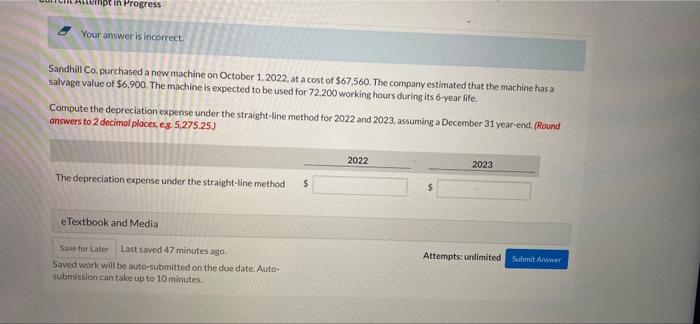

Question: empt in Progress Your answer is incorrect Sandhill Co. purchased a new machine on October 1, 2022, at a cost of $67,560. The company estimated

empt in Progress Your answer is incorrect Sandhill Co. purchased a new machine on October 1, 2022, at a cost of $67,560. The company estimated that the machine has a salvage value of $6,900. The machine is expected to be used for 72.200 working hours during its 6-year life. Compute the depreciation expense under the straight-line method for 2022 and 2023, assuming a December 31 year-end. (Round answers to 2 decimal places, es 5,275.25) a 2022 2023 The depreciation expense under the straight-line method $ e Textbook and Media Attempts: unlimited Save for Later Last saved 47 minutes ago Saved work will be auto-submitted on the due date. Auto- submission can take up to 10 minutes Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts