Question: : elearning.act.edu.com Al-Amal Company is planning to replace its old equipment and obtained two quotations for Model A and Model B. Model A has an

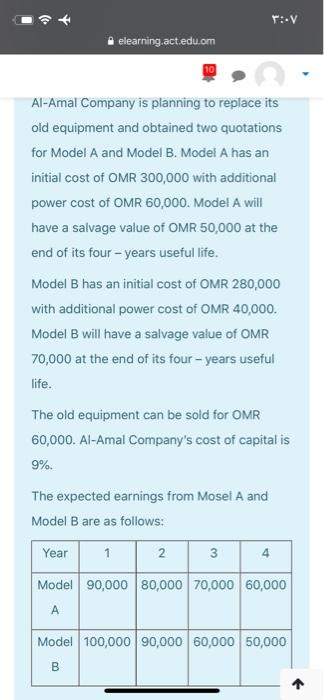

: elearning.act.edu.com Al-Amal Company is planning to replace its old equipment and obtained two quotations for Model A and Model B. Model A has an initial cost of OMR 300,000 with additional power cost of OMR 60,000. Model A will have a salvage value of OMR 50,000 at the end of its four-years useful life. Model B has an initial cost of OMR 280,000 with additional power cost of OMR 40,000. Model B will have a salvage value of OMR 70,000 at the end of its four-years useful life. The old equipment can be sold for OMR 60,000. Al-Amal Company's cost of capital is 9%. The expected earnings from Mosel A and Model B are as follows: Year 1 2 3 Model 90,000 80,000 70,000 60,000 Model 100,000 90,000 60,000 50,000 B : elearning.act.edu.om 1. Calculate the net cash outflows of Model A. 2. Calculate the net cash outflows of Model B. 3. What is NPV of Model A? 4. What is NPV of Model B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts