Question: Edge Soccer Program (Edge) began the year with a cash balance of $10,500. The budget forecasts that collections from company owed to the company by

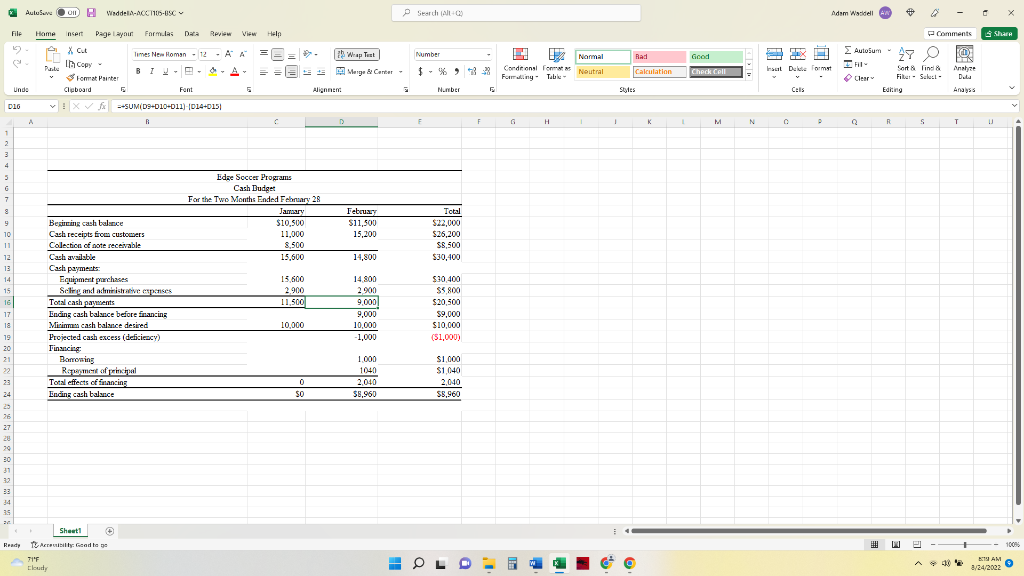

Edge Soccer Program (Edge) began the year with a cash balance of $10,500. The budget forecasts that collections from company owed to the company by customers will be $11,000 in January and $15,200 in February. The soccer program is also supposed to receive $8,500 on a notes receivable from a soccer club that owes Edge for training current player in January.

Edge plans to purchase soccer equipment in January and February with cash. The budgeted amounts of the purchases are $15,600 in January and $14,800 in February. Operating costs for the business is $2900 per month.

Edge requires $10,000 to maintain in the back account at all times. If the amount in the account falls below $10,000 the credit union extends credit to Edge immediately in multiples of $1000. Edge pays back any amounts borrowed each quarter in payments of $2000 plus 4% interest. The first payment occurs three months after the advance is made to Edge.

Requirement

Prepare a cash budget for January and February.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts