Question: eBook Problem 9-3 Withholding Methods (LO 9.1) Sophie is a single taxpayer. For the first payroll period in July 2021, she paid wages of $2,200

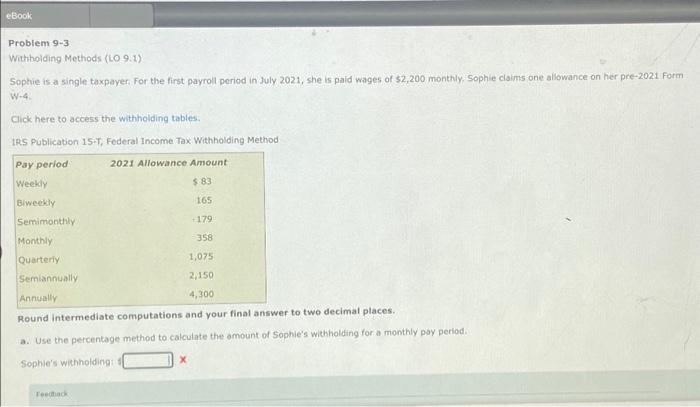

eBook Problem 9-3 Withholding Methods (LO 9.1) Sophie is a single taxpayer. For the first payroll period in July 2021, she paid wages of $2,200 monthly. Sophie claims one allowance on her pre-2021 Form W-4. Click here to access the withholding tables. IRS Publication 15-T, Federal Income Tax Withholding Method Pay period 2021 Allowance Amount Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Round intermediate computations and your final answer to two decimal places. a. Use the percentage method to calculate the amount of Sophie's withholding for a monthly pay period. Sophie's withholding: $ Feedback X $83 165 179 358 1,075 2,150 4,300

Problem 9-3 Withholding Methods (LO 9.1) Sophie is a single taxpayer For the first payrol period in July 2021, she is paid wages of 52,200 monthly, Sophie ciaims one allowance on her pre-2021 Form W-4: Click here to access the withholding tables: IRS Publication 15-T, Federal Income Tax Withholding Method Round intermediate computations and your final answer to two decimal places. a. Use the percentage method to calculate the omount of Sophie's witholding for a monthly pay period. Sophie's whiholdingt1 x

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock