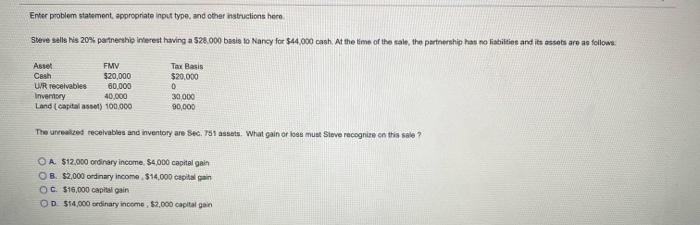

Question: Enter problem statement appropriate input type, and other instructions here Steve Sells his 20% partnership Interest having a 528.000 basis to Nancy for $44.000 cash.

Enter problem statement appropriate input type, and other instructions here Steve Sells his 20% partnership Interest having a 528.000 basis to Nancy for $44.000 cash. At the time of the sale, the partnership has no liabilities and its assets are as follows Cash Asset FMV 520,000 UR Teceivables 60.000 Inventory 40.000 Land capital asso) 100.000 Tax Basis $20,000 0 30,000 90,000 The realized receivables and inventory are se 751 assets. What gain or los must love recognize on this sale? O A $12.000 ordinary income $4.000 capital gain OB. $2,000 ordinary income $14.000 capital gain OG $10,000 capital gain OD $14,000 ordinary income $2,000 capital gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts