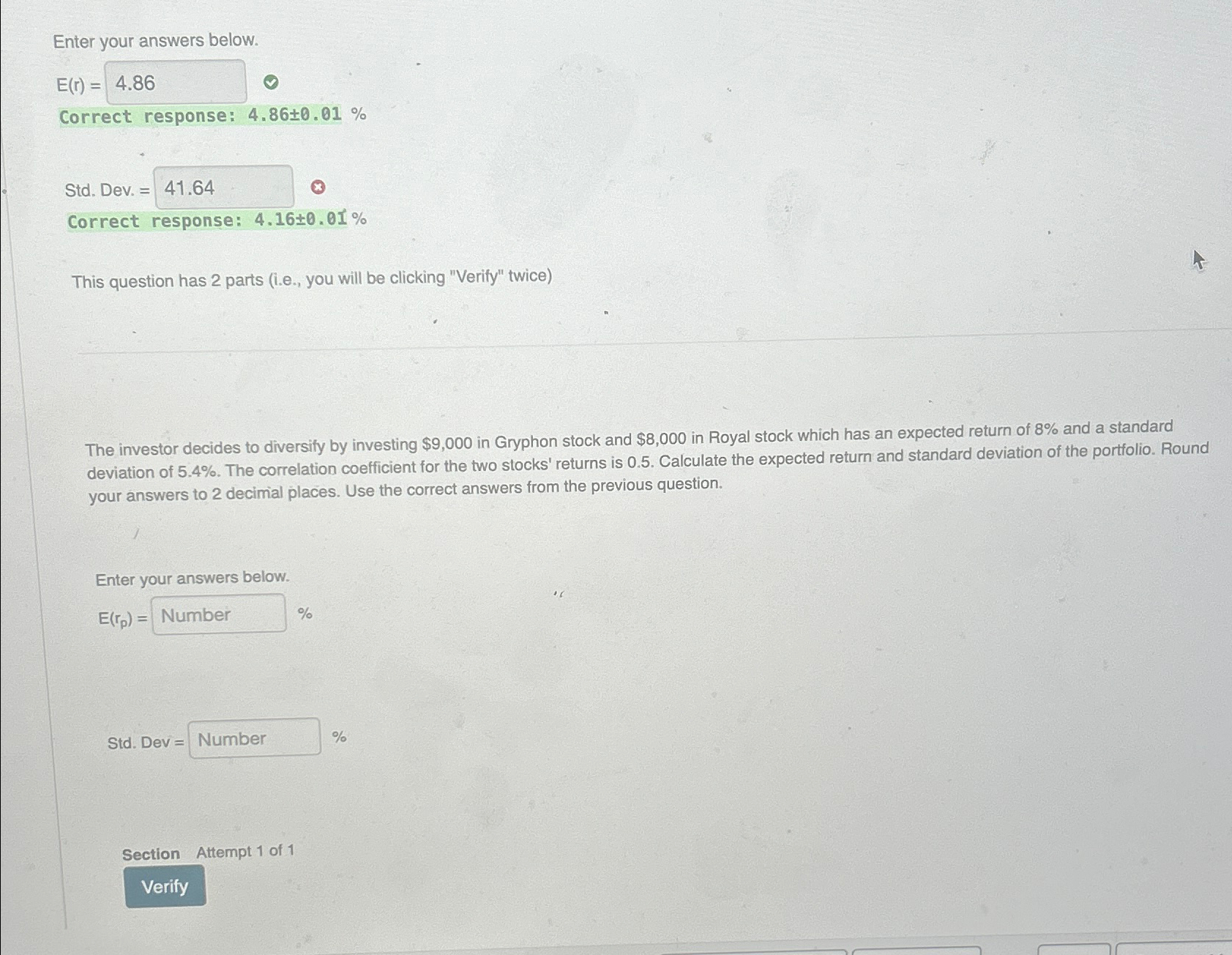

Question: Enter your answers below. E ( r ) = Correct response: 4 . 8 6 + - 0 . 0 1 % Std . Dev.

Enter your answers below.

Correct response:

Std Dev.

Correct response:

This question has parts ie you will be clicking "Verify" twice

The investor decides to diversity by investing $ in Gryphon stock and $ in Royal stock which has an expected return of and a standard deviation of The correlation coefficient for the two stocks' returns is Calculate the expected return and standard deviation of the portfolio. Round your answers to decimal places. Use the correct answers from the previous question.

Enter your answers below.

Std Dev

Section

Attempt of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock