Question: Engineering economy question Need help with it ASAP Problem 3: (40 points) Three mutually exclusive investment alternatives are being considered. The estimated cash flows for

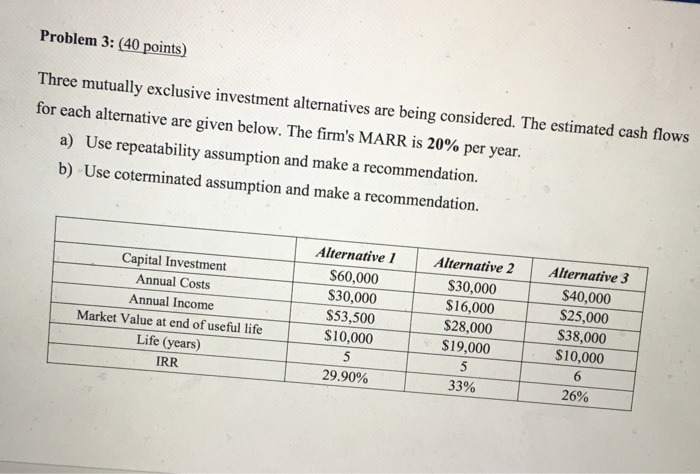

Problem 3: (40 points) Three mutually exclusive investment alternatives are being considered. The estimated cash flows for each alternative are given below. The firm's MARR is 20% per year a) Use repeatability assumption and make a recommendation. b Use coterminated assumption and make a recommendation. Alternative 1 Alternative 2 Alternative 3 $60,000 S30,000 Capital Investment Annual Costs $30,000 $40,000 Annual Income $16,000 Market Value at end of useful life $53,500 S25,000 $28,000 $38.000 $10,000 Life (years) $19,000 $10,000 IRR. 29.90% 33% 26%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts