1. Should the Air Comfort Division institute the 5 percent price reduction on its air-conditioner units even...

Question:

1. Should the Air Comfort Division institute the 5 percent price reduction on its air-conditioner units even if it cannot acquire the compressors internally for $50 each? Support your conclusion with appropriate calculations.

2. Independently of your answer to requirement 1, assume the Air Comfort Division needs 17,400 units. Should the Compressor Division be willing to supply the compressor units for $50 each? Support your conclusions with appropriate calculations.

3. Independently of your answer to requirement 1, assume Air Comfort needs 17,400 units. Suppose InterGlobal’s top management has specified a transfer price of $50. Would it be in the best interest of InterGlobal Industries for the Compressor Division to supply the compressor units at $50 each to the Air Comfort Division? Support your conclusions with appropriate calculations.

4. Is $50 a goal-congruent transfer price? [Refer to your answers for requirements 2 and 3.]

InterGlobal Industries is a diversified corporation with separate operating divisions. Each division’s performance is evaluated on the basis of profit and return on investment.

The Air Comfort Division manufactures and sells air-conditioner units. The coming year’s budgeted income statement, which follows, is based upon a sales volume of 15,000 units.

Air Comfort’s division manager believes sales can be increased if the price of the air conditioners is reduced. A market research study by an independent firm indicates that a 5 percent reduction in the selling price would increase sales volume 16 percent, or 2,400 units. The division has sufficient production capacity to manage this increased volume with no increase in fixed costs.

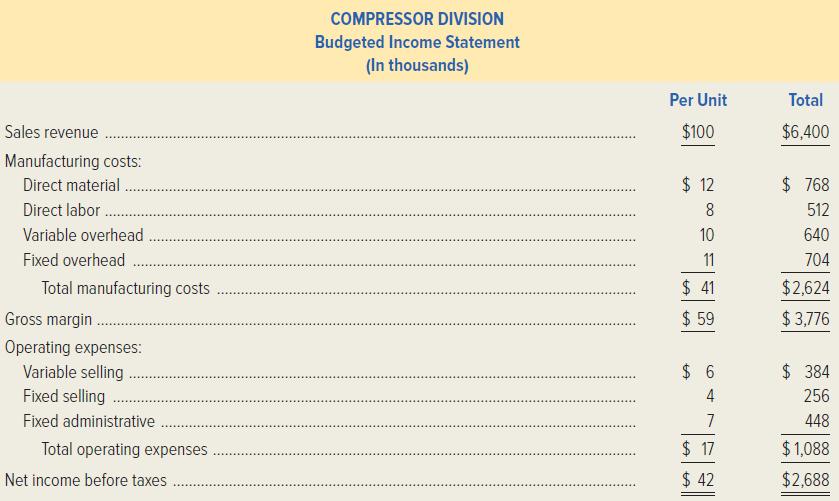

The Air Comfort Division uses a compressor in its units, which it purchases from an outside supplier at a cost of $70 per compressor. The Air Comfort Division manager has asked the manager of the Compressor Division about selling compressor units to Air Comfort. The Compressor Division currently manufactures and sells a unit to outside firms that is similar to the unit used by the Air Comfort Division. The specifications of the Air Comfort Division compressor are slightly different, which would reduce the Compressor Division’s direct material cost by $1.50 per unit. In addition, the Compressor Division would not incur any variable selling costs in the units sold to the Air Comfort Division. The manager of the Air Comfort Division wants all of the compressors it uses to come from one supplier and has offered to pay $50 for each compressor unit. The Compressor Division has the capacity to produce 75,000 units. Its budgeted income statement for the coming year, which follows, is based on a sales volume of 64,000 units without considering Air Comfort’s proposal.

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Managerial Accounting Creating Value in a Dynamic Business Environment

ISBN: 978-1260417043

12th edition

Authors: Ronald Hilton, David Platt