Question: Edit View History Bookmarks Profiles Tab Window Help zes 2 baylor.instructure:com / ounsse$ / 2 1 1 0 6 7 / external _ tobls /

Edit

View

History

Bookmarks

Profiles

Tab

Window

Help

zes

baylor.instructure:comounsse$externaltoblsretrievedisplay

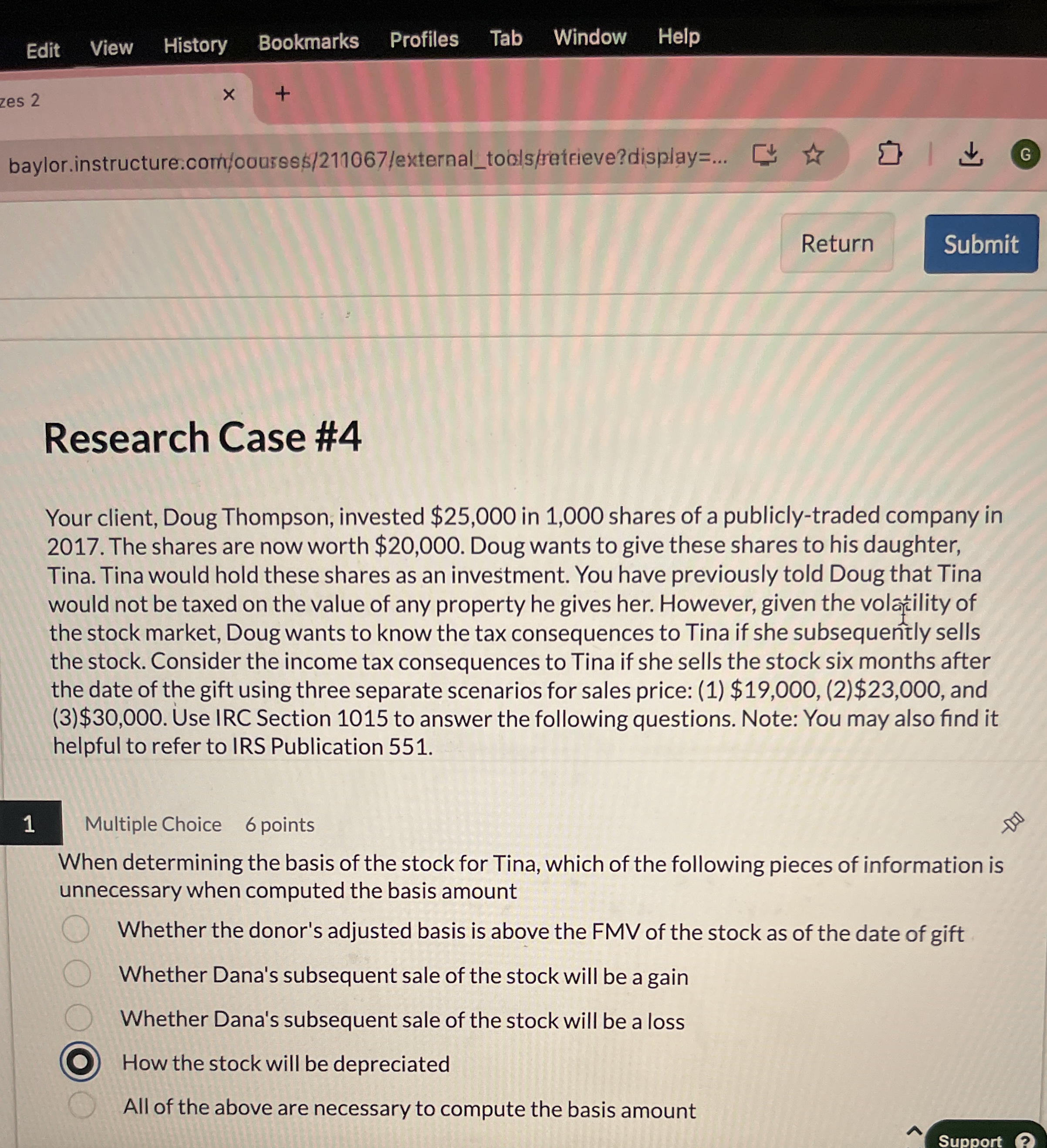

Research Case #

Your client, Doug Thompson, invested $ in shares of a publiclytraded company in The shares are now worth $ Doug wants to give these shares to his daughter, Tina. Tina would hold these shares as an investment. You have previously told Doug that Tina would not be taxed on the value of any property he gives her. However, given the volatility of the stock market, Doug wants to know the tax consequences to Tina if she subsequently sells the stock. Consider the income tax consequences to Tina if she sells the stock six months after the date of the gift using three separate scenarios for sales price: $$ and $ Use IRC Section to answer the following questions. Note: You may also find it helpful to refer to IRS Publication

Multiple Choice

points

When determining the basis of the stock for Tina, which of the following pieces of information is unnecessary when computed the basis amount

Whether the donor's adjusted basis is above the FMV of the stock as of the date of gift

Whether Dana's subsequent sale of the stock will be a gain

Whether Dana's subsequent sale of the stock will be a loss

How the stock will be depreciated

All of the above are necessary to compute the basis amount

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock