Question: eBook Problem Walk-Through Problem 11-09 Replacement Analysis The Gilbert Instrument Corporation is considering replacing the wood steamer it currently uses to shape guitar sides. The

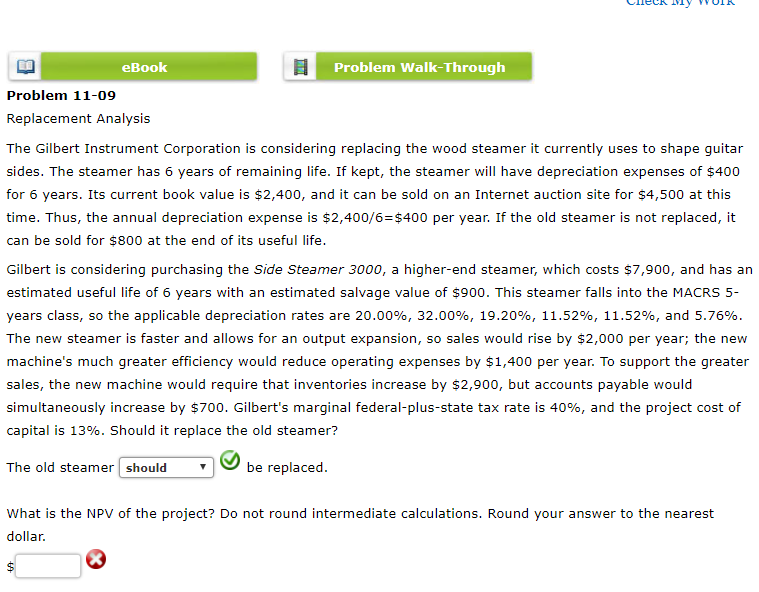

eBook Problem Walk-Through Problem 11-09 Replacement Analysis The Gilbert Instrument Corporation is considering replacing the wood steamer it currently uses to shape guitar sides. The steamer has 6 years of remaining life. If kept, the steamer will have depreciation expenses of $400 for 6 years. Its current book value is $2,400, and it can be sold on an Internet auction site for $4,500 at this time. Thus, the annual depreciation expense is $2,400/6=$400 per year. If the old steamer is not replaced, it can be sold for $800 at the end of its useful life. Gilbert is considering purchasing the Side Steamer 3000, a higher-end steamer, which costs $7,900, and has an estimated useful life of 6 years with an estimated salvage value of $900. This steamer falls into the MACRS 5- years class, so the applicable depreciation rates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76% The new steamer is faster and allows for an output expansion, so sales would rise by $2,000 per year; the new machine's much greater efficiency would reduce operating expenses by $1,400 per year. To support the greater sales, the new machine would require that inventories increase by $2,900, but accounts payable would simultaneously increase by $700. Gilbert's marginal federal-plus-state tax rate is 40%, and the project cost of capital is 13%. Should it replace the old steamer? The old steamer shouldv be replaced What is the NPV of the project? Do not round intermediate calculations. Round your answer to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts