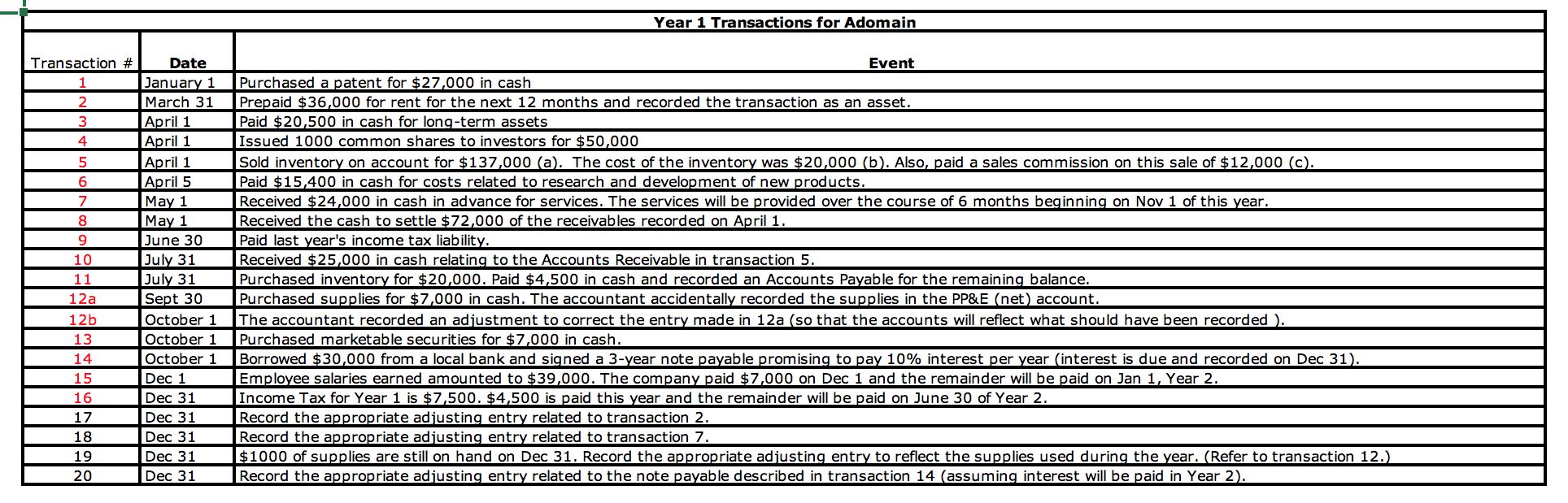

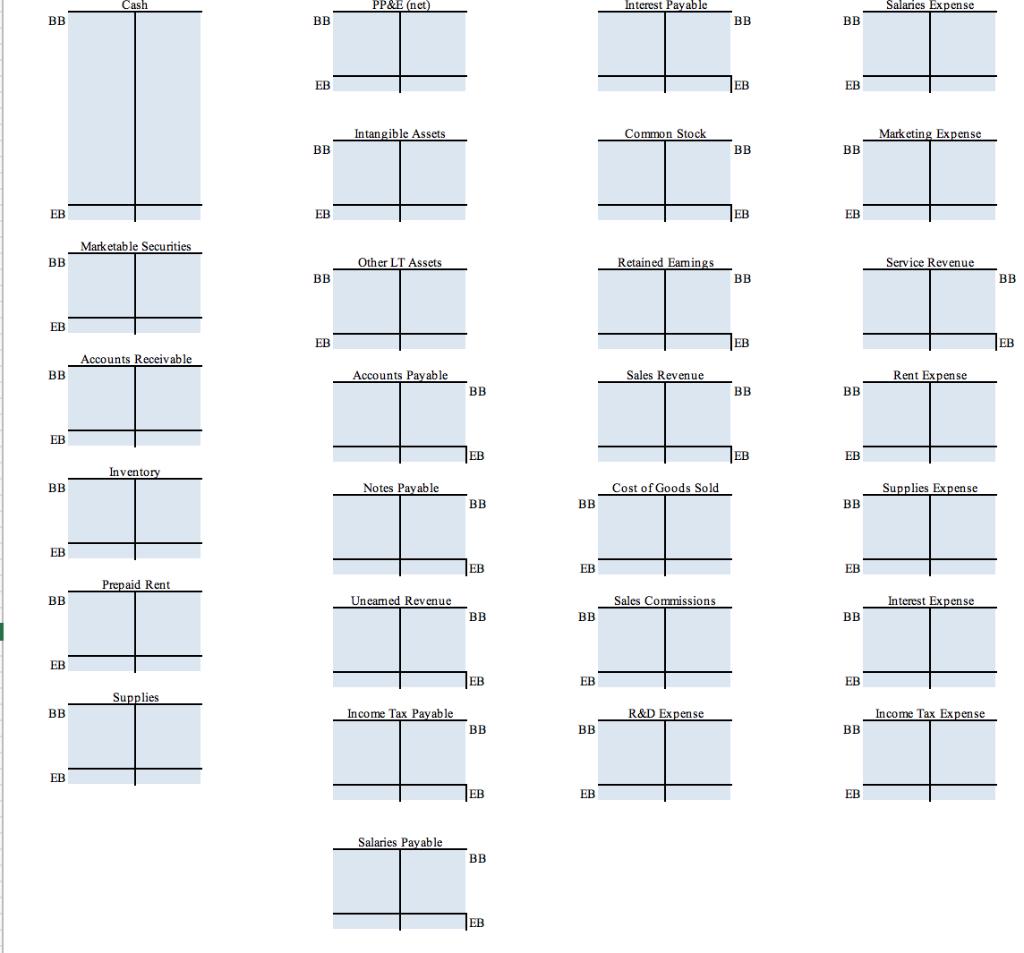

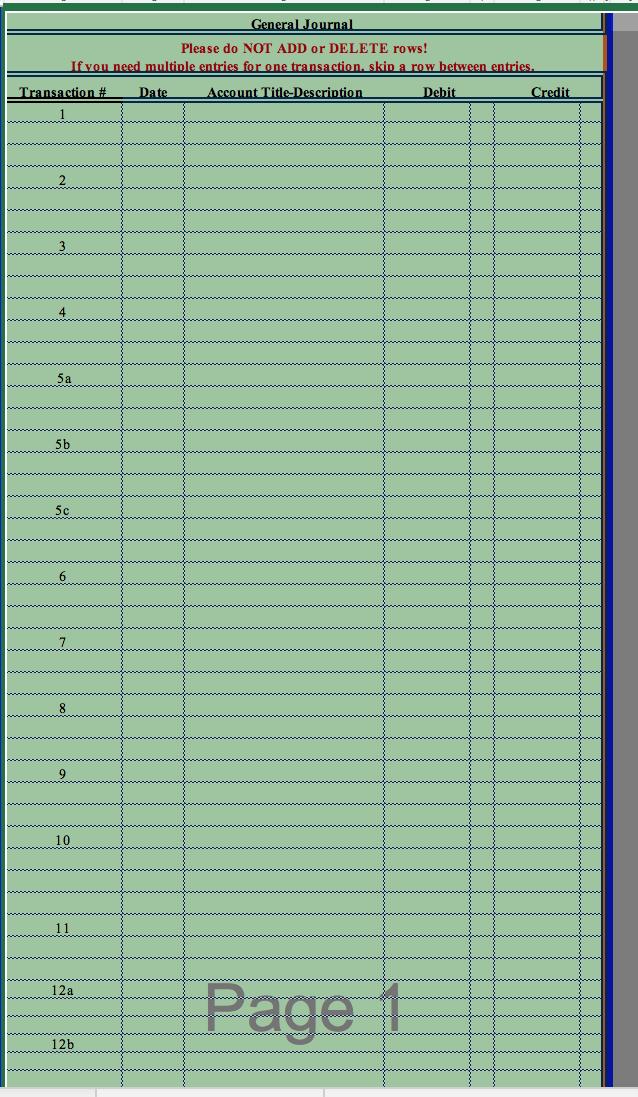

Question: Start by inserting the beginning balances in the T-accounts from the Year 0 Balance Sheet and then post your journal entries from the General Journal.

Start by inserting the beginning balances in the T-accounts from the Year 0 Balance Sheet and then post your journal entries from the General Journal. Next, calculate the ending balance in each account. Then, prepare Year 1 financial statements based on the ending balances in each T-account. Finally, go back to the General Journal and prepare closing entries. Post your closing entries to the General Ledger T-accounts. Finally, prepare a Post-Closing Trial Balance.

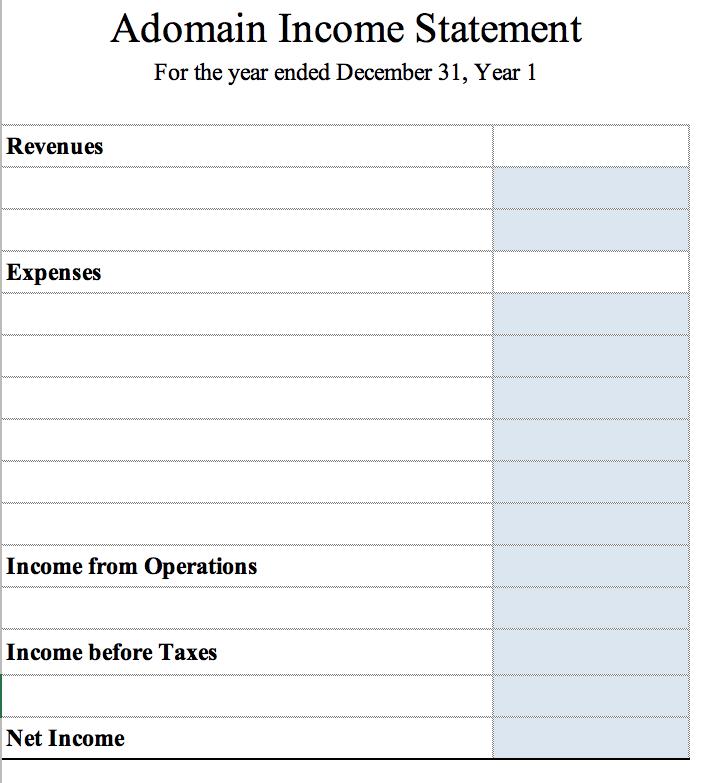

| Adomain Income Statement | ||

| for Year ended December 31, Year 0 | ||

| Revenues | ||

| Sales Revenue | $146,500 | |

| Expenses | ||

| Cost of Goods Sold | (62,500) | |

| R & D Expense | (9,100) | |

| Sales Commissions | (3,000) | |

| Marketing Expense | (9,000) | |

| Rent Expense | (5,700) | |

| Other Operating Expenses | (23,000) | |

| Income from Operations | $34,200 | |

| Interest Income | 400 | |

| Income before Taxes | 34,600 | |

| Income Tax Expense | (8,500) | |

| Net Income | 26,100 | |

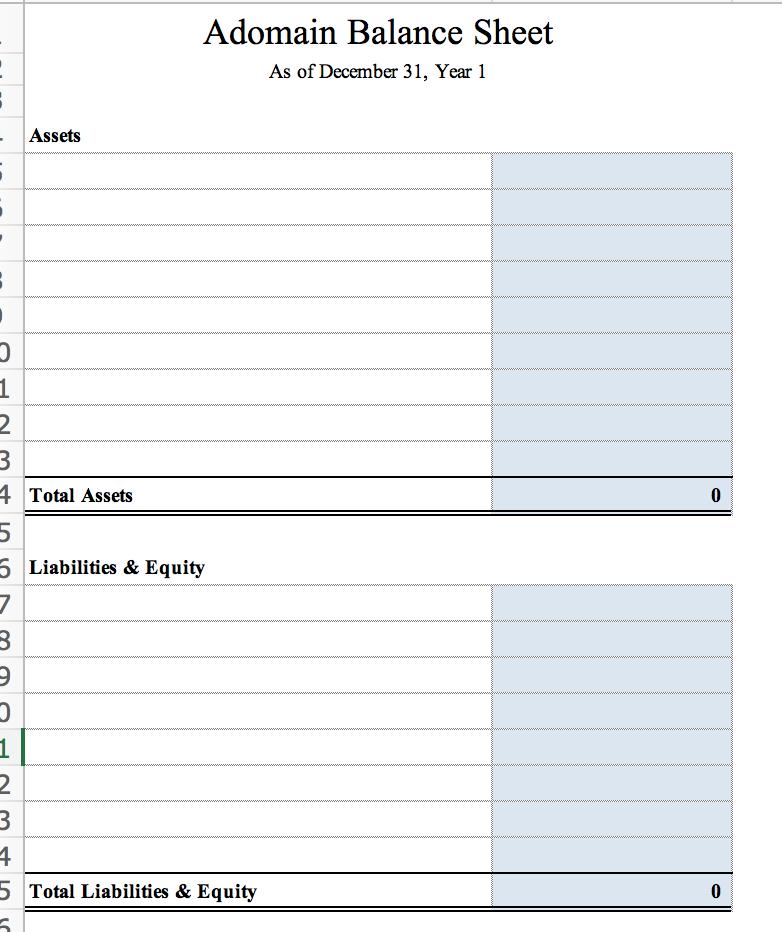

| Adomain Balance Sheet | ||||

| As of December 31, Year 0 | ||||

| Assets | ||||

| Cash | $80,000 | |||

| Marketable Securities | 6,700 | |||

| Accounts Receivable | 20,000 | |||

| Inventory | 25,000 | |||

| PP&E (net) | 34,700 | |||

| Intangible Assets | 10,500 | |||

| Other Long-Term Assets | 15,000 | |||

| Total Assets | $191,900 | |||

| Liabilities & Equity | ||||

| Accounts Payable | $45,000 | |||

| Notes Payable* | 28,500 | |||

| Unearned Revenue | 50,000 | |||

| Income Tax Payable | 4,300 | |||

| Common Stock | 45,000 | |||

| Retained Earnings | 19,100 | |||

| Total Liabilities & Equity | $191,900 | |||

*Assume these notes represent non-interest-bearing loans from owners, due in 5 years . | ||||

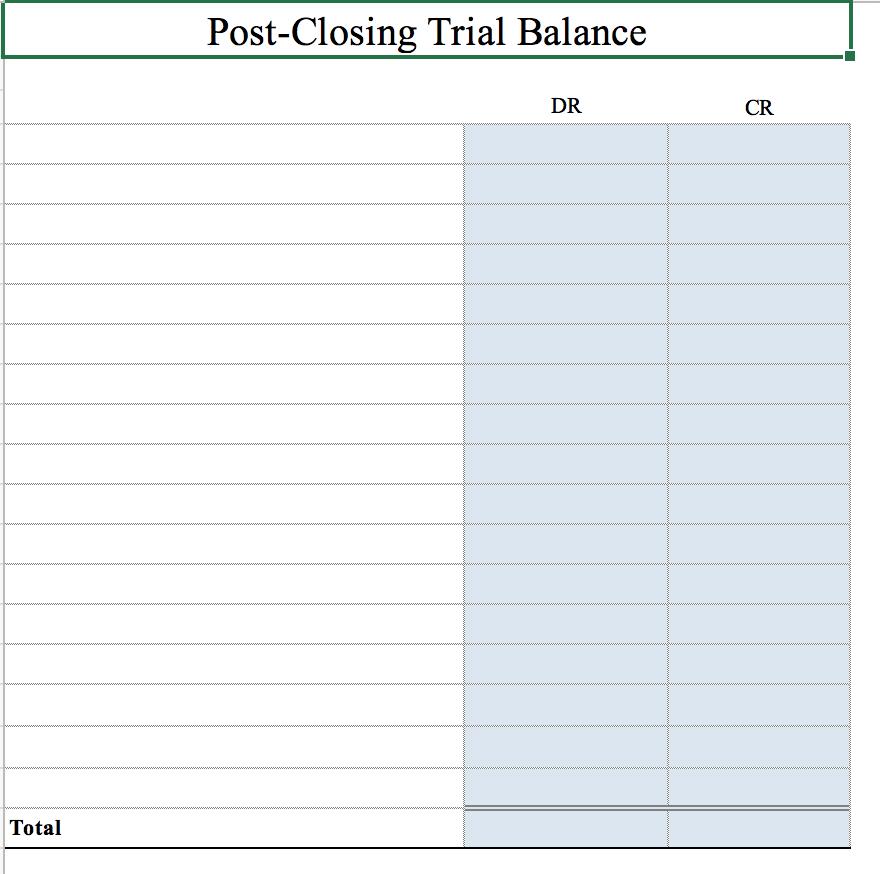

Post-Closing Trial Balance DR CR Total

Step by Step Solution

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts