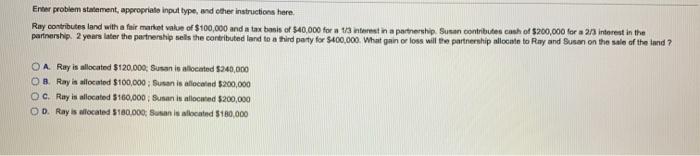

Question: Enter problem statement appropriate input type, and other instructions here. Ray contributes land with a fair market value of $100,000 and tax basis of $40,000

Enter problem statement appropriate input type, and other instructions here. Ray contributes land with a fair market value of $100,000 and tax basis of $40,000 for a 13 interest in a partnership Susan contributes cash of $200,000 for a 23 interest in the partnership 2 years later the partnership sols the contributed land to a third party for $400,000. What gain or loss will the partnership allocate to Ray and Susan on the sale of the land? O A Ray is allocated $120.000, Susan is allocated $240,000 OB Ray is allocated $100,000 : Susan is allocated $200,000 OC. Ray is allocated $160,000 Sunan is allowed $200,000 OD. Ray is located 5180,000: Susan is located 180,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts