Question: ECN 6 0 6 Cost Benefit Analysis A project has an initial cost of 1 , 0 0 0 and yields benefit of 3 0

ECN

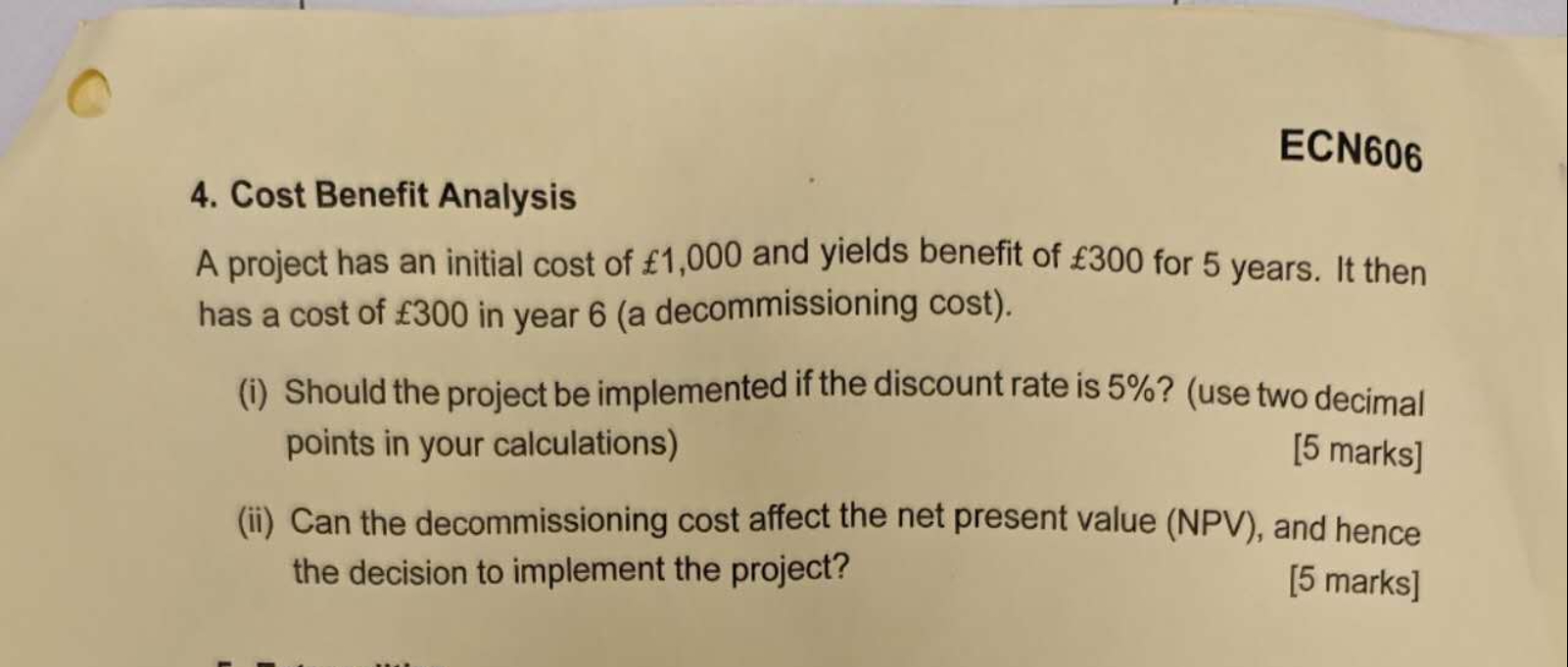

Cost Benefit Analysis

A project has an initial cost of and yields benefit of for years. It then

has a cost of in year a decommissioning cost

i Should the project be implemented if the discount rate is use two decimal

points in your calculations

ii Can the decommissioning cost affect the net present value NPV and hence

the decision to implement the project?

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock