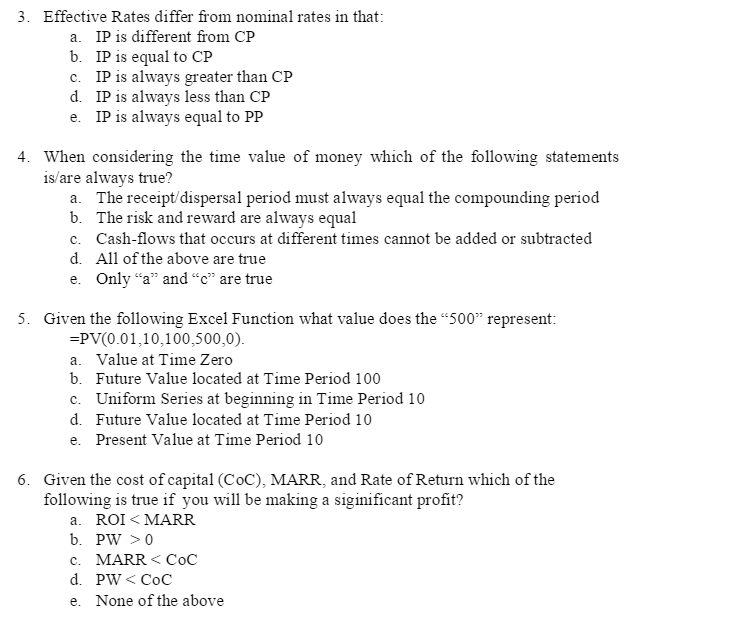

Question: Effective Rates differ from nominal rates in that: IP is different from CP IP is equal to CP IP is always greater than CP IP

Effective Rates differ from nominal rates in that: IP is different from CP IP is equal to CP IP is always greater than CP IP is always less than CP IP is always equal to PP When considering the time value of money which of the following statement is are always true? The receipt/dispersal period must always equal the compounding period The risk and reward are always equal Cash-flows that occurs at different times cannot be added or subtracted All of the above are true Only "a" and "c" are true Given the following Excel Function what value does the "500" represent = PV(0.01, 10, 100, 500, 0). Value at Time Zero Future Value located at Time Period 100 Uniform Series at beginning in Time Period 10 Future Value located at Time Period 10 Present Value at Time Period 10 Given the cost of capital (CoC), MARR, and Rate of Return which of the following is true if you will be making a significant profit? ROI 0 MARR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts