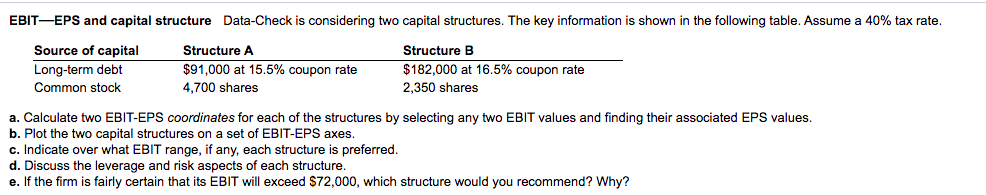

Question: EBITEPS and capital structure Data-Check is considering two capital structures. The key information is shown in the following table. Assume a 40% tax rate. Source

EBITEPS and capital structure Data-Check is considering two capital structures. The key information is shown in the following table. Assume a 40% tax rate. Source of capital Long-term debt Common stock Structure A $91,000 at 15.5% coupon rate 4,700 shares Structure B $182,000 at 16.5% coupon rate 2,350 shares a. Calculate two EBIT-EPS coordinates for each of the structures by selecting any two EBIT values and finding their associated EPS values b. Plot the two capital structures on a set of EBIT-EPS axes. c. Indicate over what EBIT range, if any, each structure is preferred. d. Discuss the leverage and risk aspects of each structure. e. If the firm is fairly certain that its EBIT will exceed $72,000, which structure would you recommend? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts