Question: Full-Time End-of-Module Assessment 2021/2022 (Semester 3) Module Code/Title: FIN4205/Investment Analytics I Programme Code/Year: BA114048/1 Question 4 a) Bond W is a bond with a par

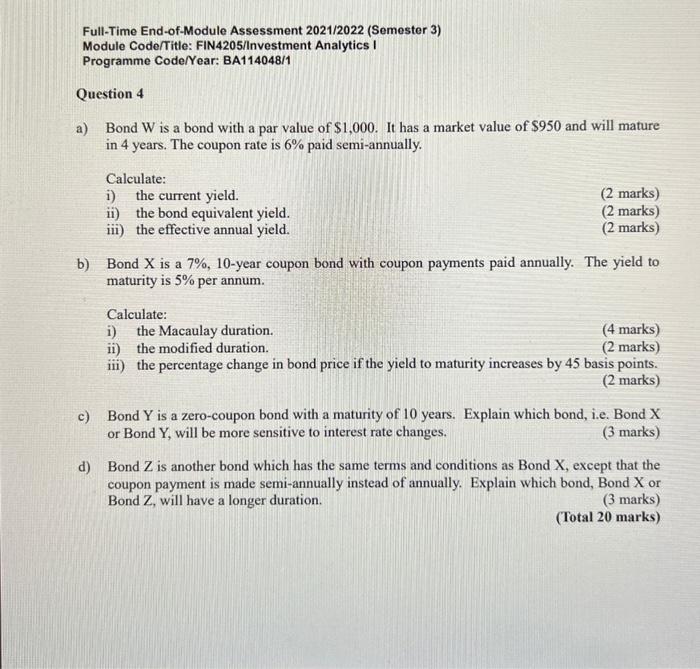

Full-Time End-of-Module Assessment 2021/2022 (Semester 3) Module Code/Title: FIN4205/Investment Analytics I Programme Code/Year: BA114048/1 Question 4 a) Bond W is a bond with a par value of $1,000. It has a market value of $950 and will mature in 4 years. The coupon rate is 6% paid semi-annually. Calculate: i) the current yield. ii) the bond equivalent yield. iii) the effective annual yield. (2 marks) (2 marks) (2 marks) b) Bond X is a 7%, 10-year coupon bond with coupon payments paid annually. The yield to maturity is 5% per annum. Calculate: i) the Macaulay duration. ii) the modified duration. (4 marks) (2 marks) iii) the percentage change in bond price if the yield to maturity increases by 45 basis points. (2 marks) c) Bond Y is a zero-coupon bond with a maturity of 10 years. Explain which bond, i.e. Bond X or Bond Y, will be more sensitive to interest rate changes. (3 marks) d) Bond Z is another bond which has the same terms and conditions as Bond X, except that the coupon payment is made semi-annually instead of annually. Explain which bond, Bond X or Bond Z, will have a longer duration. (3 marks) (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts