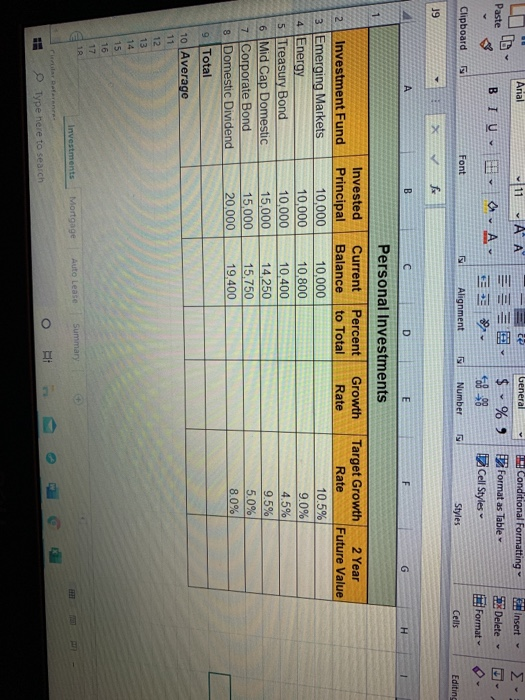

Question: Enter a function in cell B9 on the Investments worksheet that calculates the total of the values in the range B3:B8. b. Copy the function

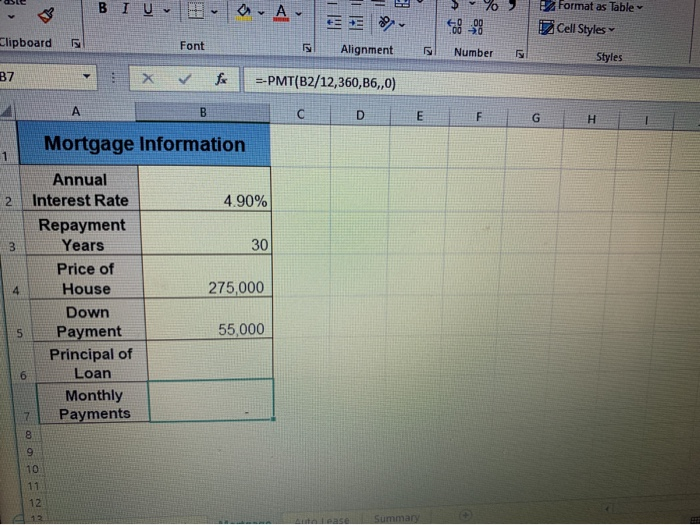

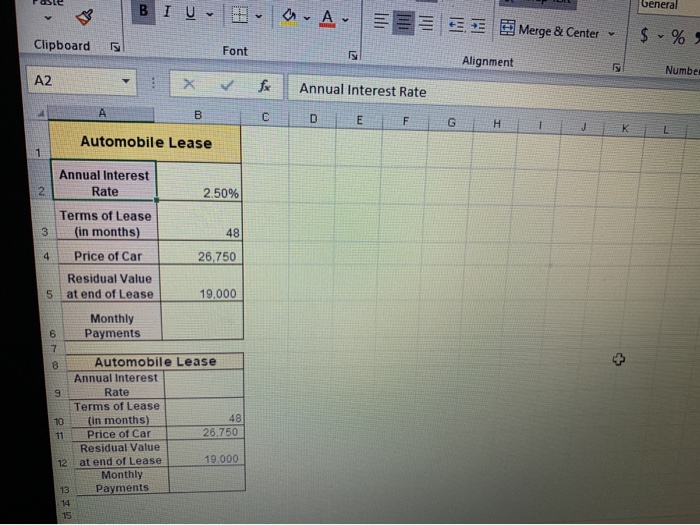

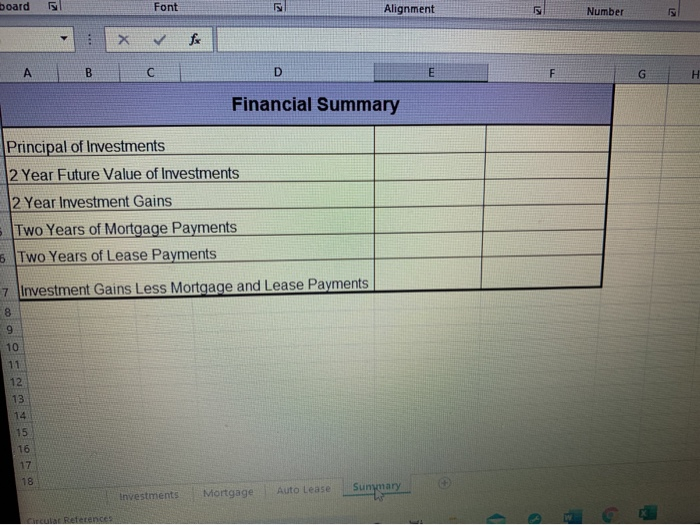

Arial 11 AA ze General Paste E- Conditional Formatting $ %. Format as Table Cell Styles BI U I a. A Insert 58 Delete Format Clipboard Font Alignment Number Styles Cells Editing J9 Xfx A B D E F G H Personal Investments 1 Percent to Total Growth Rate 2 Year Future Value 2 Investment Fund 3 Emerging Markets 4 Energy 5 Treasury Bond 6 Mid Cap Domestic 7 Corporate Bond 8 Domestic Dividend Invested Principal 10,000 10,000 10,000 15,000 15,000 20,000 Current Balance 10,000 10,800 10.400 14.250 15.750 19,400 Target Growth Rate 10.5% 9.0% 4.5% 9.5% 5.0% 8.0% 9 Total 10 Average 11 12 13 15 16 17 18 Investments Mortgage Auto Lease Summary I 3 I Type here to search I a. A Format as Table 2 Cell Styles Clipboard 2 Font Alignment Number 5 Styles B7 X Fox --PMT(B2/12,360,36,0) B C D E F G H Mortgage Information 2 4.90% 3 30 4 275,000 Annual Interest Rate Repayment Years Price of House Down Payment Principal of Loan Monthly Payments 5 55,000 6 7 8 9 10 17 12 12 Summary BIU General - A- . Merge & Center $ % Clipboard Font Alignment ly Number A2 XV fx Annual Interest Rate A B D E F G H 1 K Automobile Lease Annual Interest Rate 2 2.50% Terms of Lease (in months) 3 48 4 Price of Car 26.750 Residual Value at end of Lease 5 19,000 Monthly Payments 6 7 OD 10 Automobile Lease Annual Interest Rate Terms of Lease (in months) 48 Price of Car 26.750 Residual Value at end of Lease 19.000 Monthly Payments 12 13 14 15 board Font Alignment Number 12 > A B D E F G H Financial Summary Principal of Investments 12 Year Future Value of Investments 2 Year Investment Gains Two Years of Mortgage Payments 6 Two Years of Lease Payments 7 Investment Gains Less Mortgage and Lease Payments 8 9 10 11 12 13 14 15 16 17 18 Mortgage Auto Lease Investments Summary Circular References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts