Question: en CASE STUDIES nd Case Study 1 You are a fraud investigator who has been hired to detect financial statement fraud for the Chipmunk Company.

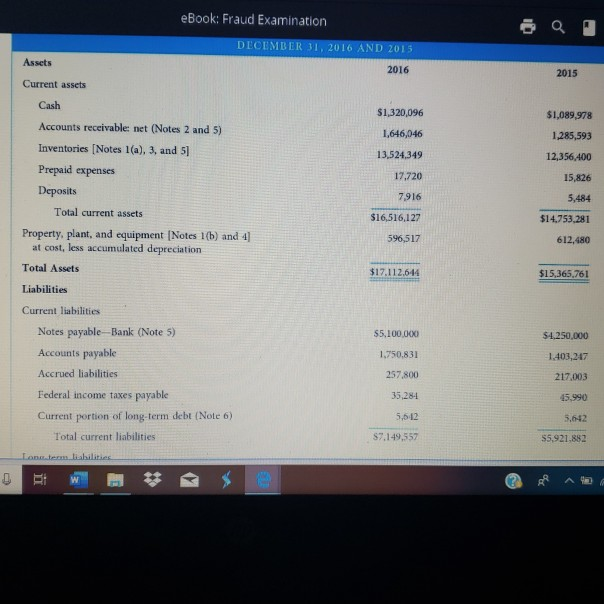

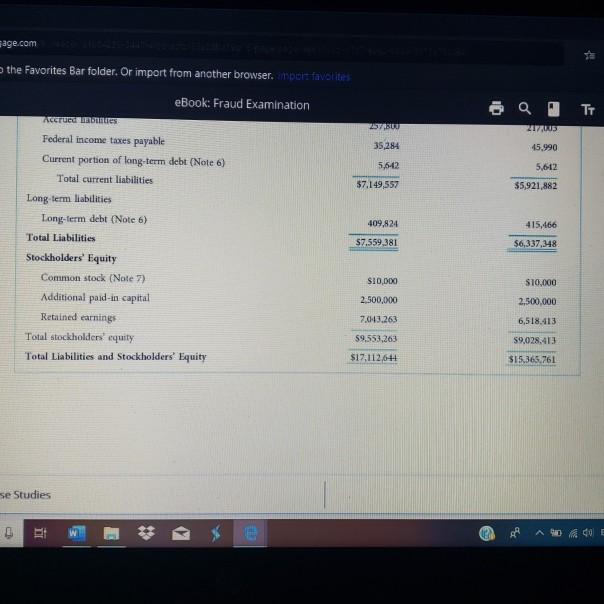

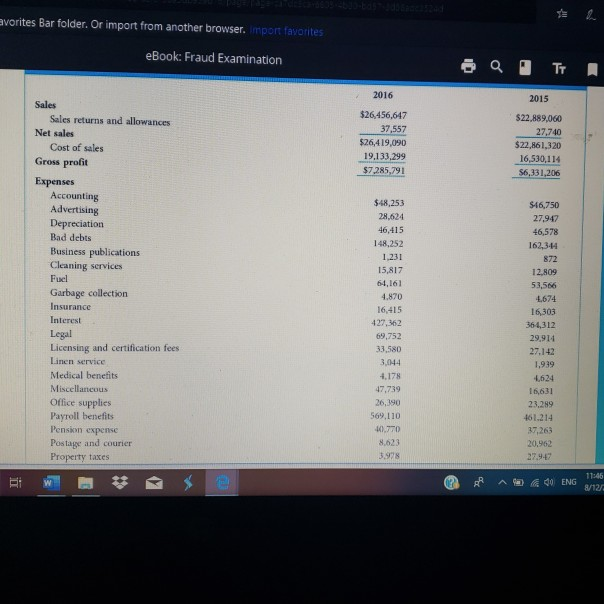

en CASE STUDIES nd Case Study 1 You are a fraud investigator who has been hired to detect financial statement fraud for the Chipmunk Company. You have been provided with the financial statements on the following pages and are now begin- ning your analysis of those financial statements. he Ors ad Questions ue dit the pur to 1. Calculate the 2016 and 2015 liquidity ratios identified using the ratio analysis table below. Also calculate the change and the percentage change for the ratios and complete the table. (Formulas are given to shorten the time spent on the assignment.) 2. Analyze the Chipmunk Company's ratios for both years and compare the figures with the given industry ratios. Based on the ratios identified, where do you think fraud may have occurred? ard tes sod hat eBook: Fraud Examination DECEMBER 31, 2016 AND 2015 2016 Assets 2015 Current assets Cash $1,320,096 Accounts receivable net (Notes 2 and 5) Inventories [Notes 1(a), 3, and 5] Prepaid expenses Deposits 1,646,046 13,524.349 $1,089,978 1,285,593 12,356400 15,826 5,484 17.720 7,916 Total current assets $16,516,127 $14.753.281 596,517 612.480 Property, plant, and equipment [Notes 1(b) and 4 at cost, less accumulated depreciation Total Assets Liabilities $17.112.644 $15,365,761 Current liabilities $5,100.000 1.750.831 $4,250,000 1.403,247 217.003 257.800 Notes payable--Bank (Note 5) Accounts payable Accrued liabilities Federal income taxes payable Current portion of long-term debt (Note 6) Total current liabilities 35.284 45.990 5,512 5.612 55.921.882 57.149,557 Lonem liabilities the Favorites Bar folder. Or import from another browser. Import favorites eBook: Fraud Examination Accrued abuses 257 SUU 217UUS 35,284 45,990 5.612 Federal income taxes payable Current portion of long-term debt (Note 6) Total current liabilities Long-term liabilities Long-term debt (Note 6) Total Liabilities 5,642 $7.149,557 $5,921,882 409,824 57,559,381 415,466 $6,337,348 Stockholders' Equity $10,000 $10,000 2,500,000 2.500,000 Common stock (Note 7) Additional paid-in capital Retained earnings Total stockholders' equity Total Liabilities and Stockholders' Equity 7.0-13.263 6,518.413 59,553,263 59,028,413 $17.112.641 $15.365,761 se Studies avorites Bar folder. Or import from another browser. mport favorites eBook: Fraud Examination QITI 2016 2015 $26,456,647 37,557 $26,419,090 19,133,299 $7.,285,791 $22,889,060 27,740 $22,861,320 16,530,114 $6,331,206 Sales Sales returns and allowances Net sales Cost of sales Gross profit Expenses Accounting Advertising Depreciation Bad debts Business publications Cleaning services Fuel Garbage collection Insurance Interest Legal Licensing and certification fees Linen service Medical benefits Miscellaneous Office supplies Payroll benefits Pension expense Postage and courier Property taxes $48,253 28.624 46,415 148,252 1.231 15,817 64,161 4.870 16,415 427.362 69,752 33,580 3,044 7,178 47,739 26,390 569,110 -. $46,750 27.947 46,578 162,344 872 12.809 53,566 4.674 16,303 36-4,312 29,914 27.142 1,939 4,624 16,631 23.289 461.214 8.623 3.9%8 20.962 27.947 2 P A 40 ENG 12

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock