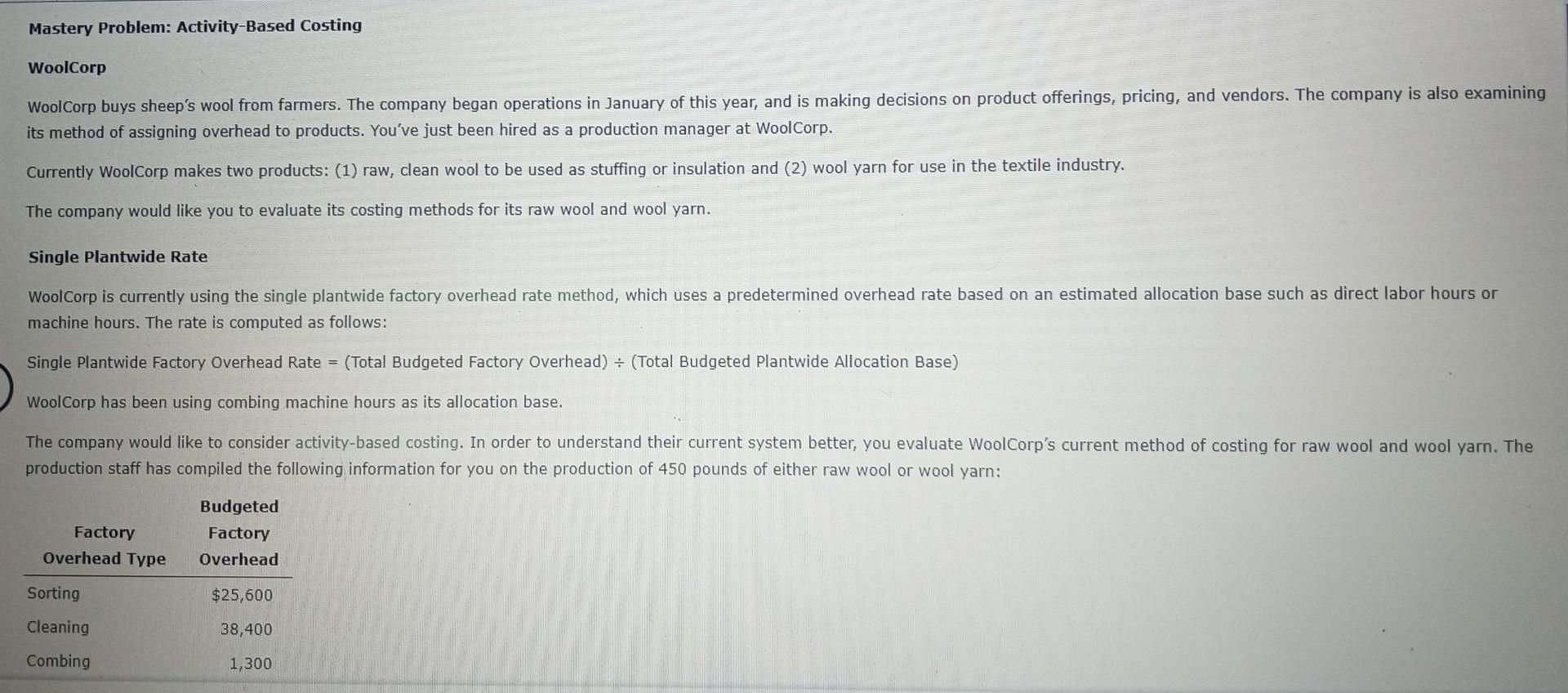

Question: need help Mastery Problem: Activity-Based Costing WoolCorp its method of assigning overhead to products. You've just been hired as a production manager at WoolCorp. Currently

need help

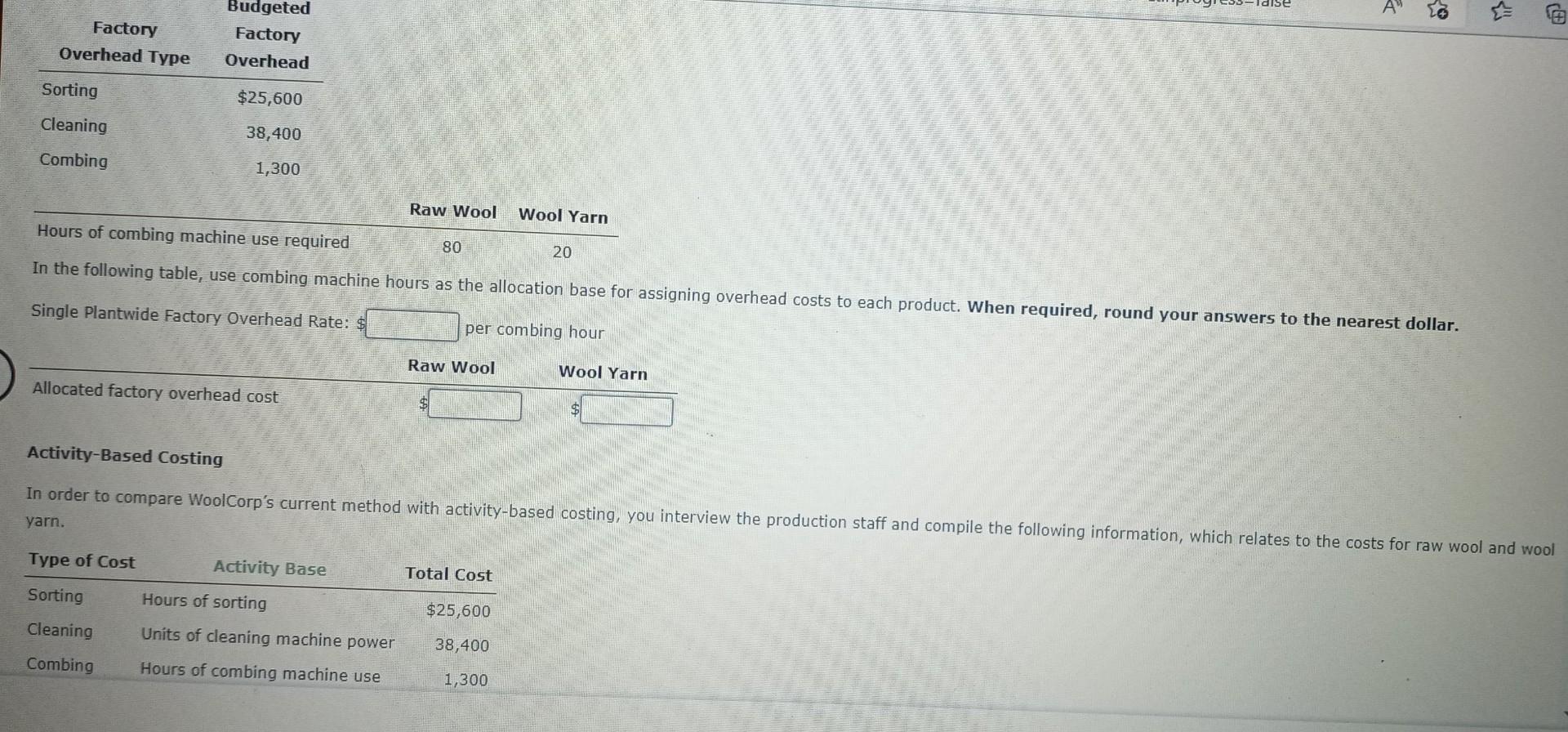

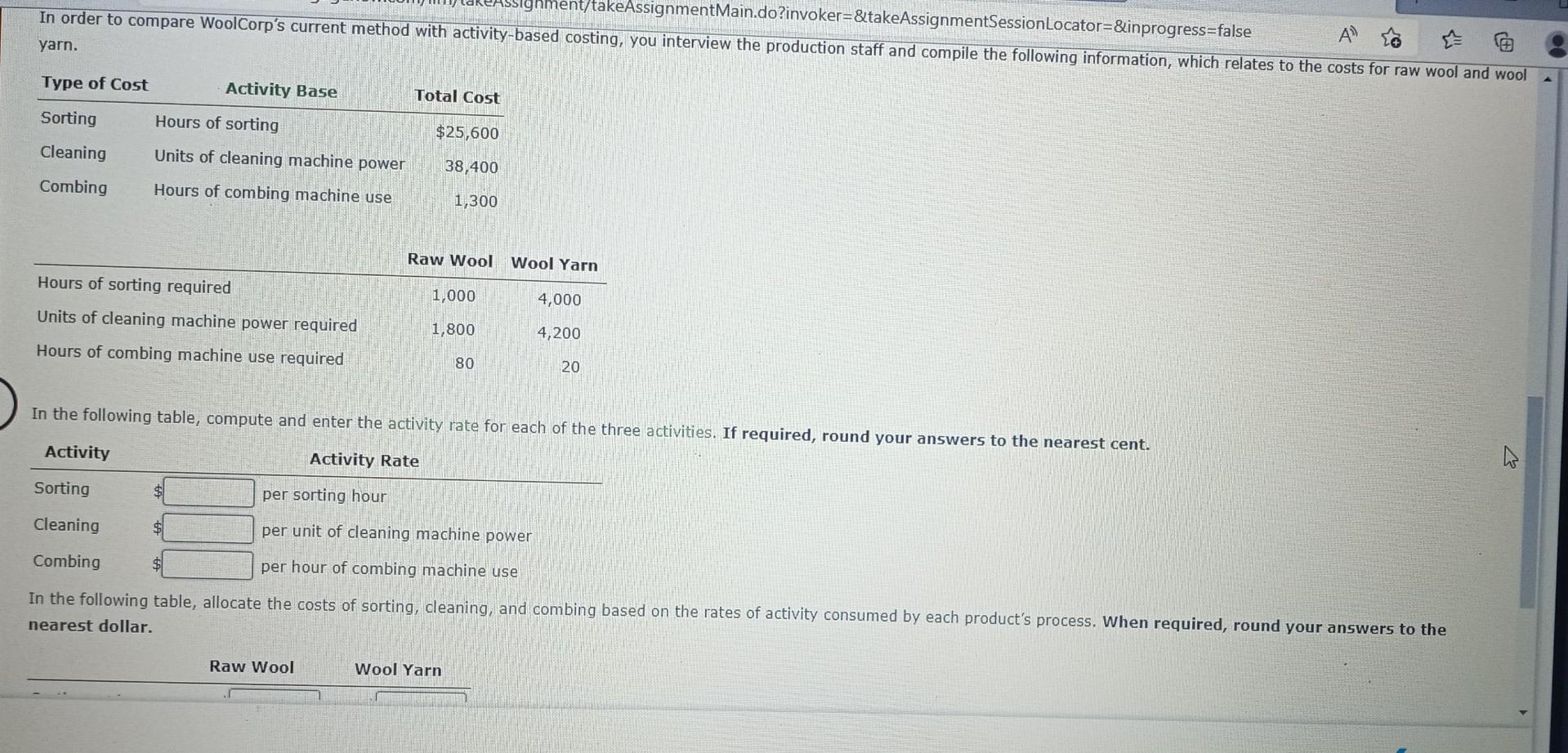

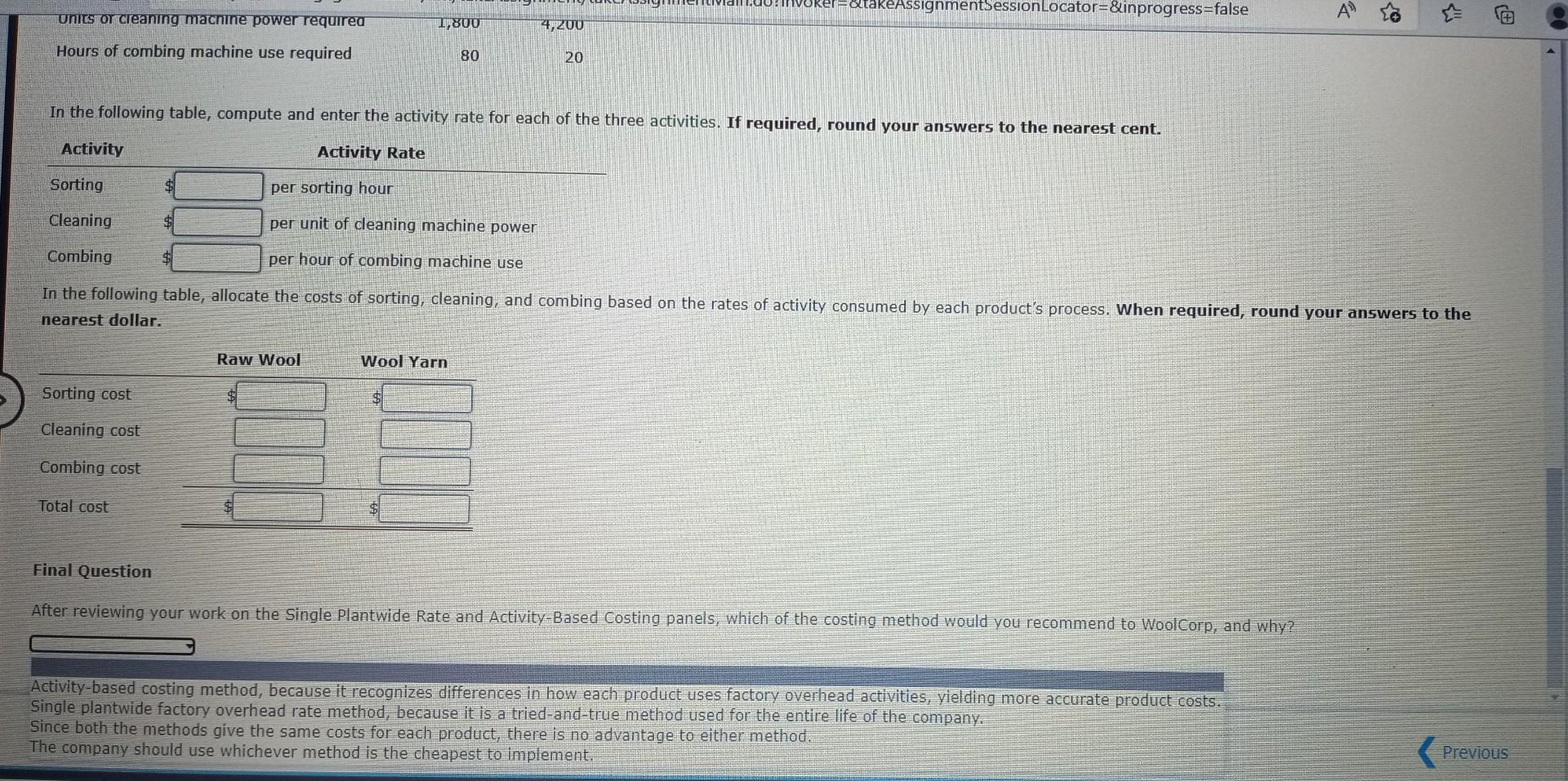

Mastery Problem: Activity-Based Costing WoolCorp its method of assigning overhead to products. You've just been hired as a production manager at WoolCorp. Currently WoolCorp makes two products: (1) raw, clean wool to be used as stuffing or insulation and (2) wool yarn for use in the textile industry. The company would like you to evaluate its costing methods for its raw wool and wool yarn. Single Plantwide Rate machine hours. The rate is computed as follows: Single Plantwide Factory Overhead Rate = (Total Budgeted Factory Overhead) (Total Budgeted Plantwide Allocation Base) WoolCorp has been using combing machine hours as its allocation base. production staff has compiled the following information for you on the production of 450 pounds of either raw wool or wool yarn: Single Plantwide Factory Overhead Rate: per combing hour Activity-Based Costing yarn. yarn. In the following table, compute and enter the activity rate for each of the three activities. If required, round your answers to the nearest cent. nearest dollar. In the following table, compute and enter the activity rate for each of the three activities. If required, round your answers to the nearest cent. nearest dollar. Final

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts