Question: Engineering Economics, help pls. 4) Machine A costs $35,000, lasts 3 years and has a salvage value of $17,500. Machine B costs S25,000, lasts 3

Engineering Economics, help pls.

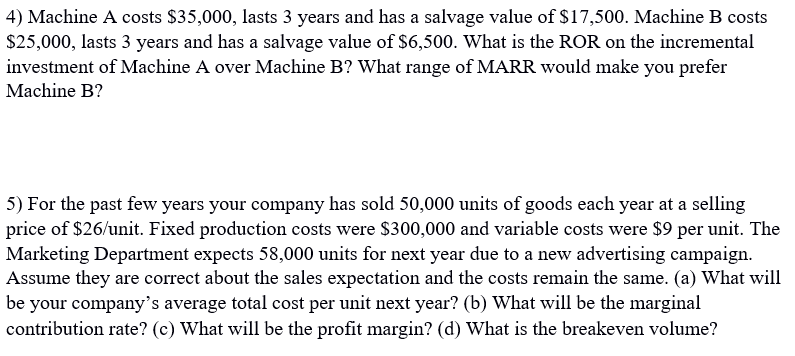

4) Machine A costs $35,000, lasts 3 years and has a salvage value of $17,500. Machine B costs S25,000, lasts 3 years and has a salvage value of $6,500. What is the ROR on the incremental investment of Machine A over Machine B? What range of MARR would make you prefer Machine B? 5) For the past few years your company has sold 50,000 units of goods each year at a selling price of $26/unit. Fixed production costs were $300,000 and variable costs were $9 per unit. The Marketing Department expects 58,000 units for next year due to a new advertising campaign. Assume they are correct about the sales expectation and the costs remain the same. (a) What will be your company's average total cost per unit next year? (b) What will be the marginal contribution rate? (c) What will be the profit margin? (d) What is the breakeven volume? 4) Machine A costs $35,000, lasts 3 years and has a salvage value of $17,500. Machine B costs S25,000, lasts 3 years and has a salvage value of $6,500. What is the ROR on the incremental investment of Machine A over Machine B? What range of MARR would make you prefer Machine B? 5) For the past few years your company has sold 50,000 units of goods each year at a selling price of $26/unit. Fixed production costs were $300,000 and variable costs were $9 per unit. The Marketing Department expects 58,000 units for next year due to a new advertising campaign. Assume they are correct about the sales expectation and the costs remain the same. (a) What will be your company's average total cost per unit next year? (b) What will be the marginal contribution rate? (c) What will be the profit margin? (d) What is the breakeven volume

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts