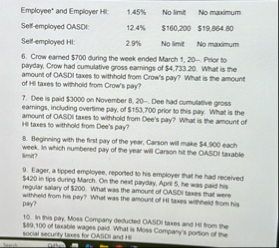

Question: Employee' and Employer Hi: 1 . 4 5 % , No limit No maximum Selt - employed OASD: 1 2 4 % , $ 1

Employee' and Employer Hi:

No limit

No maximum

Seltemployed OASD:

$

$

Sellemployed HI :

No limet

No maximum

Crow earred $ during the week ended March Piror tio payday. Crow had cumulative gross earnings of What is the amount of OASDI taxes to withhold from Crow's pay? What is the amount of Hil taues to withoid from Crow's pay?

Dee is paid $ on November Dee had cumulable gross earnings, including overtime pay, of $ prior io this pay. What is the amount of OASDI tases to withold from Dee's pay? What is the amount of If taves to withoid from Dee's pay?

Begirning with the first pay of the vear, Carson will mabe each week, In which numbered pay of the year wil Carson het The OASDI taxable Imal?

Eager, a tipped employee, reported to his employer that he had received $ is tips during March. On the next payday. Apri he was paid his regular salary of $ What was the amount of OASOR tawes that were witheid from his per? What was the anount of hil laxes wetheld fors his pey?

In This pay Moss Compary desucted CASDI taves and If hom the $ of lacabie wages paid What is Moss Comparys portion of the social securty lanes for OASDI and is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock