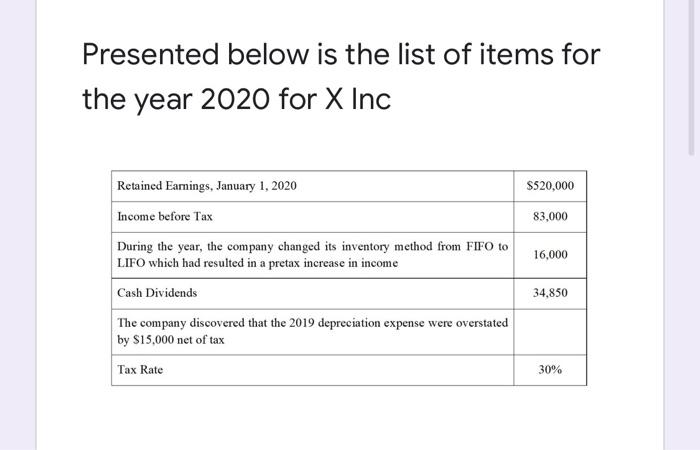

Question: please choose the right answer . thank you Presented below is the list of items for the year 2020 for X Inc $520,000 83,000 Retained

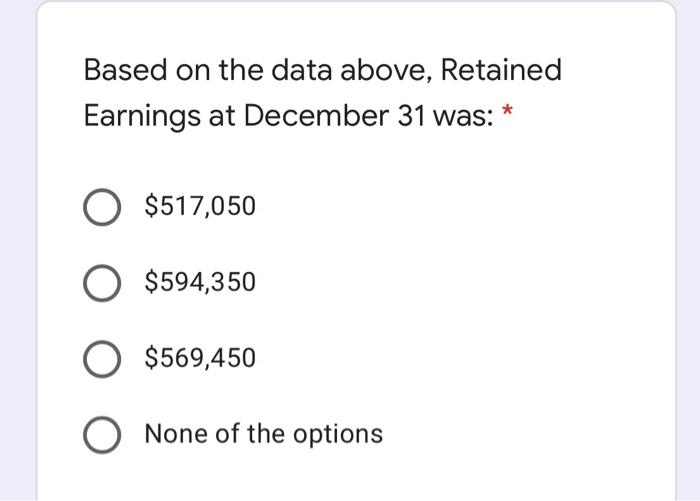

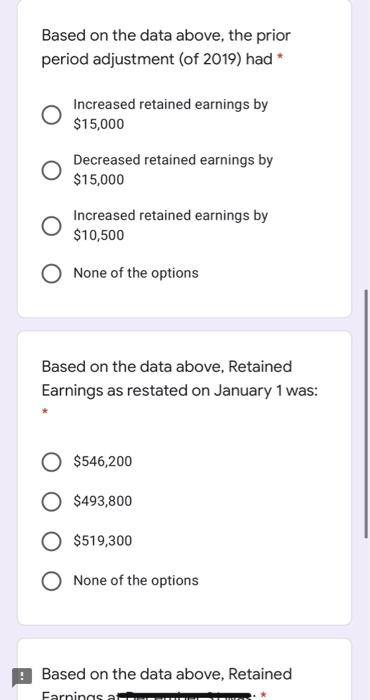

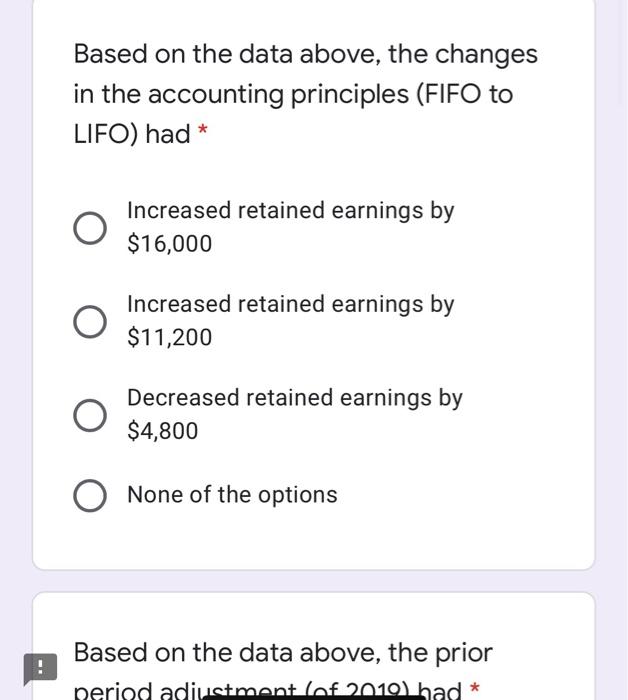

Presented below is the list of items for the year 2020 for X Inc $520,000 83,000 Retained Earings, January 1, 2020 Income before Tax During the year, the company changed its inventory method from FIFO to LIFO which had resulted in a pretax increase in income 16,000 Cash Dividends 34,850 The company discovered that the 2019 depreciation expense were overstated by $15,000 net of tax Tax Rate 30% Based on the data above, Retained Earnings at December 31 was: O $517,050 $594,350 $569,450 O None of the options Based on the data above, the prior period adjustment (of 2019) had* Increased retained earnings by $15,000 Decreased retained earnings by $15,000 Increased retained earnings by $10,500 O None of the options Based on the data above, Retained Earnings as restated on January 1 was: $546,200 $493,800 $519,300 None of the options Based on the data above, Retained Farnings Based on the data above, the changes in the accounting principles (FIFO to LIFO) had * Increased retained earnings by $16,000 Increased retained earnings by $11,200 Decreased retained earnings by $4,800 None of the options Based on the data above, the prior period adiustment (of 2010 had *

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts