Question: Electron Wizards, Inc. (EWI) has a new idea for producing TV sets and it is planning to enter the devel- opment stage. Once the product

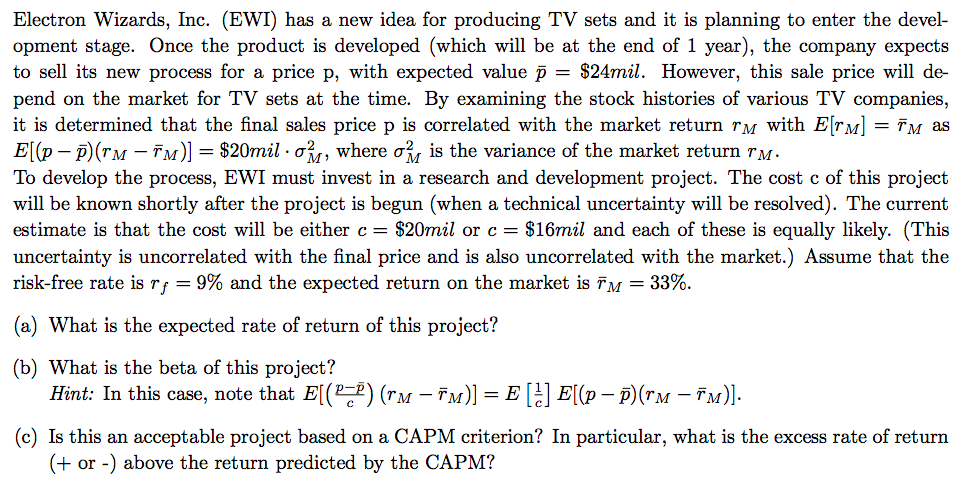

Electron Wizards, Inc. (EWI) has a new idea for producing TV sets and it is planning to enter the devel- opment stage. Once the product is developed (which will be at the end of 1 year), the company expects to sell its new process for a price p, with expected value p = $24mil. However, this sale price will de- pend on the market for TV sets at the time. By examining the stock histories of various TV companies it is determined that the final sales price p is correlated with the market return rM with EITM) = rM as E[P_P) (rM--M)] : : $20mil . 24, where 2 is the variance of the market return TM To develop the process, EWI must invest in a research and development project. The cost c of this project will be known shortly after the project is begun (when a technical uncertainty will be resolved). The current estimate is that the cost will be either c-$20mil or c $16mil and each of these is equally likely. (This uncertainty is uncorrelated with the final price and is also uncorrelated with the market.) Assume that the risk-free rate is rf-9% and the expected return on the market is rM-33% (a) What is the expected rate of return of this project? (b) What is the beta of this project? Hint: In this case, note that E(P-2) (rM-TM)] = E [] E[(p-)(TM-TM)] (c) Is this an acceptable project based on a CAPM criterion? In particular, what is the excess rate of return (+ or -) above the return predicted by the CAPM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts