Question: Endo Mountain Bikes inc. is purchasing a new machine for constructing hydraulic shocks. The machine costs $25,000 and falls in a 7 year property class

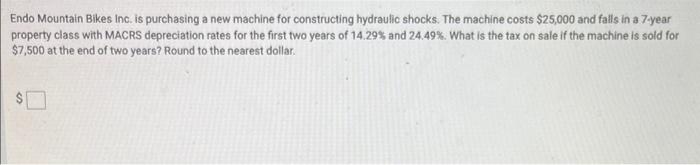

Endo Mountain Bikes inc. is purchasing a new machine for constructing hydraulic shocks. The machine costs $25,000 and falls in a 7 year property class with MACRS depreciation rates for the first two years of 14.29% and 24.49%. What is the tax on sale if the machine is sold for $7,500 at the end of two years? Round to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock