Question: Entries for HTM Debt Securities: Effective Interest Method On July 1 of Year 1 , West Company purchased for cash, fourteen, ( $

Entries for HTM Debt Securities: Effective Interest Method

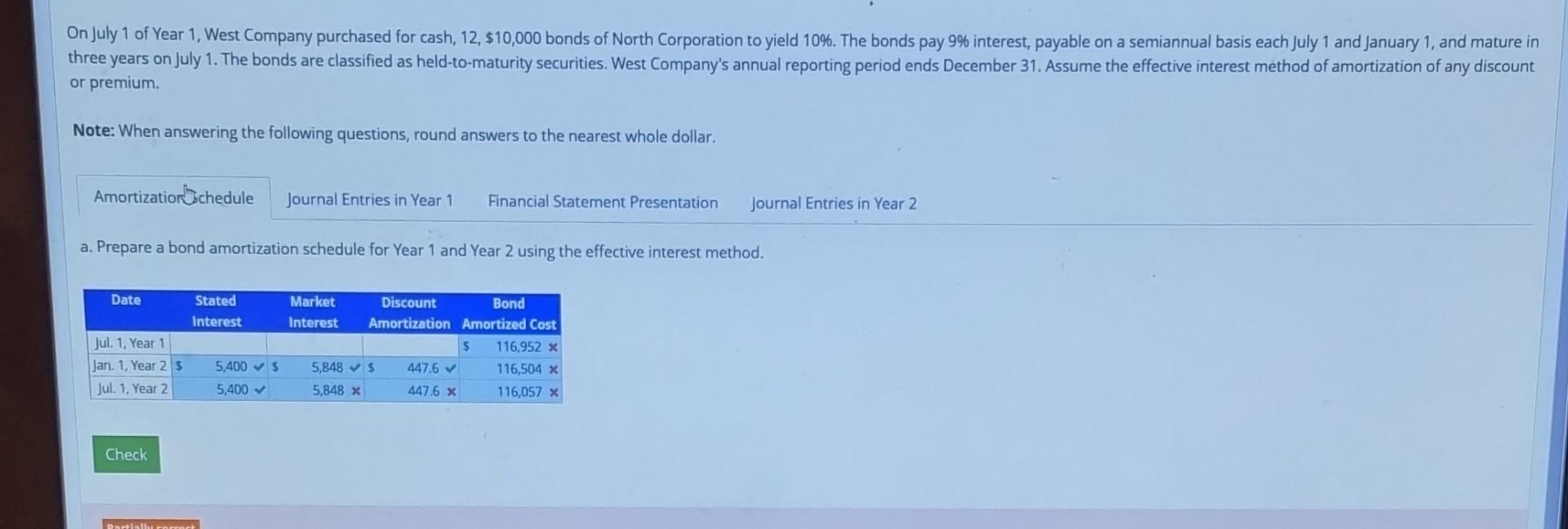

On July of Year West Company purchased for cash, fourteen, $ bonds of North Corporation to yield The bonds pay interest, payable on a semiannual basis each July and January and mature in three years on July The bonds are classified as heldtomaturity securities West Company's annual reporting period ends December Assume the effective interest method of amortization of any discount or premium.

Note: When answering the following questions, round answers to the nearest whole dollar.

Amortization Schedule

b Record the entry for the purchase of the bonds by West Company on July of Year

c Record the adjusting entry by West Company on December of Year The fair value of the bonds at December of Year was $ Entries for HTM Debt Securities: Effective Interest Method

On July of Year West Company purchased for cash, fourteen, $ bonds of North Corporation to yield The bonds pay interest, payable on a semiannual basis each July and January and mature in three years on July The bonds are classified as heldtomaturity securities West Company's annual reporting period ends December Assume the effective interest method of amortization of any discount or premium.

Note: When answering the following questions, round answers to the nearest whole dollar.

Amortization Schedule

Journal Entries in Year

Journal Entries in Year

d Indicate the effects of this investment on the Year income statement and yearend balance sheet. Entries for HTM Debt Securities: Effective Interest Method

On July of Year West Company purchased for cash, fourteen, $ bonds of North Corporation to yield The bonds pay interest, payable on a semiannual basis each July and January and mature in three years on July The bonds are classified as heldtomaturity securities West Company's annual reporting period ends December Assume the effective interest method of amortization of any discount or premium.

Note: When answering the following questions, round answers to the nearest whole dollar.

e Record the receipt of interest on January of Year

f After the interest was received on July of Year two of the bonds were sold for $ cash. Provide the required entries on July of Year for the receipt of interest and the sale of the two bonds.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock