Question: ed Question 5 0 / 1 pts A convertible bond issued by firm BigRed has a conversion ratio of 20, coupon rate of 5.5% (interest

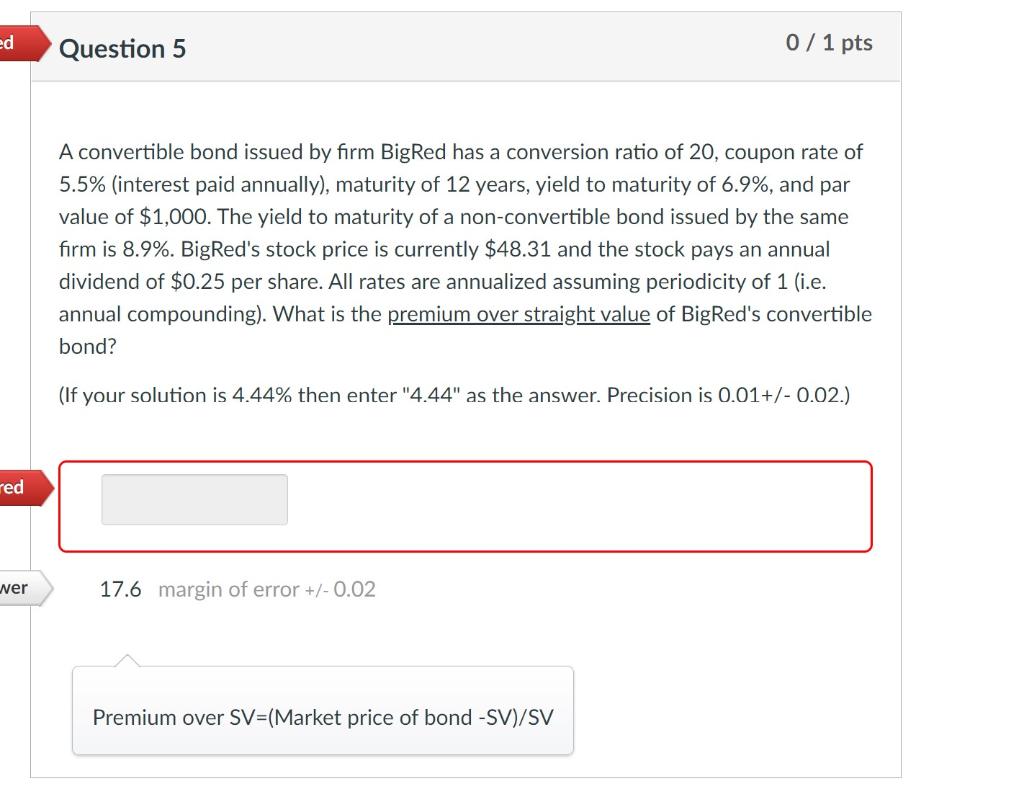

ed Question 5 0 / 1 pts A convertible bond issued by firm BigRed has a conversion ratio of 20, coupon rate of 5.5% (interest paid annually), maturity of 12 years, yield to maturity of 6.9%, and par value of $1,000. The yield to maturity of a non-convertible bond issued by the same firm is 8.9%. BigRed's stock price is currently $48.31 and the stock pays an annual dividend of $0.25 per share. All rates are annualized assuming periodicity of 1 (i.e. annual compounding). What is the premium over straight value of BigRed's convertible bond? (If your solution is 4.44% then enter "4.44" as the answer. Precision is 0.01+/- 0.02.) red wer 17.6 margin of error +/- 0.02 Premium over SV=(Market price of bond -SV)/SV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts