Question: End-of-Module Assessment (2019/20) (Semester 2) Module Code/Title: BUS3006 Accounting Programme Code/Year: Various (BA114*** and BA124***), except BA124009 A2 Consider the following two independent cases: (a)

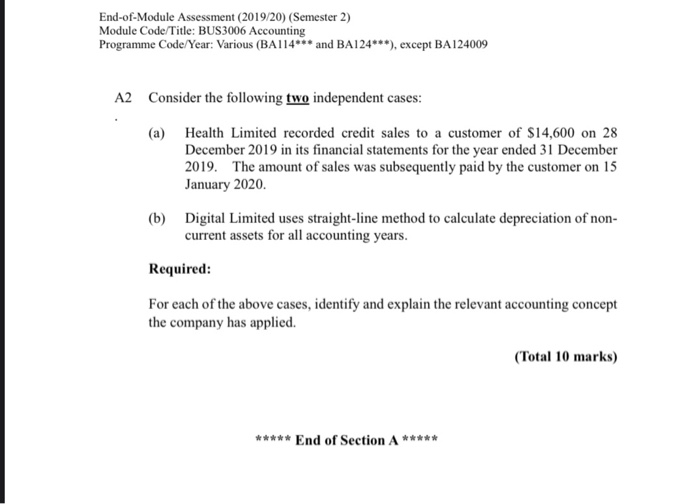

End-of-Module Assessment (2019/20) (Semester 2) Module Code/Title: BUS3006 Accounting Programme Code/Year: Various (BA114*** and BA124***), except BA124009 A2 Consider the following two independent cases: (a) Health Limited recorded credit sales to a customer of $14,600 on 28 December 2019 in its financial statements for the year ended 31 December 2019. The amount of sales was subsequently paid by the customer on 15 January 2020. (b) Digital Limited uses straight-line method to calculate depreciation of non- current assets for all accounting years. Required: For each of the above cases, identify and explain the relevant accounting concept the company has applied. (Total 10 marks) ***** End of Section A *****

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts