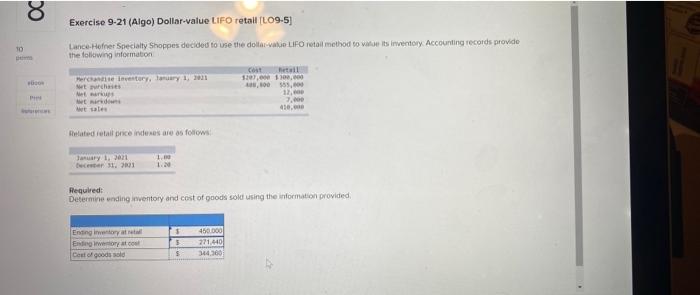

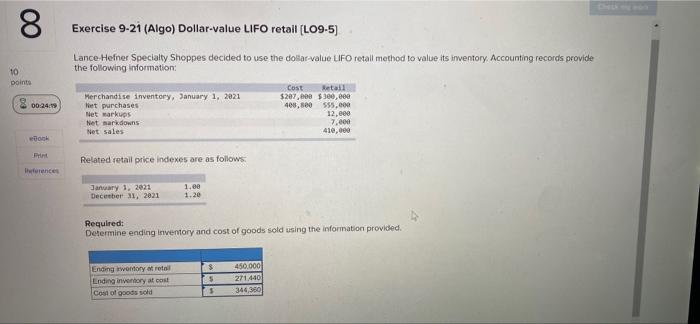

Question: Ending Inventory at cost and COGS are shown as wrong. resubmittion 8 DO Exercise 9-21 (Algo) Dollar-value LIFO retail LO9-5) 10 Lance Hofner Specialty Shoppes

8 DO Exercise 9-21 (Algo) Dollar-value LIFO retail LO9-5) 10 Lance Hofner Specialty Shoppes decided to use the dollara LIFO retail method to wait inventory Accounting records provide the following information cost til Peremetery, anuary 1, 2011 5207.000 with 0,100 85,00 Menu 17, wird 7. w sales 450.000 Belated retail once indexes are as follows January 2011 1. Required: Determine ending inventory and cost of goods sold using the information provided Enting inoyat Esting wat Cost of goods sold $ 5 $ 450.000 271.440 144.300 8 Exercise 9-21 (Algo) Dollar-value LIFO retail (109-5) Lance Hefner Specialty Shoppes decided to use the dollar-value LIFO retail method to value its inventory Accounting records provide the following information: 10 Dointe 00:24 Merchandise inventory, January 1, 2021 Het purchases Net markups Net sarkdowns Net sales Cost Retail $207,000 $300,000 400,500 555,600 12.000 7.000 410,000 Ft Related retail price indexes are as follows: frances January 1, 2021 December 31, 2021 1.00 1.20 Required: Determine ending inventory and cost of goods sold using the information provided. Ending womory retail Ending inventory at cost Cost of goods sold $ 5 $ 450,000 271440 344,360 8 DO Exercise 9-21 (Algo) Dollar-value LIFO retail LO9-5) 10 Lance Hofner Specialty Shoppes decided to use the dollara LIFO retail method to wait inventory Accounting records provide the following information cost til Peremetery, anuary 1, 2011 5207.000 with 0,100 85,00 Menu 17, wird 7. w sales 450.000 Belated retail once indexes are as follows January 2011 1. Required: Determine ending inventory and cost of goods sold using the information provided Enting inoyat Esting wat Cost of goods sold $ 5 $ 450.000 271.440 144.300 8 Exercise 9-21 (Algo) Dollar-value LIFO retail (109-5) Lance Hefner Specialty Shoppes decided to use the dollar-value LIFO retail method to value its inventory Accounting records provide the following information: 10 Dointe 00:24 Merchandise inventory, January 1, 2021 Het purchases Net markups Net sarkdowns Net sales Cost Retail $207,000 $300,000 400,500 555,600 12.000 7.000 410,000 Ft Related retail price indexes are as follows: frances January 1, 2021 December 31, 2021 1.00 1.20 Required: Determine ending inventory and cost of goods sold using the information provided. Ending womory retail Ending inventory at cost Cost of goods sold $ 5 $ 450,000 271440 344,360

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts