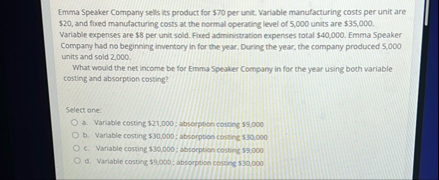

Question: Emma Speaker Company sells its product for $ 7 0 per unit. Variable manufacturing costs per unit are $ 2 0 , and fored manufacturing

Emma Speaker Company sells its product for $ per unit. Variable manufacturing costs per unit are $ and fored manufacturing costs at the normal operating level of units are $ Variable expenses are $ per unit sold. Foxed administration expenses total $ Emma Speaker Company had no beginning inventory in for the year. During the year, the company produced units and sold

What woutd the net Income be for Emma Speaker Company in for the year using both variable costing and absorption costing?

Select one:

a Variable costing ; absorption costing

b Variable costing $; absorption costine $

c Variable corting $; absorption costing

d Variable costing $ : absorptige cosine

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock