Question: Enter the missing dollar amounts for the income statement for each of the following independent cases: Select Apparel purchased 90 new shirts and recorded a

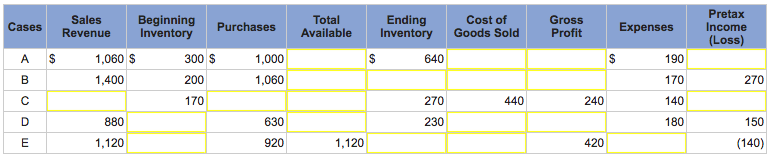

Enter the missing dollar amounts for the income statement for each of the following independent cases:

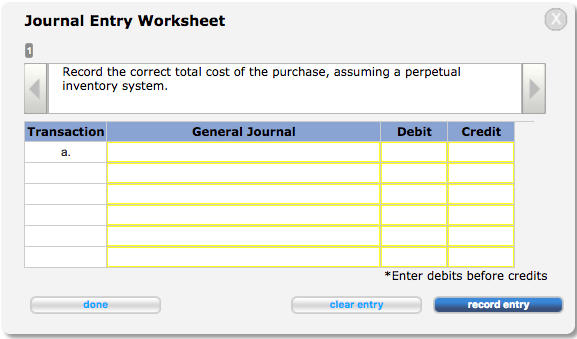

Select Apparel purchased 90 new shirts and recorded a total cost of $2,816 determined as follows:

| Invoice cost | $ | 2,330 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shipping charges | 185 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Import taxes and duties | 161 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest (6.0%) on $2,330 borrowed to finance the purchase | 140 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 2,816 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

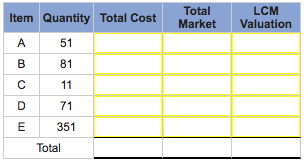

Jones Company is preparing the annual financial statements dated December 31 of the current year. Ending inventory information about the five major items stocked for regular sale follows:

Required: Compute the valuation that should be used for the current year ending inventory using the LCM rule applied on an item-by-item basis.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Cases A E Sales Revenue Inventory 1,060 300 1 200 1,400 170 880 1,120 1,000 1.060 630 920 Total Ending Available inventory Goods sold 640 270 440 230 1,120 Gross Profit s 240 420 190 170 140 180 Pretax Income (Loss) 270 150 (140)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts