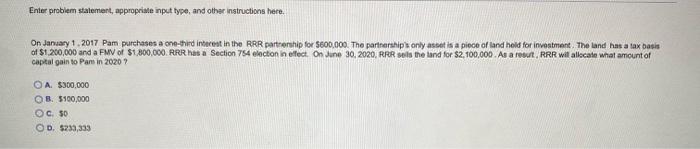

Question: Enter problem statement, appropriate input type, and other instructions here. On January 1, 2017 Pam purchases a one-third interest in the RRR partnership for $600,000.

Enter problem statement, appropriate input type, and other instructions here. On January 1, 2017 Pam purchases a one-third interest in the RRR partnership for $600,000. The partnership's only as is a piece of land hold for investment. The land has a tax basis of $1,200,000 and a FMV of $1,800,000 RRR has a Section 754 lecton in effect on June 30, 2020, RRR Sols the land for $2,100,000. As a resut, RRR will allocate what amount of capital gain to Pam in 2020? O A $300,000 B. 3100,000 OG 50 OD. 5233,333

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts