Question: Problem 9-3 Withholding Methods (LO 9.1) Sophie is a single taxpayer. For the first payroll period in July 2021 , she is paid wages of

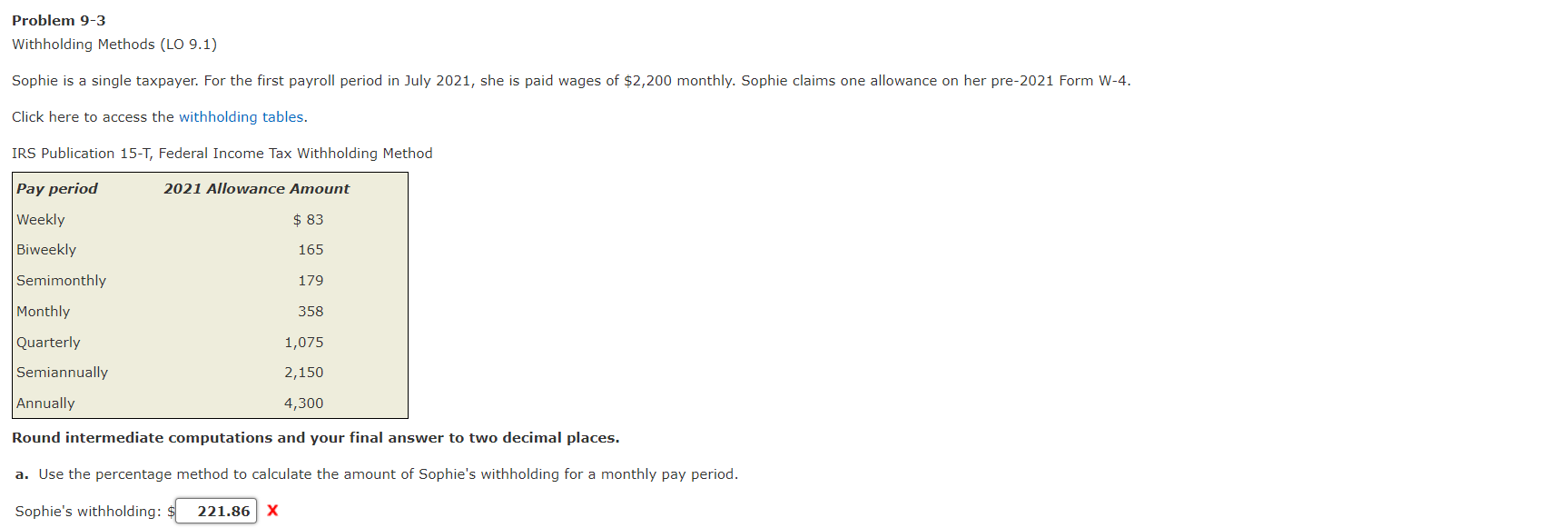

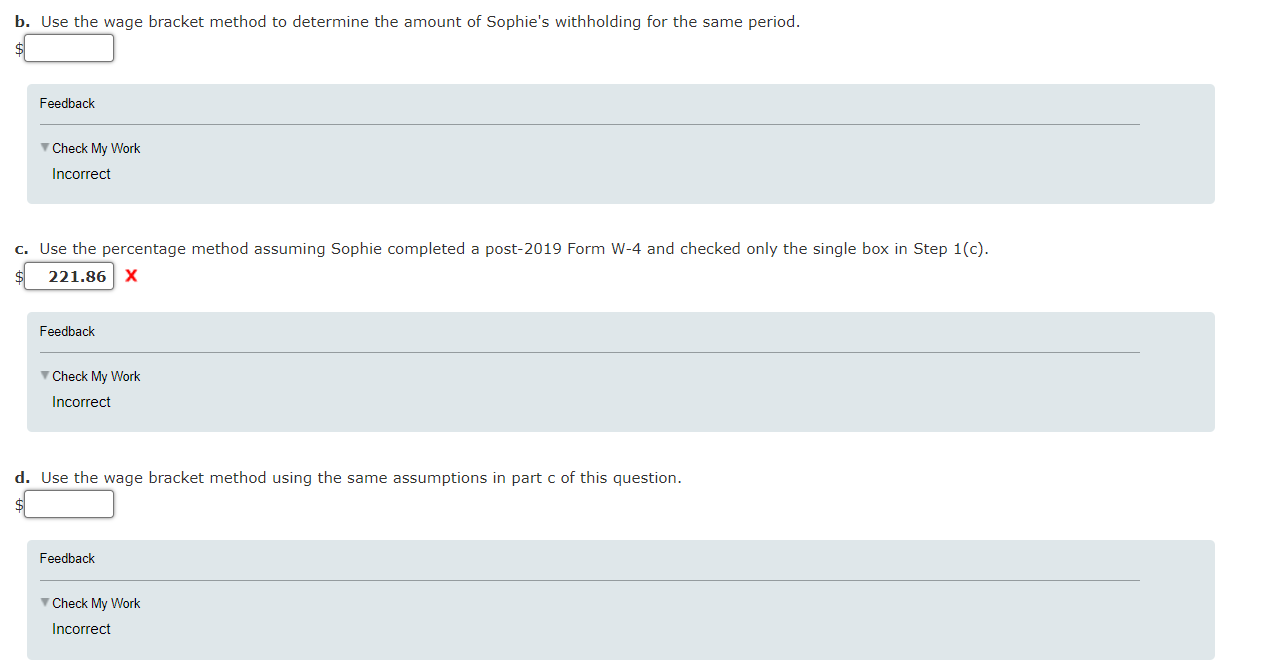

Problem 9-3 Withholding Methods (LO 9.1) Sophie is a single taxpayer. For the first payroll period in July 2021 , she is paid wages of $2,200 monthly. Sophie claims one allowance on her pre-2021 Form W-4. Click here to access the withholding tables. IRS Publication 15-T, Federal Income Tax Withholding Method Round intermediate computations and your final answer to two decimal places. a. Use the percentage method to calculate the amount of Sophie's withholding for a monthly pay period. Sophie's withholding: $X b. Use the wage bracket method to determine the amount of Sophie's withholding for the same period. Feedback Check My Work Incorrect c. Use the percentage method assuming Sophie completed a post-2019 Form W-4 and checked only the single box in Step 1 (c). X Feedback Check My Work Incorrect d. Use the wage bracket method using the same assumptions in part c of this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts