Question: ENGLISH VERSION QUESTION 2 (25 MARKS) A. Explain two differences between process costing and job order costing. B. For each following business, indicate whether job

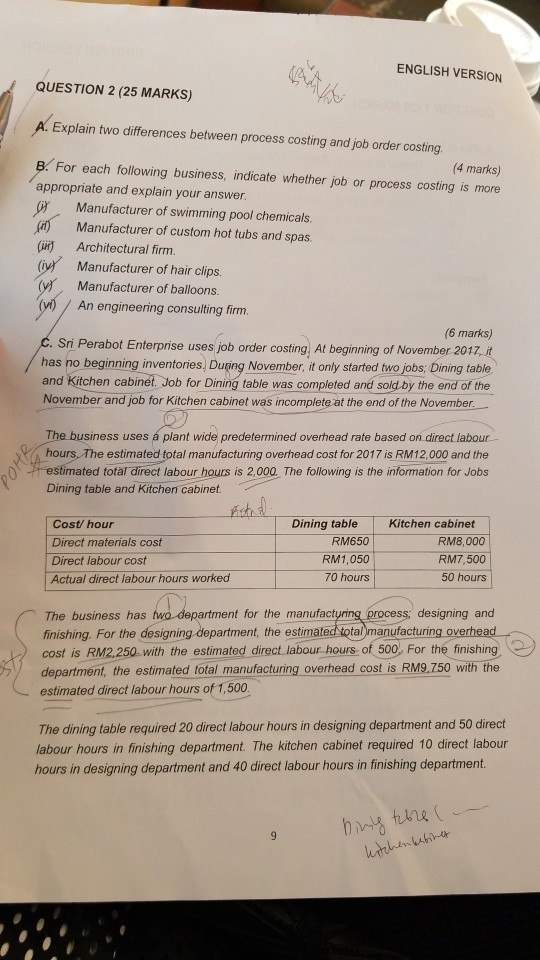

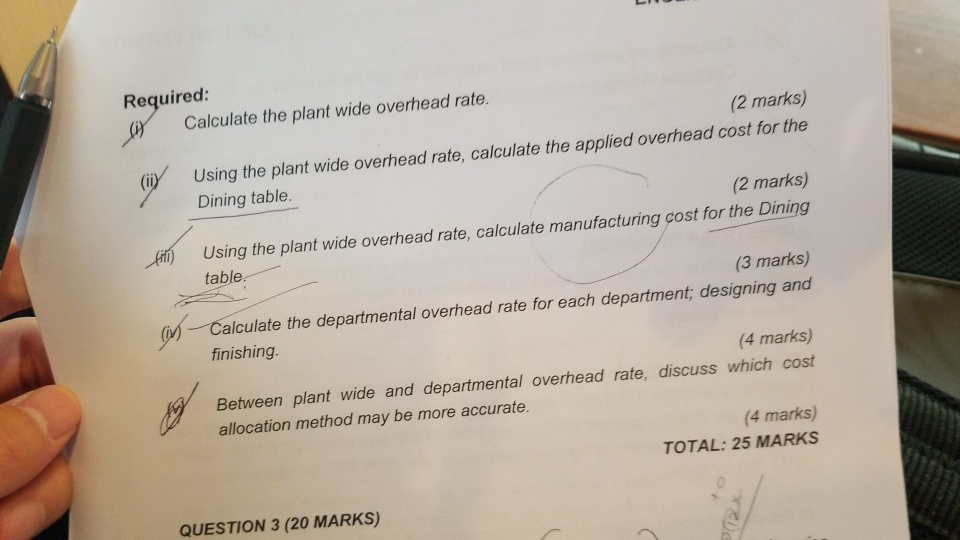

ENGLISH VERSION QUESTION 2 (25 MARKS) A. Explain two differences between process costing and job order costing. B. For each following business, indicate whether job (4 marks) or process costing is more appropriate and explain your answer. Manufacturer of swimming pool chemicals. Manufacturer of custom hot tubs and spas. Architectural firm. (iv Manufacturer of hair clips Manufacturer of balloons. An engineering consulting firm. (6 marks) job order costing At beginning of November 2017, it has no beginning inventories, Duging November, it only started two jobs; Dining table and Kitchen cabinet. Job for Dining table was completed and sold by the end of the C. Sri Perabot Enterprise uses November and job for Kitchen cabinet was incomplete at the end of the November. The business uses plant wide predetermined overhead rate based on direct labour hours, The estimated total manufacturing overhead cost for 2017 is RM12,000 and the estimated total direct labour hours is 2,000. The following is the information for Jobs Dining table and Kitchen cabinet. Dining table Kitchen cabinet Cost/ hour RM650 Direct materials cost RM8,000 RM1,050 RM7,500 Direct labour cost 70 hours 50 hours Actual direct labour hours worked The business has twodepartment for the manufacturing process; designing and finishing. For the designing department, the estimated total manufacturing overhead cost is RM2,250 with the estimated direct labour hours of 500, For the finishing department, the estimated total manufacturing overhead cost is RM9,750 with the estimated direct labour hours of 1,500. The dining table required 20 direct labour hours in designing department and 50 direct labour hours in finishing department. The kitchen cabinet required 10 direct labour hours in designing department and 40 direct labour hours in finishing department. bm tere( utehentstine OHR Required: Calculate the plant wide overhead rate. (2 marks) Using the plant wide overhead rate, calculate the applied overhead cost for the Dining table. (ii) (2 marks) Using the plant wide overhead rate, calculate manufacturing cost for the Dining table (3 marks) Calculate the departmental overhead rate for each department; designing and finishing. (4 marks) Between plant wide and departmental overhead rate, discuss which cost 19 allocation method may be more accurate. (4 marks) TOTAL: 25 MARKS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts