Question: Emphasis Heading 1 Heading 2 Heading Heading 5 Paragraph Styles Edit 11 1 T. 3 2 1 14 S. 100 I. Consider attending either of

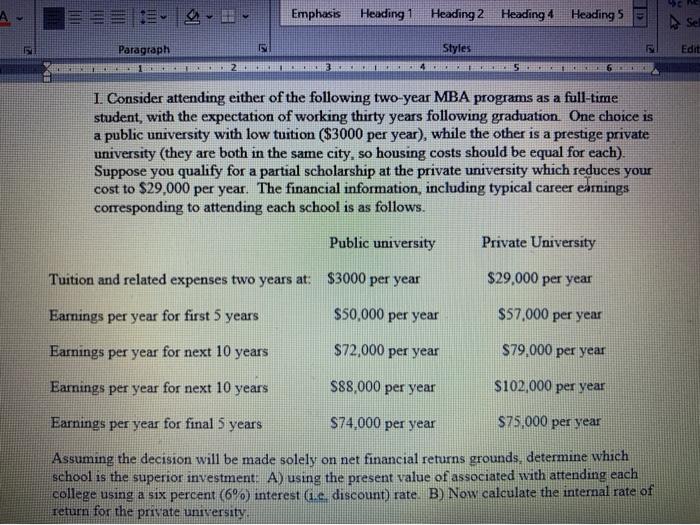

Emphasis Heading 1 Heading 2 Heading Heading 5 Paragraph Styles Edit 11 1 T. 3 2 1 14 S. 100 I. Consider attending either of the following two-year MBA programs as a full-time student, with the expectation of working thirty years following graduation. One choice is a public university with low tuition ($3000 per year), while the other is a prestige private university (they are both in the same city, so housing costs should be equal for each). Suppose you qualify for a partial scholarship at the private university which reduces your cost to $29,000 per year. The financial information, including typical career earnings corresponding to attending each school is as follows. Public university Private University Tuition and related expenses two years at: $3000 per year $29,000 per year Earnings per year for first 5 years $50,000 per year $57,000 per year Earnings per year for next 10 years $72,000 per year $79,000 per year Earnings per year for next 10 years $88,000 per year $102,000 per year Earnings per year for final 5 years $74.000 per year $75,000 per year Assuming the decision will be made solely on net financial returns grounds, determine which school is the superior investment: A) using the present value of associated with attending each college using a six percent (6%) interest (e discount) rate. B) Now calculate the internal rate of return for the private university

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts