Question: Edge Soccer Program (Edge) began the year with a cash balance of $10,500. The budget forecasts that collections from customers owed to the company

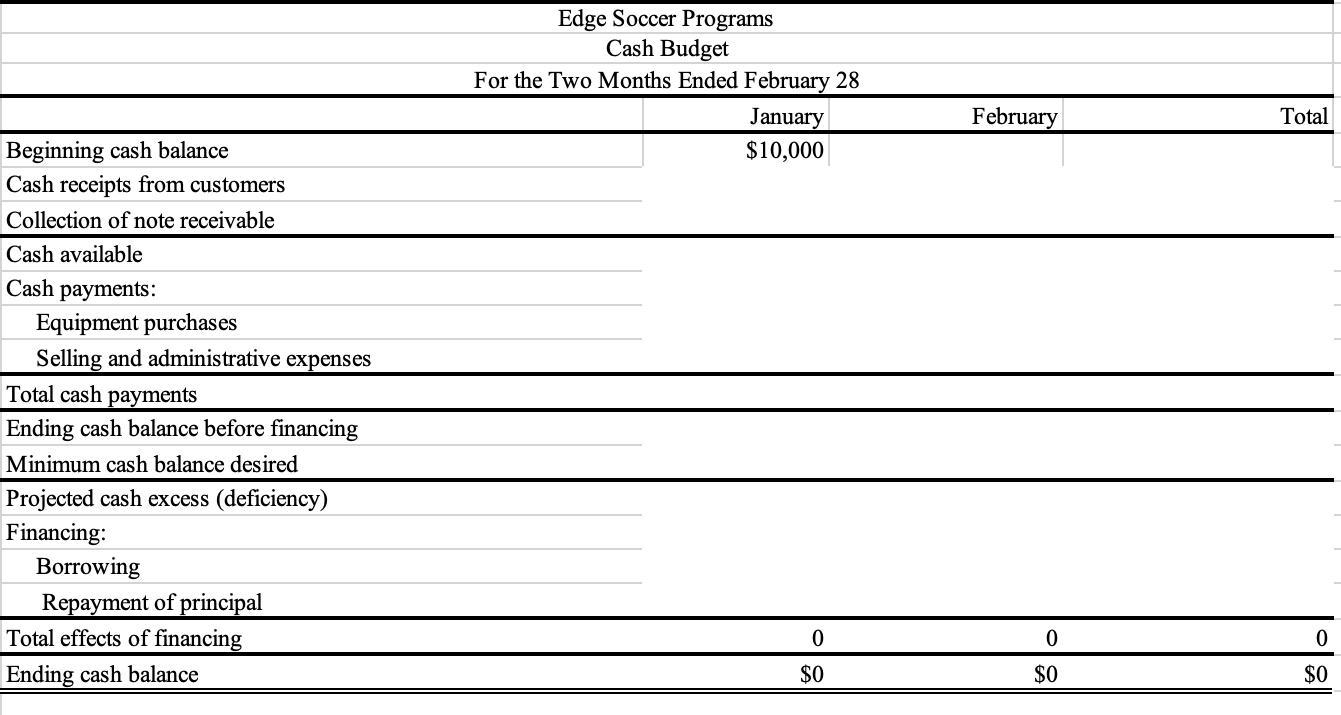

Edge Soccer Program (Edge) began the year with a cash balance of $10,500. The budget forecasts that collections from customers owed to the company will be $11,000 in January and $15,200 in February. The soccer program is also supposed to receive $8,500 in January on a note receivable from a soccer club that owes Edge for training. | Edge plans to purchase soccer equipment in January and February with cash. The budgeted amounts of the purchases are $15,600 in January and $14,800 in February. Operating costs for the business is $2900 per month. Edge must maintain a minimum cash balance of $10,000 in their bank account at all times. If the amount in the bank account falls below $10,000, then bank extends credit to Edge immediately in multiples of $1000. Edge pays back any amounts borrowed each quarter in payments of $2000 plus 4% interest. The first payment occurs three (3) months after the bank has extended edge credit. Requirement Prepare a cash budget for January and February. Beginning cash balance Cash receipts from customers Collection of note receivable Cash available Cash payments: Equipment purchases Selling and administrative expenses Total cash payments Ending cash balance before financing Minimum cash balance desired Projected cash excess (deficiency) Financing: Borrowing Repayment of principal Total effects of financing Ending cash balance Edge Soccer Programs Cash Budget For the Two Months Ended February 28 January $10,000 0 $0 February 0 $0 Total $0

Step by Step Solution

3.58 Rating (169 Votes )

There are 3 Steps involved in it

Cash Budget for Edge Soccer Program for the Two Months Ended February 28 January Beginning cash balance 10500 Cash receipts from customers 11000 Colle... View full answer

Get step-by-step solutions from verified subject matter experts