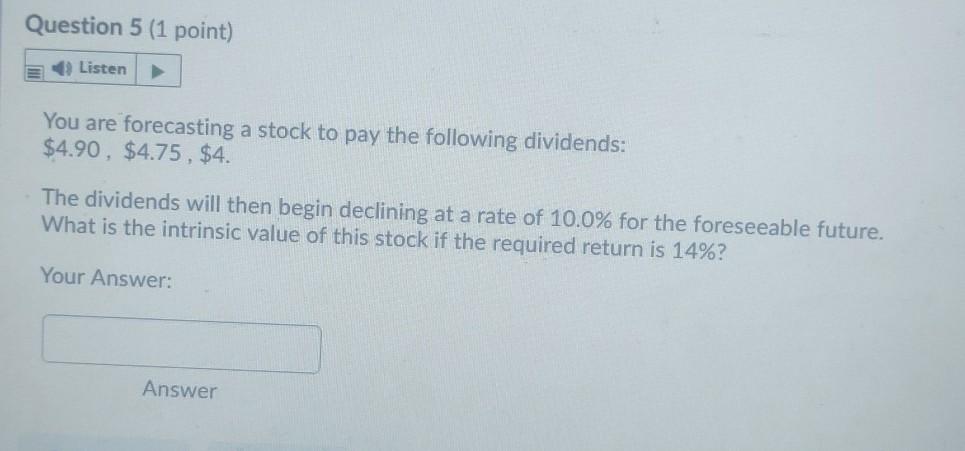

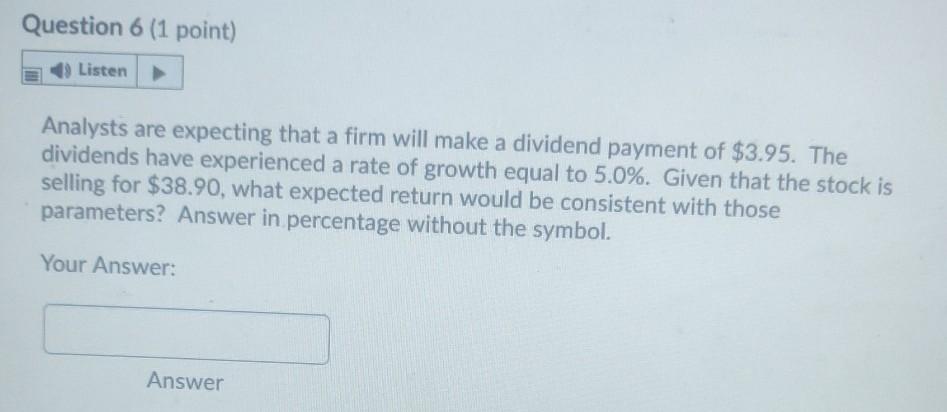

Question 4 (1 point) Listen A stock is expected to pay dividends in 15 periods. The first dividend will be $5.30 and subsequent dividends are forecasted to stay constant for the foreseeable future. If the required return on the shack is 11.5%, what is its current value? Your Answer: Answer Question 5 (1 point) E) Listen You are forecasting a stock to pay the following dividends: $4.90, $4.75, $4. The dividends will then begin declining at a rate of 10.0% for the foreseeable future. What is the intrinsic value of this stock if the required return is 14%? Your Answer: Answer Question 6 (1 point) Listen Analysts are expecting that a firm will make a dividend payment of $3.95. The dividends have experienced a rate of growth equal to 5.0%. Given that the stock is selling for $38.90, what expected return would be consistent with those parameters? Answer in percentage without the symbol. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts