Question: Eddie is evaluating a new change in the production process, as he has grown disillusioned by feng shui. Eddie has avoided renting out part of

Eddie is evaluating a new change in the production process, as he has grown disillusioned by feng shui. Eddie has avoided renting out part of the warehouse for $ a year because the consultant

had urged Eddie, in order to optimize the feng shui of the area not to setting up the equipment in a certain way. He is considering another piece of equipment to replace the one described above. IF

Eddie decides to replace the current equipment he can rent out part of the space currently housing the equipment for the $ How would you incorporate that information into the analysis?

indicate whether it is a sunk cost or an opportunity cost, or something else, and whether this would increase or decrease the annual cash flows, and finally HOWWhere you would include it in your

analysis?

Edit Format Table

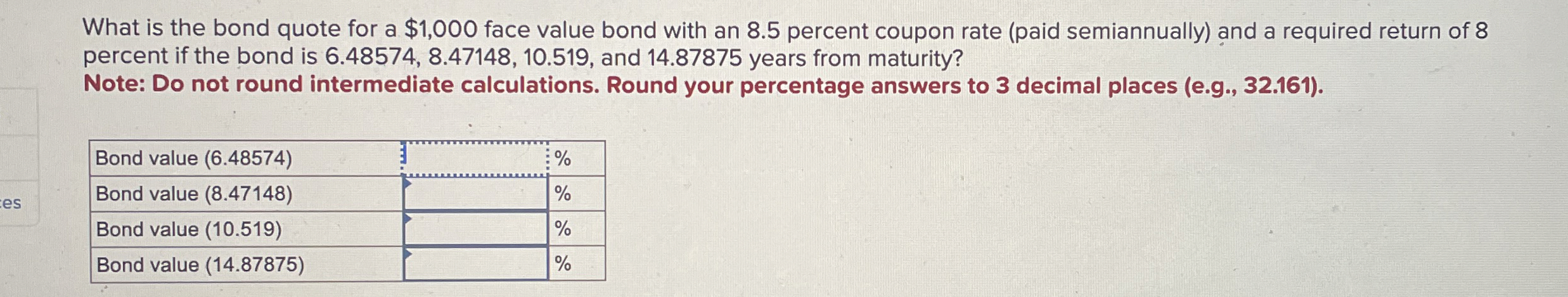

What is the bond quote for a $ face value bond with an percent coupon rate paid semiannually and a required return of

percent if the bond is and years from maturity?

Note: Do not round intermediate calculations. Round your percentage answers to decimal places eg

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock