Question: eBOOK Problem 9-24 (Algorithmic) (LO. 3) USCo incurred $98,000 in interest expense for the current year. The tax book value of USC's assets generating foreign-source

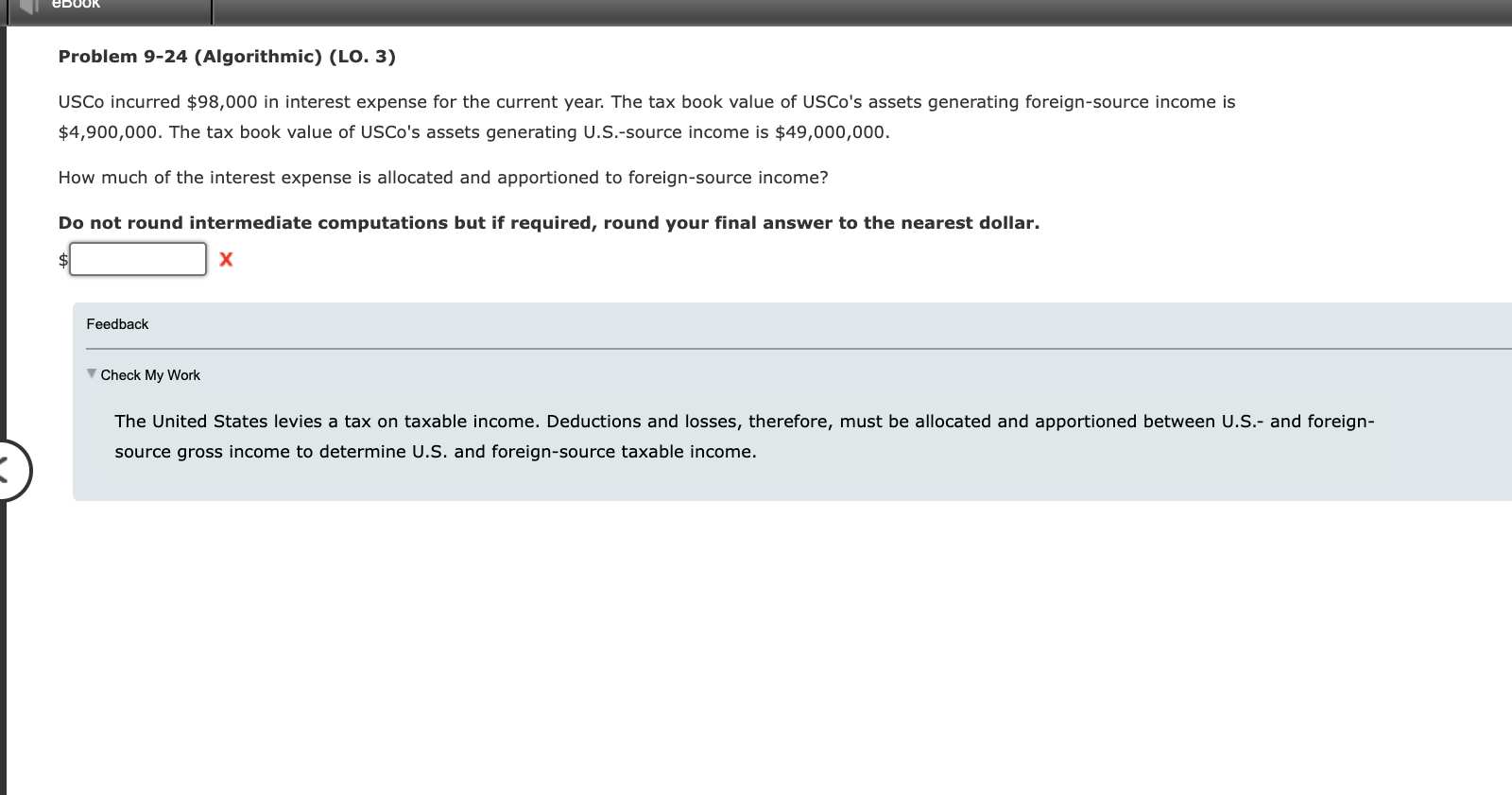

eBOOK Problem 9-24 (Algorithmic) (LO. 3) USCo incurred $98,000 in interest expense for the current year. The tax book value of USC's assets generating foreign-source income is $4,900,000. The tax book value of USC's assets generating U.S.-source income is $49,000,000. How much of the interest expense is allocated and apportioned to foreign-source income? Do not round intermediate computations but if required, round your final answer to the nearest dollar. Feedback Check My Work The United States levies a tax on taxable income. Deductions and losses, therefore, must be allocated and apportioned between U.S.- and foreign- source gross income to determine U.S. and foreign-source taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts