Question: Vistan, a spin-off company of Ford Motor Company, supplies major automobile components to auto manufacturers worldwide and is Ford's largest supplier. An engineer is

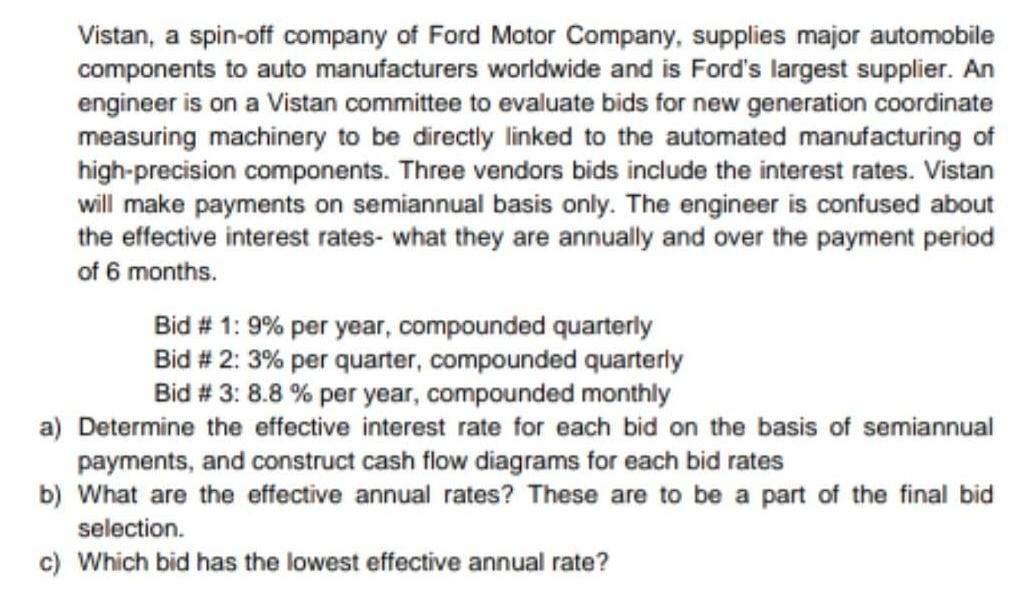

Vistan, a spin-off company of Ford Motor Company, supplies major automobile components to auto manufacturers worldwide and is Ford's largest supplier. An engineer is on a Vistan committee to evaluate bids for new generation coordinate measuring machinery to be directly linked to the automated manufacturing of high-precision components. Three vendors bids include the interest rates. Vistan will make payments on semiannual basis only. The engineer is confused about the effective interest rates- what they are annually and over the payment period of 6 months. Bid # 1: 9% per year, compounded quarterly Bid # 2: 3% per quarter, compounded quarterly Bid # 3: 8.8 % per year, compounded monthly a) Determine the effective interest rate for each bid on the basis of semiannual payments, and construct cash flow diagrams for each bid rates b) What are the effective annual rates? These are to be a part of the final bid selection. c) Which bid has the lowest effective annual rate?

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

1 Effective semiannual interest rate for each Bid Bid 1 10905 1 44 Bid 2 1032 1 609 Bid 3 10880... View full answer

Get step-by-step solutions from verified subject matter experts