Question: Please answer all as no questions remain. Thumbs up! An investor is considering the purchase of Gryphon stock, which has returns given in the table

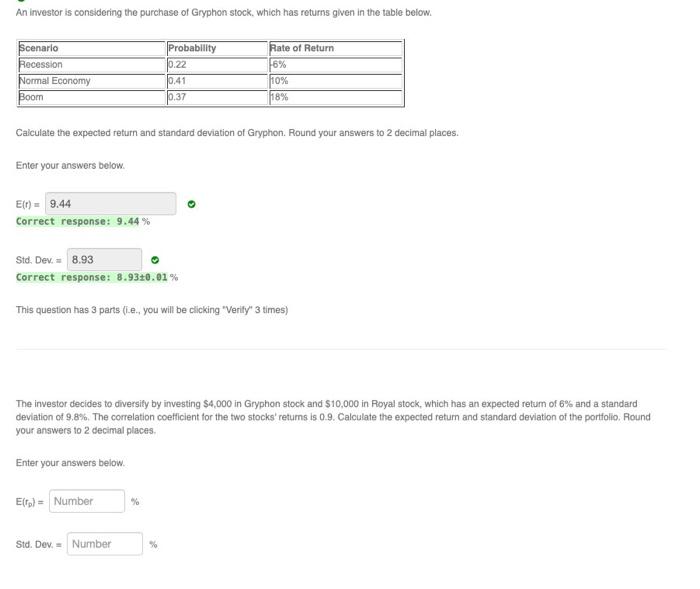

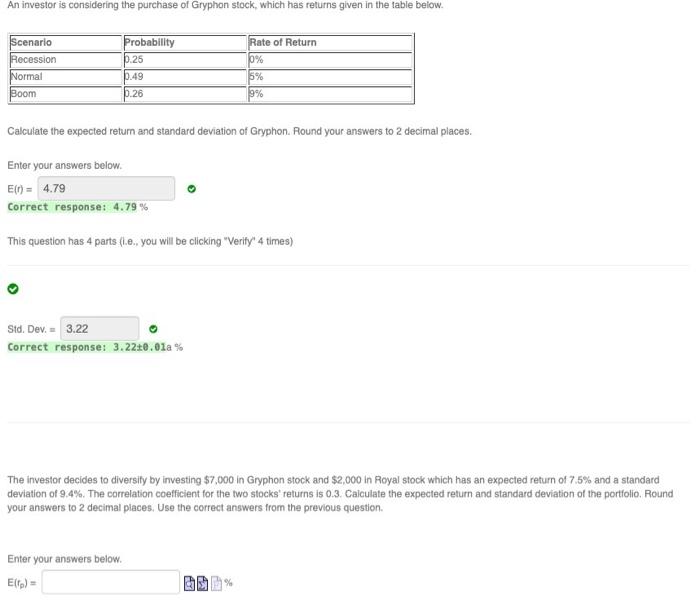

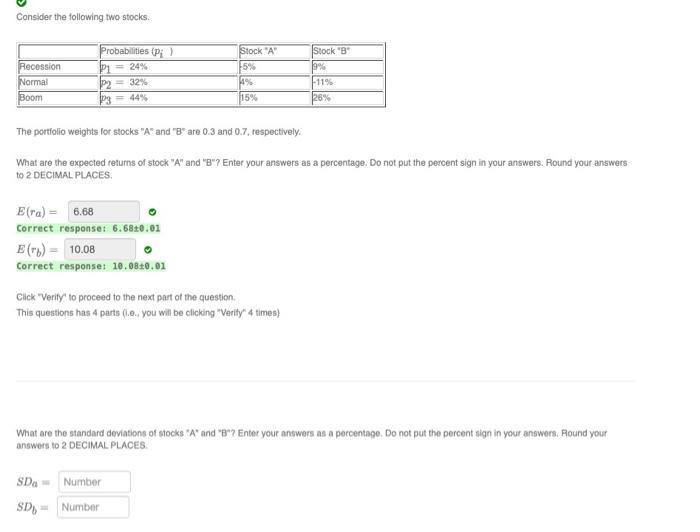

An investor is considering the purchase of Gryphon stock, which has returns given in the table below. Scenarlo Recession Normal Economy Boom Probability 0.22 10.41 0.37 Rate of Return 16% 10% 18% Calculate the expected return and standard deviation of Gryphon. Round your answers to 2 decimal places Enter your answers below. E() 9.44 Correct response: 9.44% Std. Dev. = 8.93 Correct response: 8.93+0.01% This question has 3 parts (ie, you will be clicking "Verity" 3 times) The investor decides to diversify by investing $4,000 in Gryphon stock and $10,000 in Royal stock, which has an expected retum of 6% and a standard deviation of 9,8%. The correlation coefficient for the two stocks' returns is 0.9. Calculate the expected return and standard deviation of the portfolio. Round your answers to 2 decimal places Enter your answers below E() = Number % Std. Dev. = Number An investor is considering the purchase of Gryphon stock, which has returns given in the table below. Scenario Recession Normal Boom Probability 0.25 9.49 0.26 Rate of Return 0% 5% 9% Calculate the expected return and standard deviation of Gryphon. Round your answers to 2 decimal places. Enter your answers below. E(0) = 4.79 Correct response: 4.79% This question has 4 parts (.e., you will be clicking "Verify" 4 times) Std. Dev. - 3.22 Correct response: 3.22+0.01% The investor decides to diversity by investing $7,000 in Gryphon stock and $2,000 in Royal stock which has an expected return of 7.5% and a standard deviation of 9.4%. The correlation coefficient for the two stocks returns is 0.3. Calculate the expected return and standard deviation of the portfolio Round your answers to 2 decimal places. Use the correct answers from the previous question. Enter your answers below. El) % Consider the following two stocks. Probabilities (Pi) Recession Normal Boom P = 24% P2 32% P3 StockA 5% 1998 15% Stock" 9% 1195 25% The portfolio weights for stocks "A" and " are 0.3 and 0.7, respectively. What are the expected returns of stock "A" and "B"? Enter your answers as a percentage. Do not put the percent sign in your answers. Round your answers to 2 DECIMAL PLACES E (ra) 6.68 Correct response: 6.68+0.01 E () = 10.08 Correct response: 10.0810.01 Click "Verity to proceed to the next part of the question This questions has 4 parts (.e. you will be clicking "Verity" 4 times) What are the standard deviations of stocks "A" and "B"? Enter your answers as a porcentago. Do not put the percent sign in your answers. Round yout answers to 2 DECIMAL PLACES SD Number SD Number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts